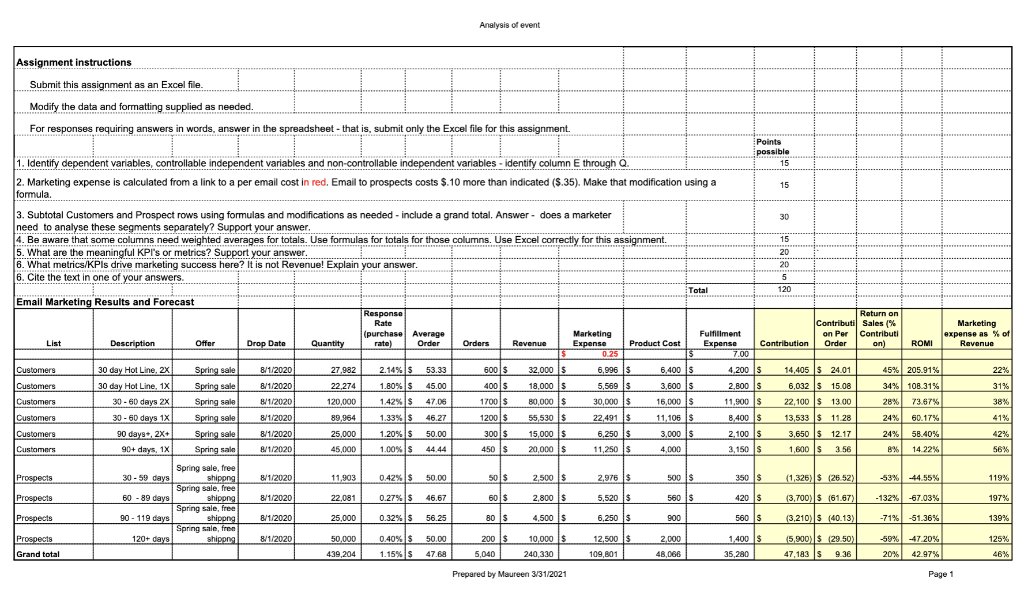

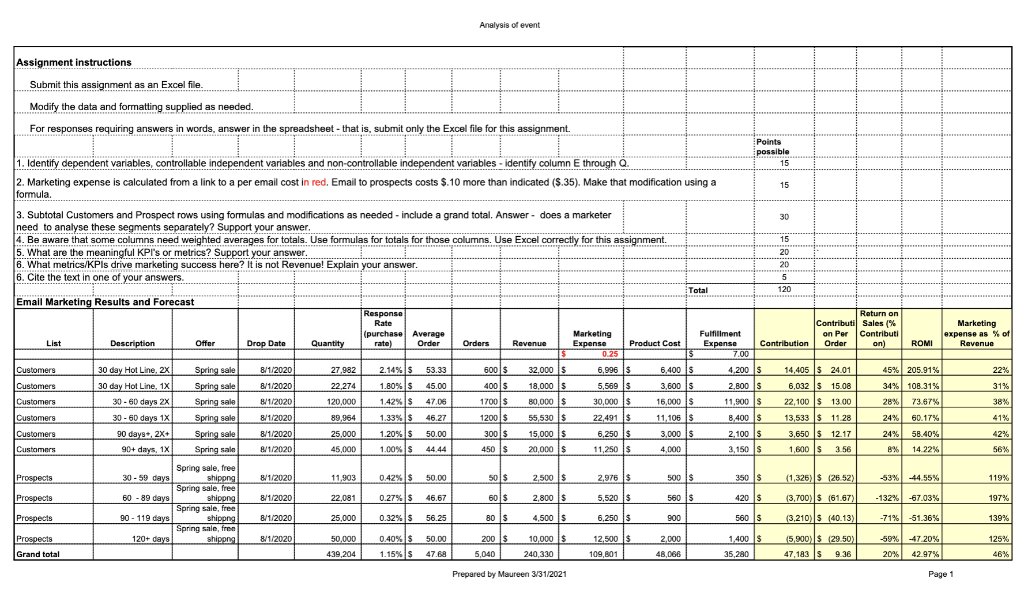

Question: Analysis of event possible Assignment instructions Submit this assignment as an Excel file . Modify the data and formatting supplied as needed For responses requiring

Analysis of event possible Assignment instructions Submit this assignment as an Excel file . Modify the data and formatting supplied as needed For responses requiring answers in words, answer in the spreadsheet - that is, submit only the Excel file for this assignment. Points 1. Identify dependent variables, controllable independent variables and non-controllable independent variables - identify column E through Q. 15 2. Marketing expense is calculated from a link to a per email cost in red. Email to prospects costs $.10 more than indicated (8.35). Make that modification using a 15 formula. 3. Subtotal Customers and Prospect rows using formulas and modifications as needed - include a grand total. Answer - does a marketer 30 need to analyse these segments separately? Support your answer. 4. Be aware that some columns need weighted averages for totals. Use formulas for totals for those columns. Use Excel correctly for this assignment. 15 5. What are the meaningful KPI's or metrics? Support your answer. 20 6. What metrics/KPIs drive marketing success here? It is not Revenue! Explain your answer. 20 6. Cite the text in one of your answers. 5 Total 120 Email Marketing Results and Forecast Response Return on Rate Contributi Sales % Marketing (purchase Average Marketing Fulfillment on Per Contributi List Description Offer expense as % of Drop Date Quantity rate) Order Orders Revenue Expense Product Cost Expense Contribution Order on) ROMI Revenue 0.25 5 7.00 Customers 30 day Hot Line. 2x Spring sale 8/1/2020 27.982 2.14% 53.33 600 E 32.000 $ 6,996 $ 6,400 S 4,200 $ 14.405 $ 24.01 45% 205.91% 22% Customer 30 day Hot Line, 1X 8/1/2020 22 274 1.80% $ 45.00 400 18,000 $ 5,569 $ 3.600 ls 2,800S 6,032 $ 15.08 34% 108.31% % 31% Customers 30-60 days 2x Spring sale 8/1/2020 120,000 1.42% 47.08 1700$ 80,000 $ 30,000 $ 16,000S 22,100 $ 13.00 28% 73.67% 38% Customers 30 - 60 days 1X Spring sale 8/1/2020 89,964 1.33% 46.27 1200 $ 55,530 s 22,491 $ 11.106 S 8,400 $ 13,533 $ 1128 24% 60.17% 41% Customers 90 days, 2X+ Spring sale 8/1/2020 25,000 1.20% $ 50.00 300 $ 6,250 $ 3,000 $ 2,100 $ 3,650 $ 12.17 24% 58.40% 42% Customers 90+ days, 1X Spring sale 8/1/2020 45,000 1.00%S 44.44 450 IS 20,000 $ 11,250 S 4,000 3,150 S $ 8% 14.22% 56% Spring sale,free Prospects 30 - 59 days shipong 8/1/2020 11,903 0.42%$ 50.00 50 $ 2.500 $ 2,976 $ 500S 350 $ (1,326) $ (26.52) -53% -44.55% 119% Spring sale,free Prospects 60 - 89 days shippng 8/1/2020 22,081 0.27% 46.67 60 $ 2,800 $ 5,520 $ 560 $ 420 S (3,700) S (61.67) -132% -67.03% 197% Spring sale,free Prospects 90 - 119 days shippng 8/1/2020 25,000 0.32% 56.25 80 $ 4.500S 6,250 $ 900 560 S (3,210) S (40.13) -71% -51.36% 139% Spring sale,free Prospects 120+ days shipong 8/1/2020 50,000 0.40% 5 50.00 200 $ 10,000 $ 12.500$ 2.000 1,400 $ (5.900) S (29.50) -59% -47 20% 125% Grand total 439,204 1.15% 47.68 5,040 240,330 109,601 48,066 35,280 47,183 9.36 20% 42.97% 46% Spring sale 11,900 $ l 15.000 ls Prepared by Maureen 3/31/2021 Page 1