Question: An index put option with a three month maturity has a strike price of 6000. The current underlying stock index is trading at 5900

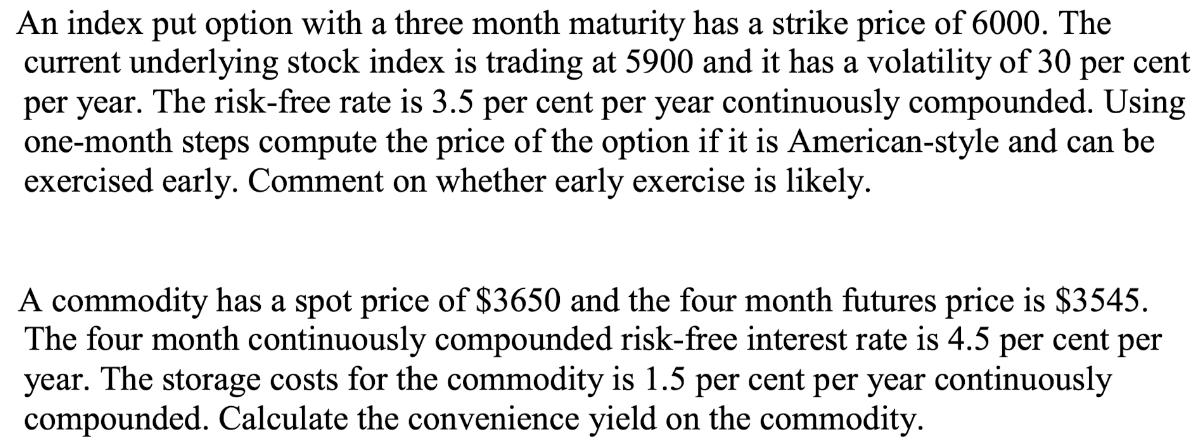

An index put option with a three month maturity has a strike price of 6000. The current underlying stock index is trading at 5900 and it has a volatility of 30 per cent per year. The risk-free rate is 3.5 per cent per year continuously compounded. Using one-month steps compute the price of the option if it is American-style and can be exercised early. Comment on whether early exercise is likely. A commodity has a spot price of $3650 and the four month futures price is $3545. The four month continuously compounded risk-free interest rate is 4.5 per cent per year. The storage costs for the commodity is 1.5 per cent per year continuously compounded. Calculate the convenience yield on the commodity.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

To compute the price of the Americanstyle put option with onemonth steps we can use the binomial opt... View full answer

Get step-by-step solutions from verified subject matter experts