Question: An answer with steps would be appreciated! Will give thumbs up! Question 10 (2 points) While out for lunch, your friend (who is a corporate

An answer with steps would be appreciated! Will give thumbs up!

An answer with steps would be appreciated! Will give thumbs up!

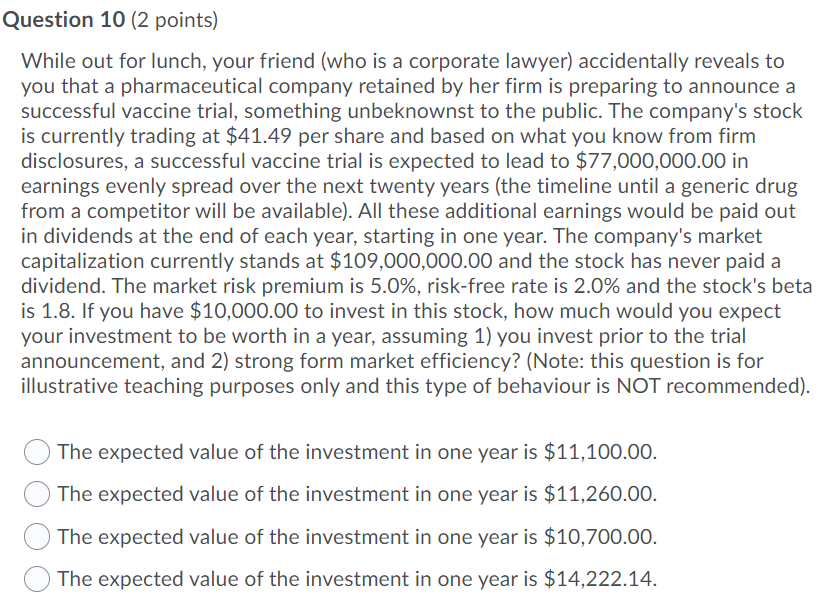

Question 10 (2 points) While out for lunch, your friend (who is a corporate lawyer) accidentally reveals to you that a pharmaceutical company retained by her firm is preparing to announce a successful vaccine trial, something unbeknownst to the public. The company's stock is currently trading at $41.49 per share and based on what you know from firm disclosures, a successful vaccine trial is expected to lead to $77,000,000.00 in earnings evenly spread over the next twenty years (the timeline until a generic drug from a competitor will be available). All these additional earnings would be paid out in dividends at the end of each year, starting in one year. The company's market capitalization currently stands at $109,000,000.00 and the stock has never paid a dividend. The market risk premium is 5.0%, risk-free rate is 2.0% and the stock's beta is 1.8. If you have $10,000.00 to invest in this stock, how much would you expect your investment to be worth in a year, assuming 1) you invest prior to the trial announcement, and 2) strong form market efficiency? (Note: this question is for illustrative teaching purposes only and this type of behaviour is NOT recommended). The expected value of the investment in one year is $11,100.00. The expected value of the investment in one year is $11,260.00. The expected value of the investment in one year is $10,700.00. The expected value of the investment in one year is $14,222.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts