Question: (Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10.5 percent based on sales of $11.2 million and

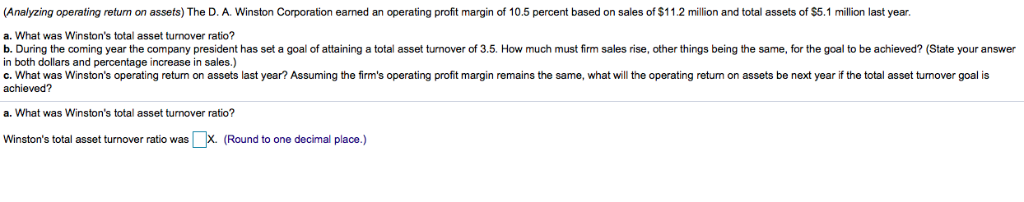

(Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10.5 percent based on sales of $11.2 million and total assets of $5.1 million last year. a. What was Winston's total asset turnover ratio? b. During the coming year the company president has set a goal of attaining a total asset turnover of 3.5. How much must firm sales rise, other things being the same, for the goal to be achieved? (State your answer in both dollars and percentage increase in sales.) c. What was Winston's operating retum on assets last year? Assuming the firm's operating profit margin remains the same, what will the operating retum on assets be next year if the total asset tunover goal is achieved? a. What was Winston's total asset turnover ratio? Winston's total asset turnover ratio was x Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts