Question: Ethics Problem Diane Dennison is a financial analyst wodking for a large chain of discount retal stores Her compamy is jooking at the possibuity of

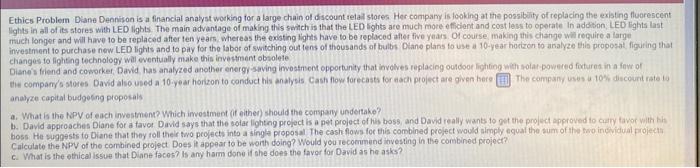

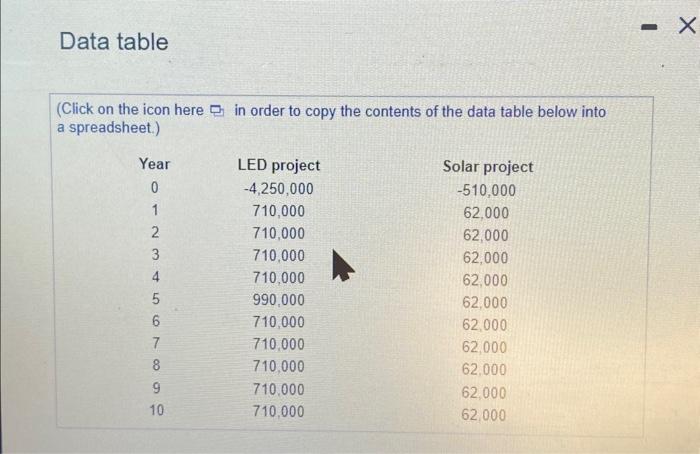

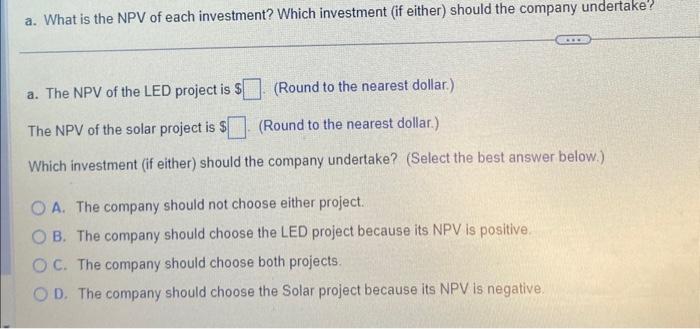

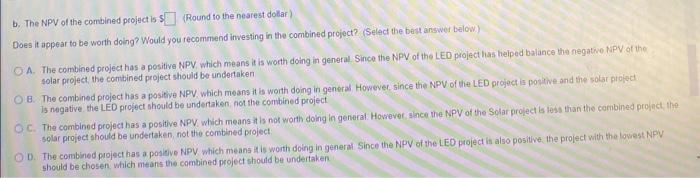

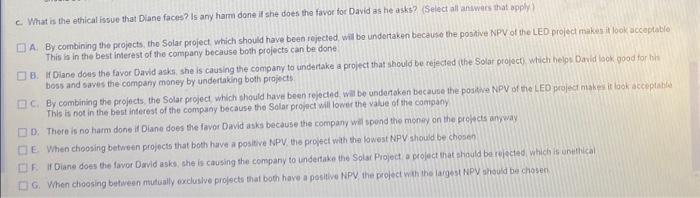

Ethics Problem Diane Dennison is a financial analyst wodking for a large chain of discount retal stores Her compamy is jooking at the possibuity of replacing the existing fluorescent lights in all of its stores with LED lights. The main advantage of making this switch is that the LED lights are much more efficient and cost less to operate In addibion, LED lights last. much longer and will have to be replaced after ten years, Whereas the exiating thgtts have to be replaced allet five yeas. Or couise making this change will reguire a latge investment to purchase new L.ED lights and to pay for the labor of switching out lens of thousands of bulbs Dlane plans to use a 10 -year horizen to analyze this propgsat. figuring that changes to lighting technology will eventually make this investment obsolete Diane's friend and cosorker, David has analyzed another energy isaving imostrsem opportunity that involves replaciog outdoor lightiog with solar-powered fixtures in a faw of the compary's atores David also used a 10 year horizon to conduct his analyeis Cash flow forecasts for each propect are given here The compang uses is 10% discount rate lo analye capital budgoting pioposals a. What is the fPPV of each investment? Which imvestment (it elther) should the comsandy undertake? 6. David approaches Dlane for a favoe David says that the solar lightng project is a pet project of his boss, and David really wants to get the propect approved to caty tavoc with bit boss He suggests to Diane that they roll their two projects ints a single proposal The cash flows for this combined project would airply equal the cum of the hao ingvidual projecta Calculate the NpP of the combined project Does it appear to be worth doing? Would you recommend investing in the combined project? c. What is the ethical issue that Diane faces? Is any harm done if she does the favor for David as he asks? Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) a. The NPV of the LED project is $ (Round to the nearest dollar.) The NPV of the solar project is $ (Round to the nearest dollar.) Which investment (if either) should the company undertake? (Select the best answer below.) A. The company should not choose either project. B. The company should choose the LED project because its NPV is positive. C. The company should choose both projects. D. The company should choose the Solar project because its NPV is negative. The NPV of the combined peoject is? (Round to the nearest dollar) Wes it appear to be worth dolng? Would yourecommend investing in the combined project? (Select the bast answer below) A. The combined project has a positive NPV, which means it is worth doing in general Since the NPV of the LED project has heiped balance the negativo NPV at the solar project, the combined project should be undertaken B. The combined project has a positive NPV, which means it is worth doing in general However, since the NPV of tite LED project ia positive and the solar piofec The negative the LED project should be undertaken not the combined project C. The combined project has a positive NPV. which means at is not worth doing in generai. Hovever. anace the NPV of the Solar prolect is lebs than the combined prof act the - solar project should be undertaken, not the combined project 0. The combined project has a podeive NPV which means is is worth doing in generad Since the NPV of the LED project is also positive. the project with the lowest NPV should be chosen. which means the combined project should be undertaken What is the ethicalissue that Diane faces? Is any harm done if she does the favor for David as he asks? (Select all anwwers that apply? A. By combining the projects, tho Solar project which should have beeb rejected wil be undertak.pn becauhe the positive NPV of the LED project makes look acceptable This in in the best interest of the company because both projects can be done 8. If Diane does the favor David asks, she is causing the company to underake a project that should be rejected (he Solar projoct) which helgs Dayid look good tor hhi boss and saves the company money by undertaking both projects C. Ey combining the projects, the Solar project which ohould have been rejecled. Wat be underaken becauge the positove NPV of the LEO project niakes is look asceptathe This is not in the best interest of the company because the Solar project will lower the value of the canipany D. There is no harm done it Diane does the favor David asks because thie company whil spond the money on the prefets anveay. E. When choosing between projocts that both have a positive NPV the project with the lowest tapV should be chosen F. If Diane does the favor Dxvid asks, she is causing the company to undertake the Solar Project a project that should bot refected which is unethikal G. When choosing between nutually oxclusive projgcts that both have a positive WPV the prolect with the largest NPV shoud be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts