Question: ANSWER ALL MCQ QUESTIONS AND NO NEED TO EXPLAIN THE ANSWERS 27. You're the purchasing manager for a large trucking company. Although oil prices have

ANSWER ALL MCQ QUESTIONS AND NO NEED TO EXPLAIN THE ANSWERS

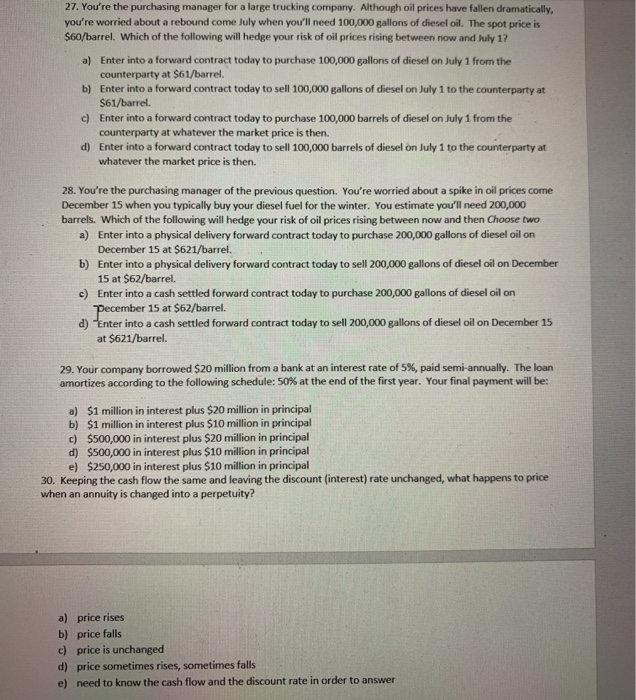

ANSWER ALL MCQ QUESTIONS AND NO NEED TO EXPLAIN THE ANSWERS 27. You're the purchasing manager for a large trucking company. Although oil prices have fallen dramatically, you're worried about a rebound come July when you'll need 100,000 gallons of diesel oil. The spot price is $60/barrel. Which of the following will hedge your risk of oil prices rising between now and July 17 a) Enter into a forward contract today to purchase 100,000 gallons of diesel on July 1 from the counterparty at $61/barrel. b) Enter into a forward contract today to sell 100,000 gallons of diesel on July 1 to the counterparty at $61/barrel. c) Enter into a forward contract today to purchase 100,000 barrels of diesel on July 1 from the counterparty at whatever the market price is then. d) Enter into a forward contract today to sell 100,000 barrels of diesel on July 1 to the counterparty at whatever the market price is then. 28. You're the purchasing manager of the previous question. You're worried about a spike in oil prices come December 15 when you typically buy your diesel fuel for the winter. You estimate you'll need 200,000 barrels. Which of the following will hedge your risk of oil prices rising between now and then choose two a) Enter into a physical delivery forward contract today to purchase 200,000 gallons of diesel oil on December 15 at $621/barrel. . b) Enter into a physical delivery forward contract today to sell 200,000 gallons of diesel oil on December 15 at $62/barrel. c) Enter into a cash settled forward contract today to purchase 200,000 gallons of diesel oil on Pecember 15 at $62/barrel. d) Enter into a cash settled forward contract today to sell 200,000 gallons of diesel oil on December 15 at $621/barrel. 29. Your company borrowed $20 million from a bank at an interest rate of 5%, paid semi-annually. The loan amortizes according to the following schedule: 50% at the end of the first year. Your final payment will be: a) $1 million in interest plus $20 million in principal b) $1 million in interest plus $10 million in principal c) $500,000 in interest plus $20 million in principal d) $500,000 in interest plus $10 million in principal e) $250,000 in interest plus $10 million in principal 30. Keeping the cash flow the same and leaving the discount (interest) rate unchanged, what happens to price when an annuity is changed into a perpetuity? a) price rises b) price falls c) price is unchanged d) price sometimes rises, sometimes falls e) need to know the cash flow and the discount rate in order to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts