Question: Am i correct?? Question 3 Assume the current yield curve is as follows: Note: All yields above are nominal annual rates but we assume all

Am i correct??

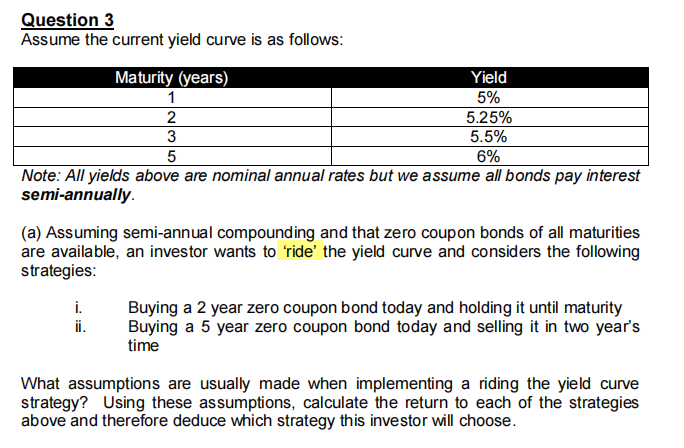

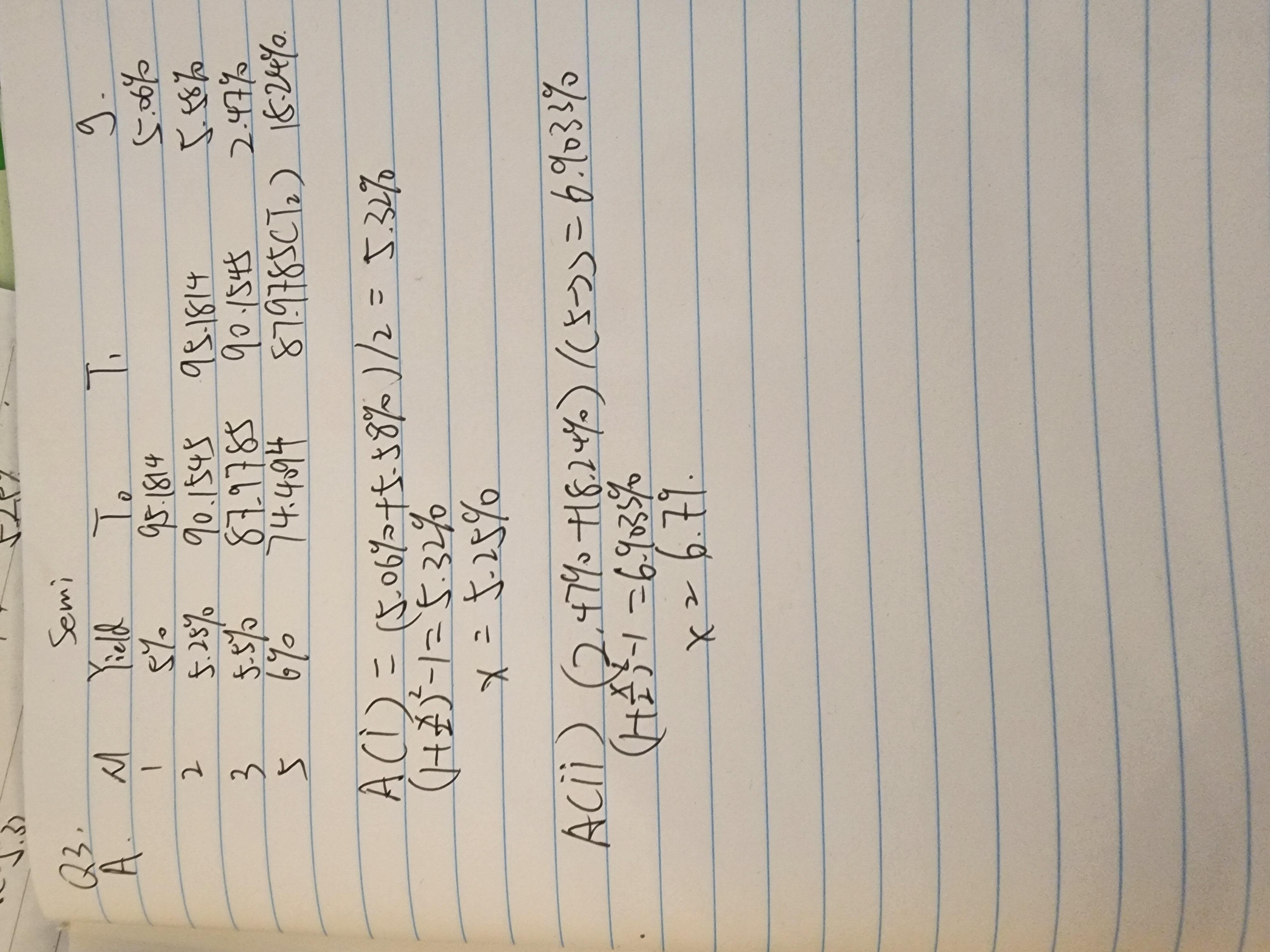

Question 3 Assume the current yield curve is as follows: Note: All yields above are nominal annual rates but we assume all bonds pay interest semi-annually. (a) Assuming semi-annual compounding and that zero coupon bonds of all maturities are available, an investor wants to 'ride' the yield curve and considers the following strategies: i. Buying a 2 year zero coupon bond today and holding it until maturity ii. Buying a 5 year zero coupon bond today and selling it in two year's time What assumptions are usually made when implementing a riding the yield curve strategy? Using these assumptions, calculate the return to each of the strategies above and therefore deduce which strategy this investor will choose. A(i)(1+2x)21x=(5.06%+5.58%)/2=5.32%=5.32%=5.25% A(ii)(2.479+18.24%)/(53)=6.9033%(1+2x)1=6.9033%x2=6.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts