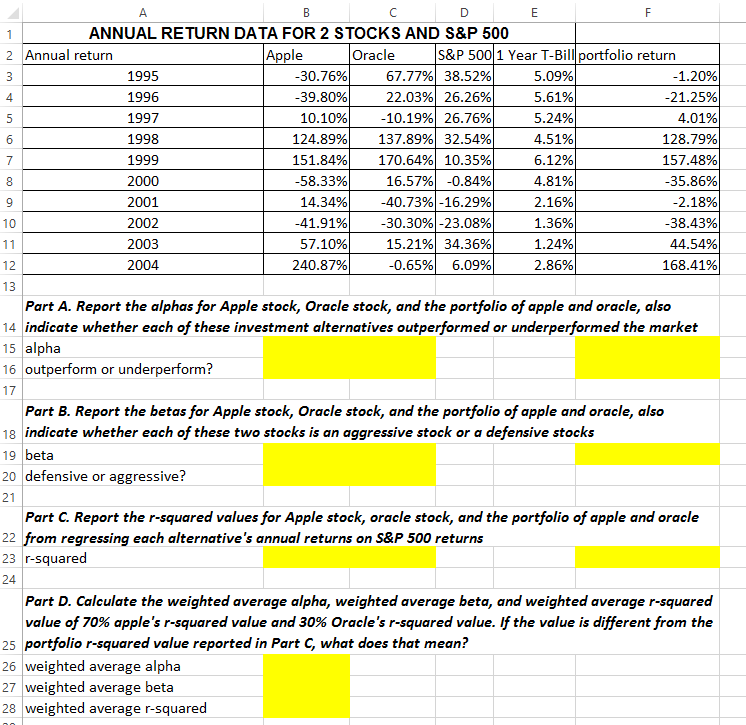

Question: Show formulas used in each highlighted cell and show work please. Report the alphas for Apple stock, Oracle stock, and the portfolio of apple and

Show formulas used in each highlighted cell and show work please.

Show formulas used in each highlighted cell and show work please.

Report the alphas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these investment alternatives outperformed or underperformed the market alpha outperform or underperform Report the betas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these two stocks is an aggressive stock or a defensive stocks beta defensive or aggressive Report the r - squared values for Apple stock, oracle stock, and the portfolio of apple and oracle from regressing each alternative's annual returns on S&P 500 returns r - squared Calculate the weighted average alpha, weighted average beta, and weighted average r - squared value of 70% apple's r - squared value and 30% Oracle's r - squared value. If the value is different from the portfolio r - squared value reported in Part C, what does that mean weighted average alpha weighted average beta weighted average r - squared Report the alphas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these investment alternatives outperformed or underperformed the market alpha outperform or underperform Report the betas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these two stocks is an aggressive stock or a defensive stocks beta defensive or aggressive Report the r - squared values for Apple stock, oracle stock, and the portfolio of apple and oracle from regressing each alternative's annual returns on S&P 500 returns r - squared Calculate the weighted average alpha, weighted average beta, and weighted average r - squared value of 70% apple's r - squared value and 30% Oracle's r - squared value. If the value is different from the portfolio r - squared value reported in Part C, what does that mean weighted average alpha weighted average beta weighted average r - squared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts