Question: An explanation on 1 & 2 would be helpful, thank you! RITZ CARLTON & MILLENNIUM PARTNERS - COUNTDOWN EXTENSION VALUE (MP) Assume that James McBride

An explanation on 1 & 2 would be helpful, thank you!

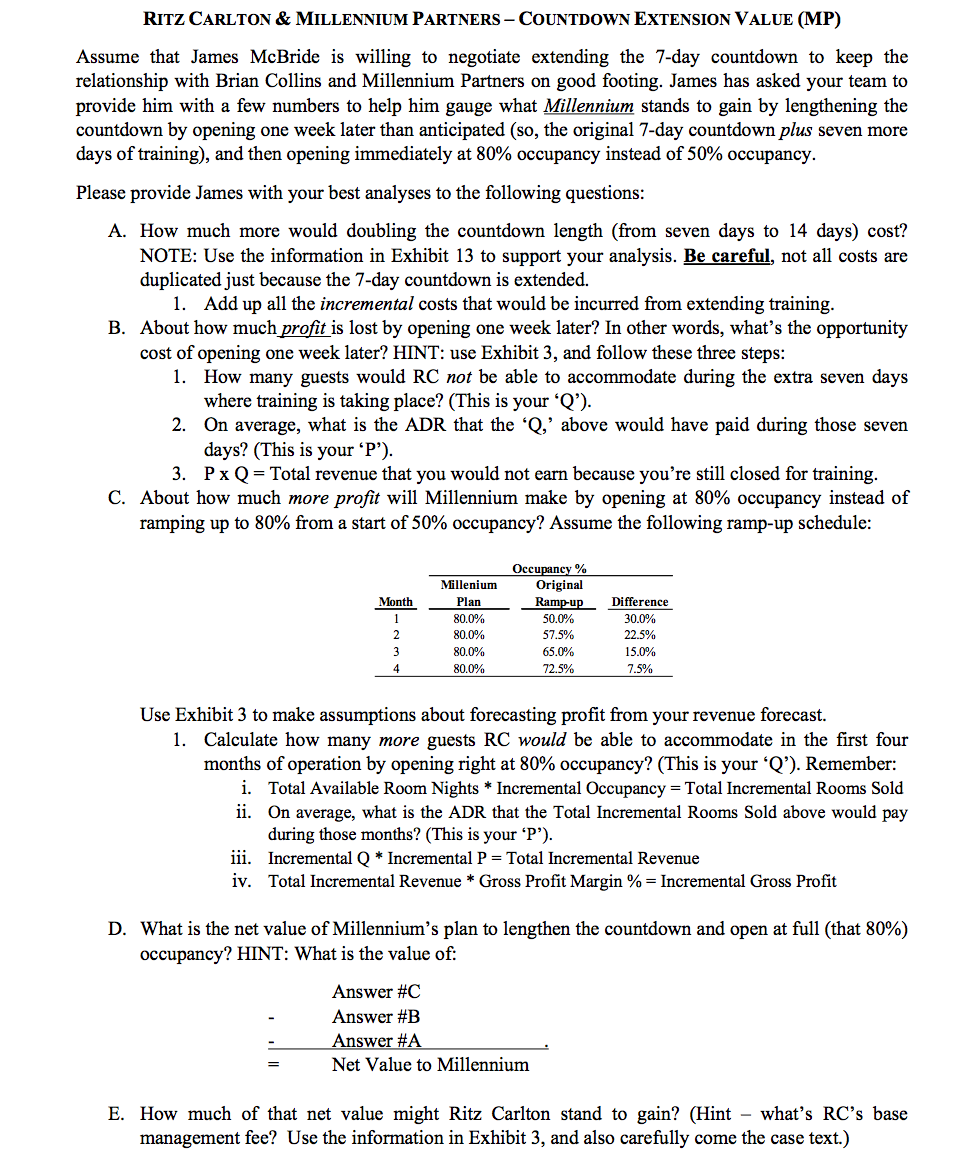

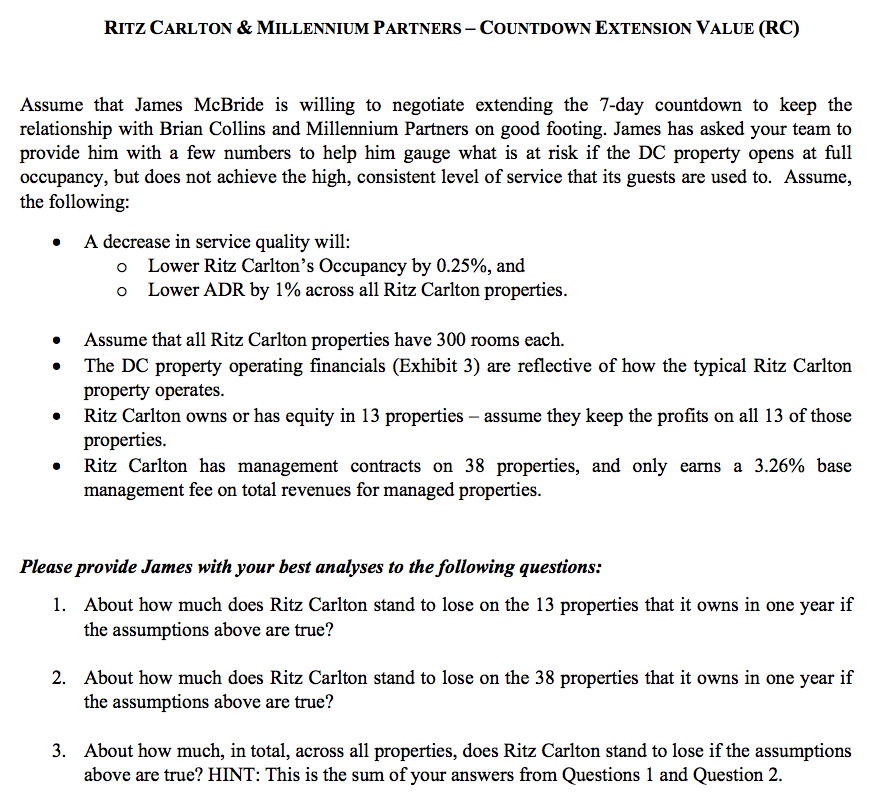

RITZ CARLTON & MILLENNIUM PARTNERS - COUNTDOWN EXTENSION VALUE (MP) Assume that James McBride is willing to negotiate extending the 7-day countdown to keep the relationship with Brian Collins and Millennium Partners on good footing. James has asked your team to provide him with a few numbers to help him gauge what Millennium stands to gain by lengthening the countdown by opening one week later than anticipated (so, the original 7-day countdown plus seven more days of training), and then opening immediately at 80% occupancy instead of 50% occupancy. Please provide James with your best analyses to the following questions: A. How much more would doubling the countdown length (from seven days to 14 days) cost? NOTE: Use the information in Exhibit 13 to support your analysis. Be careful, not all costs are duplicated just because the 7-day countdown is extended. 1. Add up all the incremental costs that would be incurred from extending training. B. About how much profit is lost by opening one week later? In other words, what's the opportunity cost of opening one week later? HINT: use Exhibit 3, and follow these three steps: 1. How many guests would RC not be able to accommodate during the extra seven days where training is taking place? (This is your 'Q'). 2. On average, what is the ADR that the 'Q,' above would have paid during those seven days? (This is your 'P'). 3. PxQ = Total revenue that you would not earn because you're still closed for training. C. About how much more profit will Millennium make by opening at 80% occupancy instead of ramping up to 80% from a start of 50% occupancy? Assume the following ramp-up schedule: Month 1 2 3 4 Millenium Plan 80.0% 80.0% 80.0% Occupancy % Original Ramp-up 50.0% 57.5% 65.0% 72.5% Difference 30.0% 22.5% 15.0% 7.5% 80.0% Use Exhibit 3 to make assumptions about forecasting profit from your revenue forecast. 1. Calculate how many more guests RC would be able to accommodate in the first four months of operation by opening right at 80% occupancy? (This is your 'Q'). Remember: i. Total Available Room Nights * Incremental Occupancy = Total Incremental Rooms Sold ii. On average, what is the ADR that the Total Incremental Rooms Sold above would pay during those months? (This is your P'). iii. Incremental Q * Incremental P= Total Incremental Revenue iv. Total Incremental Revenue * Gross Profit Margin %= Incremental Gross Profit D. What is the net value of Millennium's plan to lengthen the countdown and open at full (that 80%) occupancy? HINT: What is the value of: Answer #C Answer #B Answer #A Net Value to Millennium E. How much of that net value might Ritz Carlton stand to gain? (Hint - what's RC's base management fee? Use the information in Exhibit 3, and also carefully come the case text.) RITZ CARLTON & MILLENNIUM PARTNERS - COUNTDOWN EXTENSION VALUE (RC) Assume that James McBride is willing to negotiate extending the 7-day countdown to keep the relationship with Brian Collins and Millennium Partners on good footing. James has asked your team to provide him with a few numbers to help him gauge what is at risk if the DC property opens at full occupancy, but does not achieve the high, consistent level of service that its guests are used to. Assume, the following: A decrease in service quality will: o Lower Ritz Carlton's Occupancy by 0.25%, and o Lower ADR by 1% across all Ritz Carlton properties. Assume that all Ritz Carlton properties have 300 rooms each. The DC property operating financials (Exhibit 3) are reflective of how the typical Ritz Carlton property operates. Ritz Carlton owns or has equity in 13 properties - assume they keep the profits on all 13 of those properties. Ritz Carlton has management contracts on 38 properties, and only earns a 3.26% base management fee on total revenues for managed properties. Please provide James with your best analyses to the following questions: 1. About how much does Ritz Carlton stand to lose on the 13 properties that it owns in one year if the assumptions above are true? 2. About how much does Ritz Carlton stand to lose on the 38 properties that it owns in one year if the assumptions above are true? 3. About how much, in total, across all properties, does Ritz Carlton stand to lose if the assumptions above are true? HINT: This is the sum of your answers from Questions 1 and Question 2. RITZ CARLTON & MILLENNIUM PARTNERS - COUNTDOWN EXTENSION VALUE (MP) Assume that James McBride is willing to negotiate extending the 7-day countdown to keep the relationship with Brian Collins and Millennium Partners on good footing. James has asked your team to provide him with a few numbers to help him gauge what Millennium stands to gain by lengthening the countdown by opening one week later than anticipated (so, the original 7-day countdown plus seven more days of training), and then opening immediately at 80% occupancy instead of 50% occupancy. Please provide James with your best analyses to the following questions: A. How much more would doubling the countdown length (from seven days to 14 days) cost? NOTE: Use the information in Exhibit 13 to support your analysis. Be careful, not all costs are duplicated just because the 7-day countdown is extended. 1. Add up all the incremental costs that would be incurred from extending training. B. About how much profit is lost by opening one week later? In other words, what's the opportunity cost of opening one week later? HINT: use Exhibit 3, and follow these three steps: 1. How many guests would RC not be able to accommodate during the extra seven days where training is taking place? (This is your 'Q'). 2. On average, what is the ADR that the 'Q,' above would have paid during those seven days? (This is your 'P'). 3. PxQ = Total revenue that you would not earn because you're still closed for training. C. About how much more profit will Millennium make by opening at 80% occupancy instead of ramping up to 80% from a start of 50% occupancy? Assume the following ramp-up schedule: Month 1 2 3 4 Millenium Plan 80.0% 80.0% 80.0% Occupancy % Original Ramp-up 50.0% 57.5% 65.0% 72.5% Difference 30.0% 22.5% 15.0% 7.5% 80.0% Use Exhibit 3 to make assumptions about forecasting profit from your revenue forecast. 1. Calculate how many more guests RC would be able to accommodate in the first four months of operation by opening right at 80% occupancy? (This is your 'Q'). Remember: i. Total Available Room Nights * Incremental Occupancy = Total Incremental Rooms Sold ii. On average, what is the ADR that the Total Incremental Rooms Sold above would pay during those months? (This is your P'). iii. Incremental Q * Incremental P= Total Incremental Revenue iv. Total Incremental Revenue * Gross Profit Margin %= Incremental Gross Profit D. What is the net value of Millennium's plan to lengthen the countdown and open at full (that 80%) occupancy? HINT: What is the value of: Answer #C Answer #B Answer #A Net Value to Millennium E. How much of that net value might Ritz Carlton stand to gain? (Hint - what's RC's base management fee? Use the information in Exhibit 3, and also carefully come the case text.) RITZ CARLTON & MILLENNIUM PARTNERS - COUNTDOWN EXTENSION VALUE (RC) Assume that James McBride is willing to negotiate extending the 7-day countdown to keep the relationship with Brian Collins and Millennium Partners on good footing. James has asked your team to provide him with a few numbers to help him gauge what is at risk if the DC property opens at full occupancy, but does not achieve the high, consistent level of service that its guests are used to. Assume, the following: A decrease in service quality will: o Lower Ritz Carlton's Occupancy by 0.25%, and o Lower ADR by 1% across all Ritz Carlton properties. Assume that all Ritz Carlton properties have 300 rooms each. The DC property operating financials (Exhibit 3) are reflective of how the typical Ritz Carlton property operates. Ritz Carlton owns or has equity in 13 properties - assume they keep the profits on all 13 of those properties. Ritz Carlton has management contracts on 38 properties, and only earns a 3.26% base management fee on total revenues for managed properties. Please provide James with your best analyses to the following questions: 1. About how much does Ritz Carlton stand to lose on the 13 properties that it owns in one year if the assumptions above are true? 2. About how much does Ritz Carlton stand to lose on the 38 properties that it owns in one year if the assumptions above are true? 3. About how much, in total, across all properties, does Ritz Carlton stand to lose if the assumptions above are true? HINT: This is the sum of your answers from Questions 1 and Question 2Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock