Question: An entity is carrying out a research and development activity for a new computer software. The research activity started in January 2015 and ended on

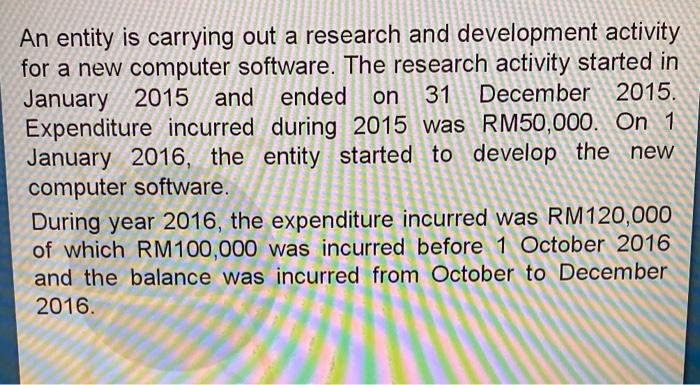

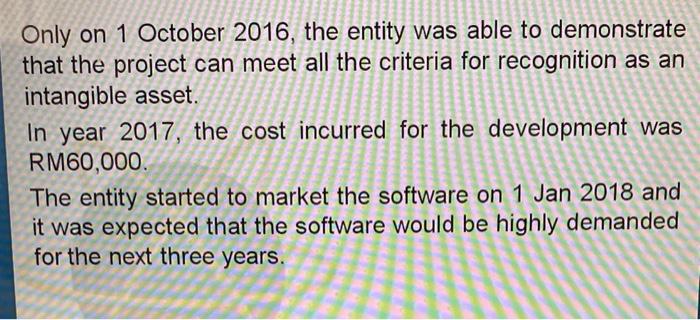

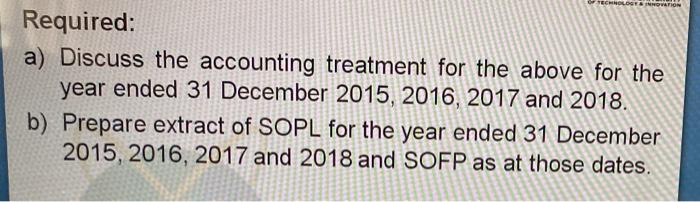

An entity is carrying out a research and development activity for a new computer software. The research activity started in January 2015 and ended on 31 December 2015. Expenditure incurred during 2015 was RM50,000. On 1 January 2016, the entity started to develop the new computer software. During year 2016, the expenditure incurred was RM120,000 of which RM100,000 was incurred before 1 October 2016 and the balance was incurred from October to December 2016 Only on 1 October 2016, the entity was able to demonstrate that the project can meet all the criteria for recognition as an intangible asset. In year 2017, the cost incurred for the development was RM60,000 The entity started to market the software on 1 Jan 2018 and it was expected that the software would be highly demanded for the next three years. TECHNOLOGE INNOVATION Required: a) Discuss the accounting treatment for the above for the year ended 31 December 2015, 2016, 2017 and 2018. b) Prepare extract of SOPL for the year ended 31 December 2015, 2016, 2017 and 2018 and SOFP as at those dates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts