Question: An analyst has created estimates for a new Putt Putt course near the local elementary school. The course will require an investment (building and equipment)

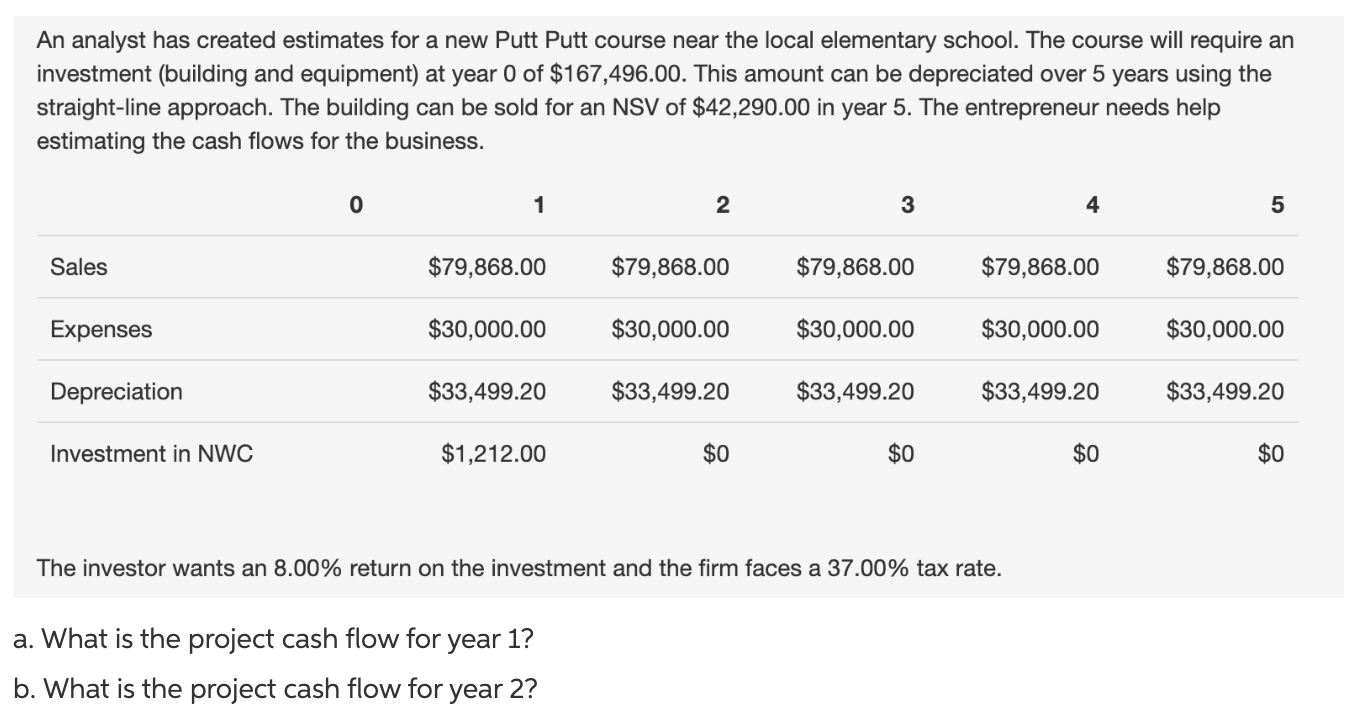

An analyst has created estimates for a new Putt Putt course near the local elementary school. The course will require an investment (building and equipment) at year 0 of $167,496.00. This amount can be depreciated over 5 years using the straight-line approach. The building can be sold for an NSV of $42,290.00 in year 5. The entrepreneur needs help estimating the cash flows for the business. 2 Sales $79,868.00 $79,868.00 $79,868.00 $79,868.00 $79,868.00 Expenses $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 Depreciation $33,499.20 $33,499.20 $33,499.20 $0 $33,499.20 $0 $33,499.20 $0 Investment in NWC $1,212.00 $0 The investor wants an 8.00% return on the investment and the firm faces a 37.00% tax rate. a. What is the project cash flow for year 1? b. What is the project cash flow for year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts