Question: Anna & Nick Biscuit - June, 2 0 2 4 Anna and Nick Biscuit are both 4 0 years of age. Anna works for a

Anna & Nick Biscuit June,

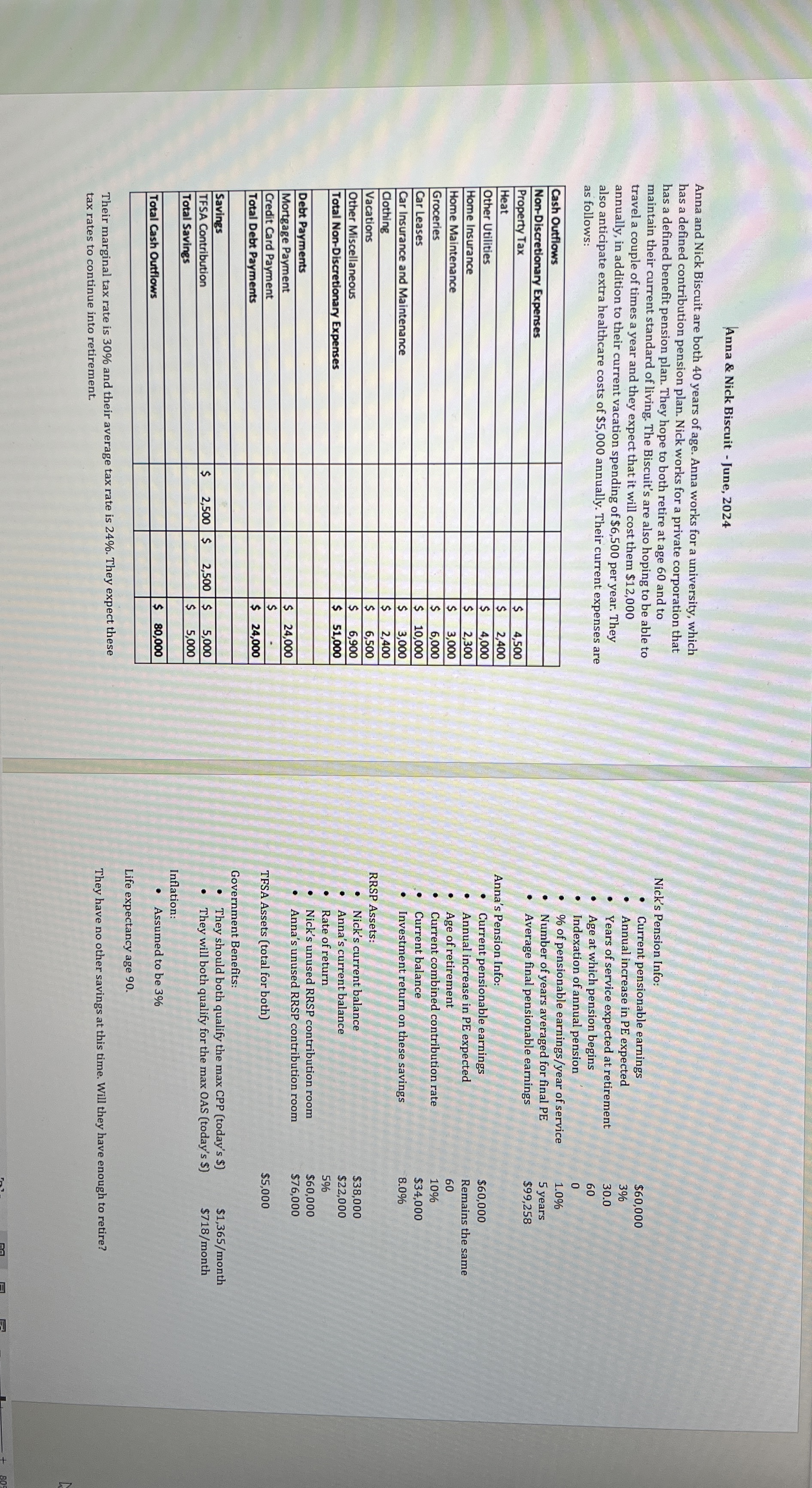

Anna and Nick Biscuit are both years of age. Anna works for a university, which

has a defined contribution pension plan. Nick works for a private corporation that

has a defined benefit pension plan. They hope to both retire at age and to

maintain their current standard of living. The Biscuit's are also hoping to be able to

travel a couple of times a year and they expect that it will cost them $

annually, in addition to their current vacation spending of $ per year. They

also anticipate extra healthcare costs of $ annually. Their current expenses are

as follows:

Their marginal tax rate is and their average tax rate is They expect these

tax rates to continue into retirement.

Nick's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Years of service expected at retirement

Age at which pension begins

Indexation of annual pension

of pensionable earningsyear of service

Number of years averaged for final PE

Average final pensionable earnings

Anna's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Age of retirement

Current combined contribution rate

Current balance

Investment return on these savings

RRSP Assets:

Nick's current balance

Anna's current balance

Rate of return

Nick's unused RRSP contribution room

Anna's unused RRSP contribution room

TFSA Assets total for both

Government Benefits:

They should both qualify the max CPP todays $

$month

$month

Inflation:

Assumed to be

Life expectancy age

They have no other savings at this time. Will they have enough to retire?Anna & Nick Biscuit June,

Anna and Nick Biscuit are both years of age. Anna works for a university, which

has a defined contribution pension plan. Nick works for a private corporation that

has a defined benefit pension plan. They hope to both retire at age and to

maintain their current standard of living. The Biscuit's are also hoping to be able to

travel a couple of times a year and they expect that it will cost them $

annually, in addition to their current vacation spending of $ per year. They

also anticipate extra healthcare costs of $ annually. Their current expenses are

as follows:

Their marginal tax rate is and their average tax rate is They expect these

tax rates to continue into retirement.

Nick's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Years of service expected at retirement

Age at which pension begins

Indexation of annual pension

of pensionable earningsyear of service

Number of years averaged for final PE

Average final pensionable earnings

Anna's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Age of retirement

Current combined contribution rate

Current balance

Investment return on these savings

RRSP Assets:

Nick's current balance

Anna's current balance

Rate of return

Nick's unused RRSP contribution room

Anna's unused RRSP contribution room

TFSA Assets total for both

Government Benefits:

They should both qualify the max CPP todays $

$month

$month

Inflation:

Assumed to be

Life expectancy age

They have no other savings at this time. Will they have enough to retire?Anna & Nick Biscuit June,

Anna and Nick Biscuit are both years of age. Anna works for a university, which

has a defined contribution pension plan. Nick works for a private corporation that

has a defined benefit pension plan. They hope to both retire at age and to

maintain their current standard of living. The Biscuit's are also hoping to be able to

travel a couple of times a year and they expect that it will cost them $

annually, in addition to their current vacation spending of $ per year. They

also anticipate extra healthcare costs of $ annually. Their current expenses are

as follows:

Their marginal tax rate is and their average tax rate is They expect these

tax rates to continue into retirement.

Nick's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Years of service expected at retirement

Age at which pension begins

Indexation of annual pension

of pensionable earningsyear of service

Number of years averaged for final PE

Average final pensionable earnings

Anna's Pension Info:

Current pensionable earnings

Annual increase in PE expected

Age of retirement

Current combined contribution rate

Current balance

Investment return on these savings

RRSP Assets:

Nick's current balance

Anna's current balance

Rate of return

Nick's unused RRSP contribution room

Anna's unused RRSP contribution room

TFSA Assets total for both

Government Benefits:

They should both qualify the max CPP todays $

$month

$month

Inflation:

Assumed to be

Life expectancy age

They have no other savings at this time. Will they have enough to retire?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock