Question: AND EXERCISES, SUPPLEMENTAL MATERIALS, AND SOLUTIONS CHAPTER 12 Example 12A: Unadjusted Rate of Return Assumptions Average annual net income Original investment amount $1,000,000 Unrecovered asset

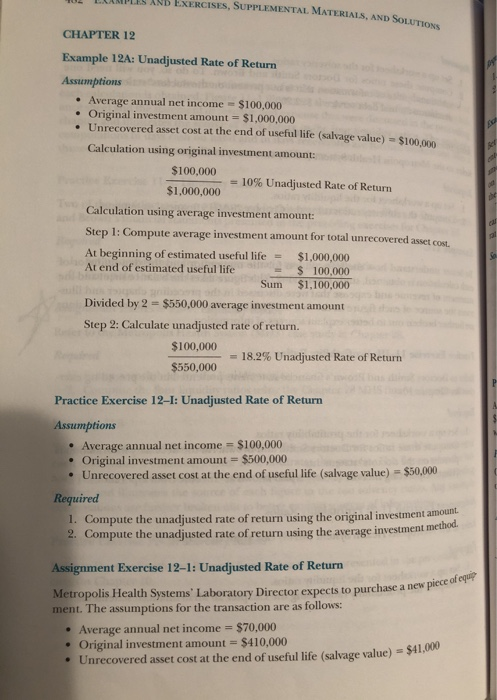

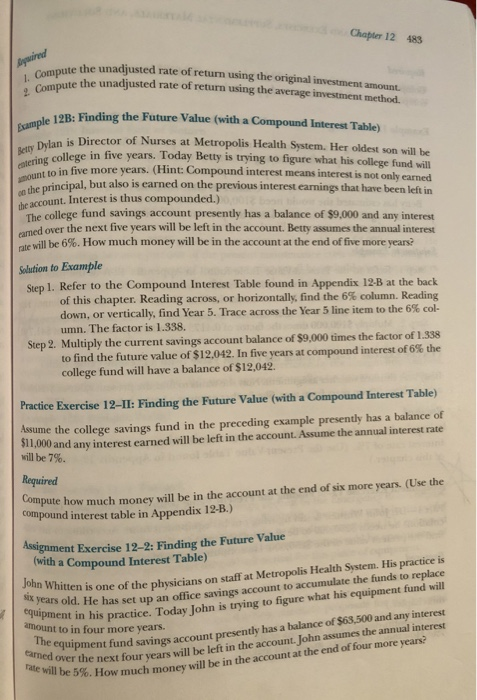

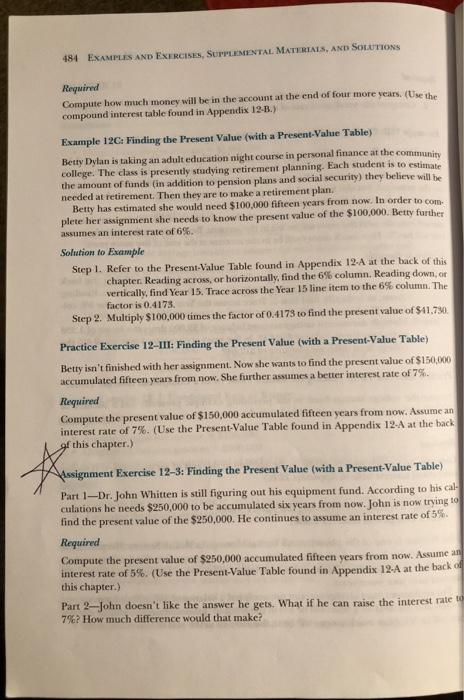

AND EXERCISES, SUPPLEMENTAL MATERIALS, AND SOLUTIONS CHAPTER 12 Example 12A: Unadjusted Rate of Return Assumptions Average annual net income Original investment amount $1,000,000 Unrecovered asset cost at the end of useful life (salvage value) - $100,000 $100,000 Calculation using original investment amount: $100,000 10% Unadjusted Rate of Return - $1,000,000 Calculation using average investment amount: And Step 1: Compute average investment amount for total unrecovered asset cost. At beginning of estimated useful life At end of estimated useful life $1,000,000 $ 100,000 $1,100,000 Sum Divided by 2 = $550,000 average investment amount Step 2: Calculate unadjusted rate of return. $100,000 18.2% Unadjusted Rate of Return $550,000 Practice Exercise 12-I: Unadjusted Rate of Return Assumptions Average annual net income $100,000 Original investment amount = $500,000 Unrecovered asset cost at the end of useful life (salvage value) $50,000 Required 1. Compute the unadjusted rate of return using the original investment amount Compute the unadjusted rate of return using the average investment method. 9. Assignment Exercise 12-1: Unadjusted Rate of Return Metropolis Health Systems' Laboratory Director expects to purchase a new piece of equip ment. The assumptions for the transaction are as follows: Average annual net income = $70,000 Original inve Unrecovered asset cost at the end of useful life (salvage value) $41,000 ment amount $410,000 Chapter 12 483 Rragwired I. Compute the unadjusted rate of return using the original investment amouant. 2 Compute the unadjusted rate of return using the average investment method. Example 12B: Finding the Future Value (with a Compound Interest Table) tyDylan is Director of Nurses eatering college in five years. Today Betty is trying to figure what his college fund will ount to in five more years. (Hint: Compound interest means interest is not only earned on the principal, but also is earned on the previous interest earnings that have been left in he account. Interest is thus compounded.) The college fund savings account presently has a balance of $9,000 and any interest amed over the next five years will be left in the account. Betty assumes the annual interest rate will be 6%. How much money will be in the account at the end of five more years? Metropolis Health System. Her oldest son will be at Solution to Example Step 1. Refer to the Compound Interest Table found in Appendix 12-B at the back of this chapter. Reading down, or vertically, find Year 5. Trace across the Year 5 line item to the 6% col- across, or horizontally, find the 6% column. Reading umn. The factor is 1.338. Step 2. Multiply the current savings account balance of $9,000 times the factor of 1.338 to find the future value of $12,042. In five years at compound interest of 6% the college fund will have a balance of $12,042. Practice Exercise 12-II: Finding the Future Value (with a Compound Interest Table) Assume the college savings fund in the preceding example presently has a balance of $11,000 and any interest earned will be left in the account. Assume the annual interest rate will be 7%. Required Compute how much money will be in the account at the end of six more years. (Use the compound interest table in Appendix 12-B.) Assignment Exercise 12-2: Finding the Future Value with a Compound Interest Table) John Whitten is one of the physicians on staff at ! Metropolis Health System. His practice is account to accumulate the funds to replace equipment in his practice. Today John is trying to figure what his equipment fund will amount to in four more years. six years old. He has set up an office savings The equipment fund savings account presently has a balance of $63,500 and any interest earned over the next four years will be left in the account. John assumes the annual interest rate will be 5%. How much money will be in the account at the end of four more years? 484 EXAMPLES AND EXERCISES, SUPPLEMENTAL MATERIALS, AND SOLUTIONS Required Compute how much money will be in the account at the end of four more years. (Use the compound interest table found in Appendix 12-B.) Example 12C: Finding the Present Value (with a Present-Value Table) Betty Dylan is taking an adult education night course in personal finance at the communins college. The class is presently studying retirement planning. Each student is to estimate the amount of funds (in addition to pension plans and social security) they believe will be needed at retirement. Then they are to make a retirement plan. Betty has estimated she would need $100,000 fifteen years from now. In order to com- plete her assignment she needs to know the present value of the $100,000. Betty further assumes an interest rate of 6%. . Solution to Example Step 1. Refer to the Present-Value Table found in Appendix 12-A at the back of this chapter. Reading across, or horizontally, find the 6% column. Reading down, or vertically, find Year 15. Trace across the Year 15 line item to the 6% column. The factor is 0.4173. Step 2. Multiply $100,000 times the factor of 0.4173 to find the present value of $41,730 Practice Exercise 12-III: Finding the Present Value (with a Present-Value Table) Betty isn't finished with her assignment. Now she wants to find the present value of $150,000 accumulated fifteen years from now. She further assumes a better interest rate of 7% Required Compute the present value of $150,000 accumulated fifteen years from now. Assume an interest rate of 7%. ( Use the Present-Value Table found in Appendix 12-A at the back gf this chapter.) Assignment Exercise 12-3: Finding the Present Value (with a Present-Value Table) Part 1-Dr. John Whitten is still figuring out his equipment fund. According to his cal- culations he needs $250,000 to be accumulated six years from now. John is now trying to find the present value of the $250,000. He continues to assume an interest rate of 5% Required Compute the present value of $250,000 accumulated fifteen vears from now. interest rate of 5 %. ( Use the Present-Value Table found in Appendix 12-A this chapter.) Assume an at the back of Part 2-John doesn't like the answer he gets. What if he can raise the interest rate to 7%? How much difference would that make? Chapter 12 485 Required Compute the present value of $250,000 accumulated fifteen years from now assuming an interest rate of 7%. Compare the difference between this amount and the present value at 5% Example 12D: Internal Rate of Return Review the chapter text to follow the steps set out to compute the internal rate of return. Practice Exercise 12-IV: Internal Rate of Return Metropolis Health System (MHS) is considering purchasing a It would cost $16,950 and have a 10-year useful life. It will have zero salvage value at the end of 10 years. The head of the MHS grounds crew estimates it would save $3,000 per year. He figures this savings because just one of the present maintenance crew would be driving the tractor, replacing the labor of several men now using small houschold-type lawn mowers Compute the internal rate of return for this proposed acquisition. tractor to mow the grounds. ignment Exercise 12-4: Computing an Internal Rate of Return r. Whitten has decided to purchase equipment that has a cost of $60,000 and will produce a pretax net cash inflow of $30,000 per year over its estimated useful life of six years. The equipment will have no salvage value and will be depreciated by the straight-line method. The tax rate is 50%. Determine Dr. Whitten's approximate after-tax internal rate of return. Example 12E: Payback Period Review the chapter computation. text and follow the Doctor Green detailed example of payback period Practice Exercise 12-V: Payback The MHS Chief Financial Officer is considering a request by the Emergency Room depart- ment for purchase of new equipment. It will cost $500,000. There is no trade-in. Its useful ig life would be 10 years. This type of machine is new to the department but it is estimated that it will result in $84,000 annual revenue and operating costs would be one-quarter of that amount. The CFO wants to find the payback period for this piece of equipment Assignment Exercise 12-5: Payback Period The MHS Chief Financial Officer is considering alternate proposals for the hospital Kadiology department. The Director of Radiology has suggested purchasing one of two pieces of equipment. Machine A costs $15,000 and Machine B costs $12,000. Both machines ar are estimated to reduce radiology operating costs by $5,000 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts