Question: An independent electronics store is contemplating either opening another store or expanding its existing location. The payoff table for these two decisions is: Peter, the

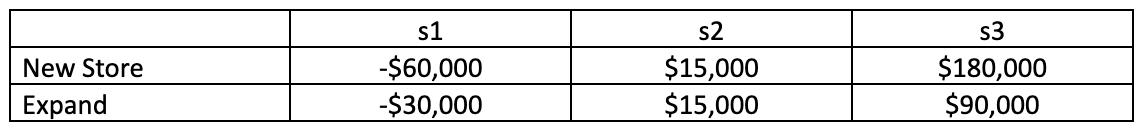

An independent electronics store is contemplating either opening another store or expanding its existing location. The payoff table for these two decisions is:

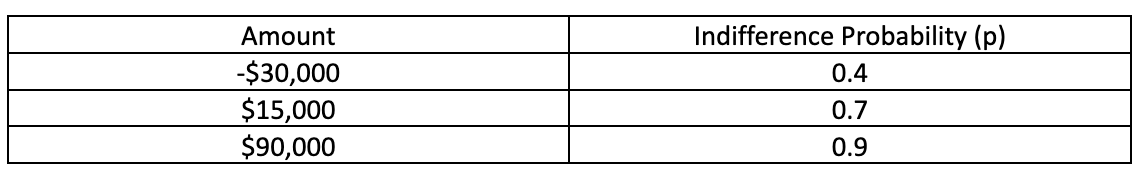

Peter, the owner of the store, has calculated the indifference probability for the lottery having a payoff of $180,000 with probability p and -$60,000 with probability (1-p) with the following sure amounts as follows:

- Suppose Peter has defined the utility of -$60,000 to be 0 and the utility of $180,000 to be 100. What would be the utility values for -$30,000, $15,000, and $90,000 based on the indifference probabilities?

- Suppose P(s1) = .4, P(s2) = .3, and P(s3) = .3. Which decision should Peter make? Compare with the decision using the expected value approach. Is Peter a risk taker or is he risk averse?

\begin{tabular}{|l|c|c|c|} \hline & s1 & s2 & s3 \\ \hline New Store & $60,000 & $15,000 & $180,000 \\ \hline Expand & $30,000 & $15,000 & $90,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Amount & Indifference Probability (p) \\ \hline$30,000 & 0.4 \\ \hline$15,000 & 0.7 \\ \hline$90,000 & 0.9 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts