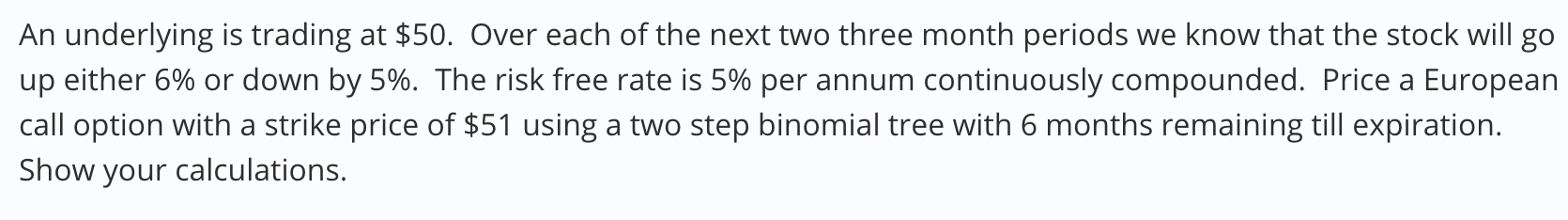

Question: An underlying is trading at $ 5 0 . Over each of the next two three month periods we know that the stock will go

An underlying is trading at $ Over each of the next two three month periods we know that the stock will go

up either or down by The risk free rate is per annum continuously compounded. Price a European

call option with a strike price of $ using a two step binomial tree with months remaining till expiration.

Show your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock