Question: ANSWER ALL PARTS USING EXCEL PLEASE. a) Explain why investing 100 in a European call option is more risky than investing 100 in the underlying

ANSWER ALL PARTS USING EXCEL PLEASE.

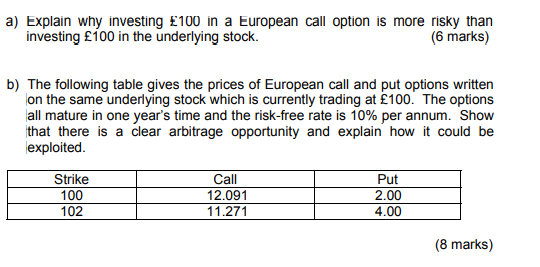

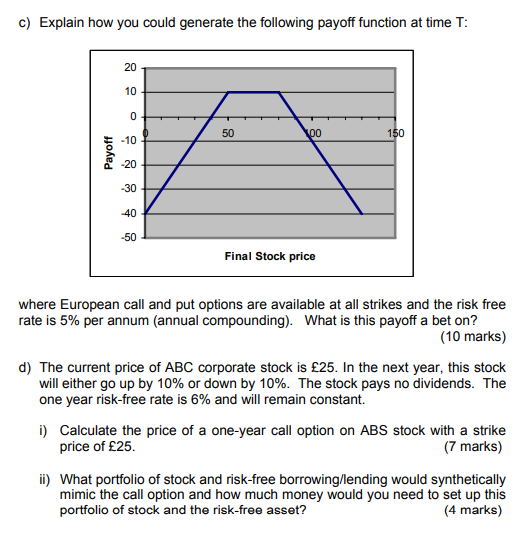

a) Explain why investing 100 in a European call option is more risky than investing 100 in the underlying stock. (6 marks) b) The following table gives the prices of European call and put options written on the same underlying stock which is currently trading at 100. The options all mature in one year's time and the risk-free rate is 10% per annum. Show that there is a clear arbitrage opportunity and explain how it could be exploited. Strike 100 102 Call 12.091 11.271 Put 2.00 4.00 (8 marks) c) Explain how you could generate the following payoff function at time T: 20 10 0 50 100 150 -10 Payoff -20 -30 40 -50 Final Stock price where European call and put options are available at all strikes and the risk free rate is 5% per annum (annual compounding). What is this payoff a bet on? (10 marks) d) The current price of ABC corporate stock is 25. In the next year, this stock will either go up by 10% or down by 10%. The stock pays no dividends. The one year risk-free rate is 6% and will remain constant. i) Calculate the price of a one-year call option on ABS stock with a strike price of 25. (7 marks) ii) What portfolio of stock and risk-free borrowing/lending would synthetically mimic the call option and how much money would you need to set up this portfolio of stock and the risk-free asset? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts