Question: am having a hard time plugging these into excel- our professor wants us to USE excel to grab the answer- the excel sheet i have

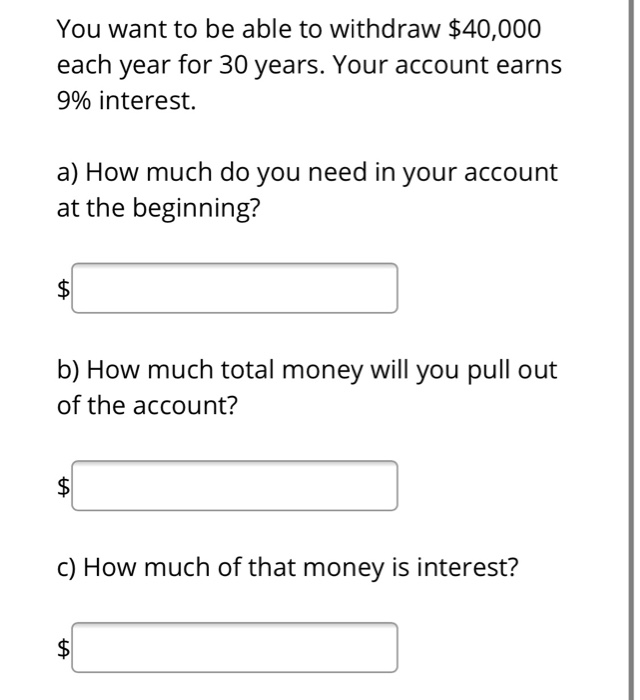

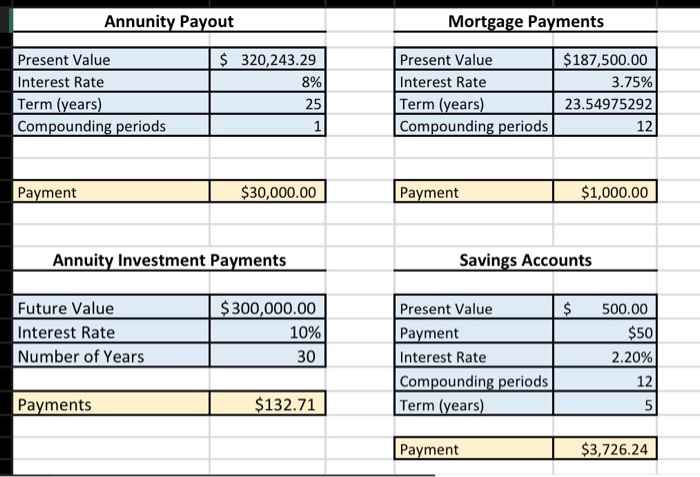

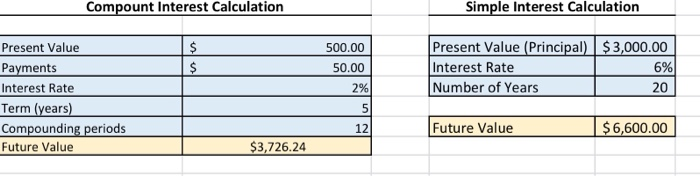

You want to be able to withdraw $40,000 each year for 30 years. Your account earns 9% interest. a) How much do you need in your account at the beginning? $ b) How much total money will you pull out of the account? c) How much of that money is interest? $ Annunity Payout Mortgage Payments Present Value Interest Rate Term (years) Compounding periods $ 320,243.29 8% 25 1 Present Value Interest Rate Term (years) Compounding periods $187,500.00 3.75% 23.54975292 12 Payment $30,000.00 Payment $1,000.00 Annuity Investment Payments Savings Accounts $ Future Value Interest Rate Number of Years $ 300,000.00 10% 30 Present Value Payment Interest Rate Compounding periods Term (years) 500.00 $50 2.20% 12 Payments $132.71 5 Payment $3,726.24 Compount Interest Calculation Simple Interest Calculation 500.00 $ $ 50.00 Present Value (Principal) $3,000.00 Interest Rate 6% Number of Years 20 2% Present Value Payments Interest Rate Term (years) Compounding periods Future Value 5 12 Future Value $6,600.00 $3,726.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts