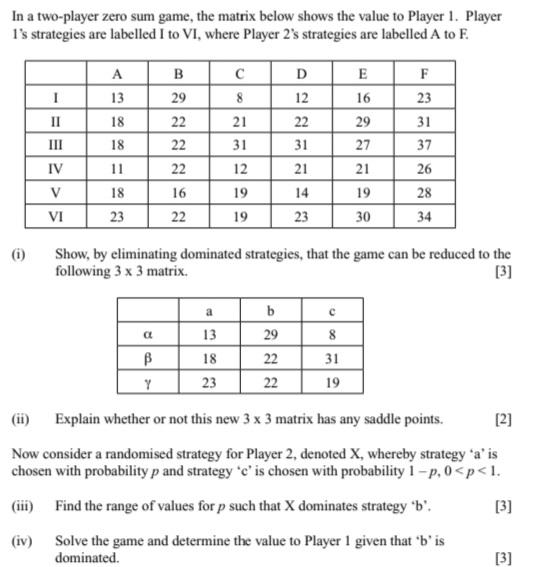

Question: In a two-player zero sum game, the matrix below shows the value to Player 1. Player 1's strategies are labelled I to VI, where

In a two-player zero sum game, the matrix below shows the value to Player 1. Player 1's strategies are labelled I to VI, where Player 2's strategies are labelled A to F. (i) I II III IV V VI A 13 18 18 11 18 23 B 29 22 22 22 16 22 a B Y C 8 a 13 18 23 21 31 12 19 19 b 29 22 D 12 Show, by eliminating dominated strategies, that the game can be reduced to the following 3 x 3 matrix. [3] 22 22 31 21 14 23 E 16 29 27 21 19 30 c 8 31 19 F 23 31 37 26 28 34 (ii) Explain whether or not this new 3 x 3 matrix has any saddle points. [2] Now consider a randomised strategy for Player 2, denoted X, whereby strategy 'a' is chosen with probability p and strategy 'e' is chosen with probability 1-p, 0 Consider a binomial tree model for the stock price S,. Let So= 50 and let the price rise by 10% or fall by 5% each month for the next three months. Assume also that the risk-free rate is 5% per annum continuously compounded. (i) State the conditions under which the market is arbitrage free. (ii) [2] Calculate the price at time 1 = 0 of a European call option on this stock, which expires in three months and is struck at-the-money (i.e. strike price K = 50). [4] A special option, called a knock-out barrier option, goes out of existence (i.e. expires without any payoff or value) if the underlying asset reaches a pre-specified barrier b>0 either from above (down-and-out) or from below (up-and-out). The down-and-out call has the following payoff at time T max (ST-K,0) if min S, b, OSIST 0 otherwise. Assume this special option is written on the given stock, has the same strike price and maturity as the European call option described in part (ii) and the barrier b is fixed at 48. (iii) Calculate the price of this contract using the binomial tree model and risk- neutral valuation. [3] (iv) Determine the price of the down-and-out contract when b = 40, without performing any further calculations.

Step by Step Solution

There are 3 Steps involved in it

To solve the given zerosum game we first need to eliminate dominated strategies A dominated strategy is one that results in a lower payoff for a player regardless of the other players strategy For Pla... View full answer

Get step-by-step solutions from verified subject matter experts