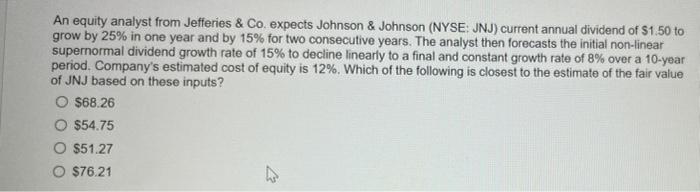

Question: An equity analyst from Jefferies & Co. expects Johnson & Johnson (NYSE: JNJ) current annual dividend of S1.50 to grow by 25% in one year

An equity analyst from Jefferies & Co. expects Johnson & Johnson (NYSE: JNJ) current annual dividend of S1.50 to grow by 25% in one year and by 15% for two consecutive years. The analyst then forecasts the initial non-linear supernormal dividend growth rate of 15% to decline linearly to a final and constant growth rate of 8% over a 10-year period. Company's estimated cost of equity is 12%. Which of the following is closest to the estimate of the fair value of JNJ based on these inputs? O $68.26 $54.75 $51.27 O $76.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts