Question: Step 4: Using the loan formula and other things we discussed in class compute and show the following calculations for a home loan with a

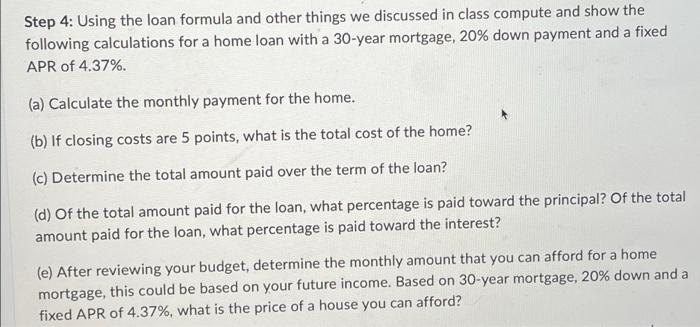

Step 4: Using the loan formula and other things we discussed in class compute and show the following calculations for a home loan with a 30-year mortgage, 20% down payment and a fixed APR of 4.37%. (a) Calculate the monthly payment for the home. (b) If closing costs are 5 points, what is the total cost of the home? (c) Determine the total amount paid over the term of the loan? (d) of the total amount paid for the loan, what percentage is paid toward the principal? Of the total amount paid for the loan, what percentage is paid toward the interest? (e) After reviewing your budget, determine the monthly amount that you can afford for a home mortgage, this could be based on your future income. Based on 30-year mortgage, 20% down and a fixed APR of 4.37%, what is the price of a house you can afford? Step 4: Using the loan formula and other things we discussed in class compute and show the following calculations for a home loan with a 30-year mortgage, 20% down payment and a fixed APR of 4.37%. (a) Calculate the monthly payment for the home. (b) If closing costs are 5 points, what is the total cost of the home? (c) Determine the total amount paid over the term of the loan? (d) of the total amount paid for the loan, what percentage is paid toward the principal? Of the total amount paid for the loan, what percentage is paid toward the interest? (e) After reviewing your budget, determine the monthly amount that you can afford for a home mortgage, this could be based on your future income. Based on 30-year mortgage, 20% down and a fixed APR of 4.37%, what is the price of a house you can afford

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts