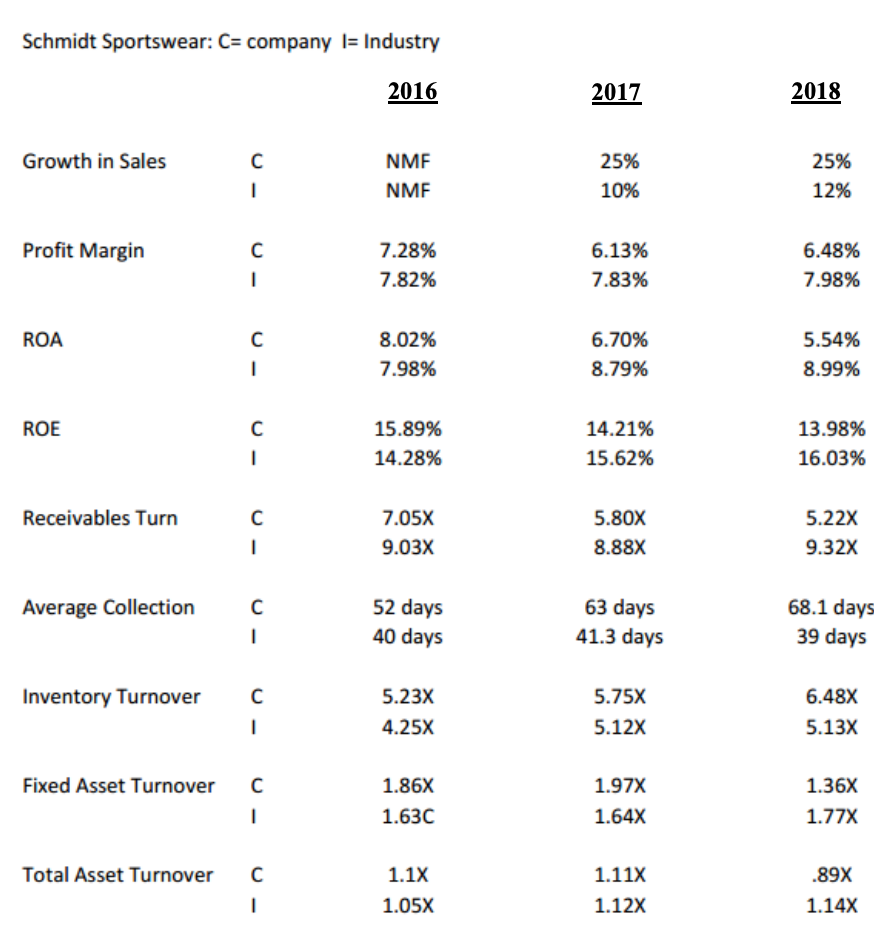

Question: Analyze each case utilizing the ratios and methods. What type of company is it? Is the company doing well or poorly? What is its overall

Analyze each case utilizing the ratios and methods.

What type of company is it? Is the company doing well or poorly? What is its overall financial position? If multiple years are available, what is happening at the company over time based on the ratios given? How does the company compare to its industry either now or over time? What ratios need to improve and how? Which ratios are strong and why?

Show multiple-year trend analysis of ratios.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts