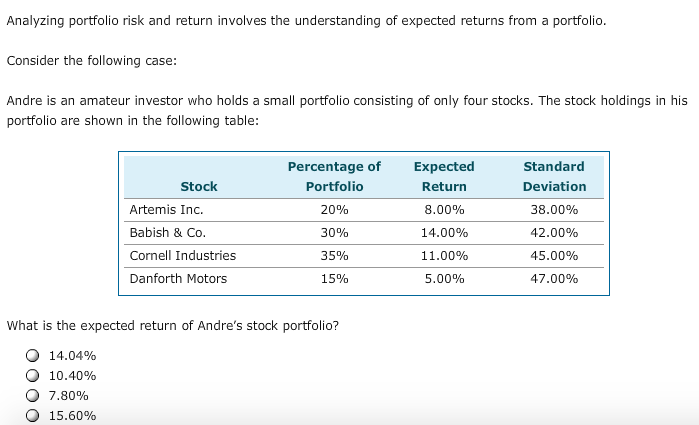

Question: Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio Consider the following case: Andre is an amateur investor who holds

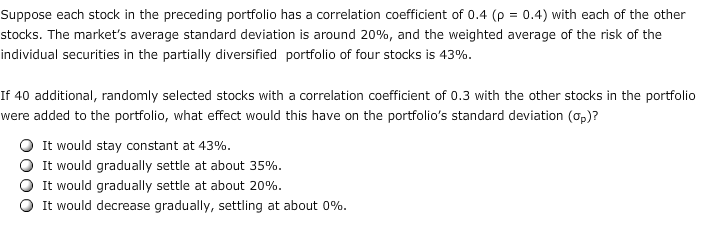

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio Consider the following case: Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table Percentage of Portfolio 20% 30% 35% 15% Expected Return 8.00% 14.00% 11.00% 5.00% Standard Deviation 38.00% 42.00% 45.00% 47.00% Stock Artemis Inc. Babish & Co Cornell Industries Danforth Motors What is the expected return of Andre's stock portfolio? O 14.04% O 10.40% 7.80% O 15.60%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock