Question: answer all please Attempts Keep the Highest/4 3. The basics of the Capital Asset Pricing Model Which of the following are assumptions of the Capital

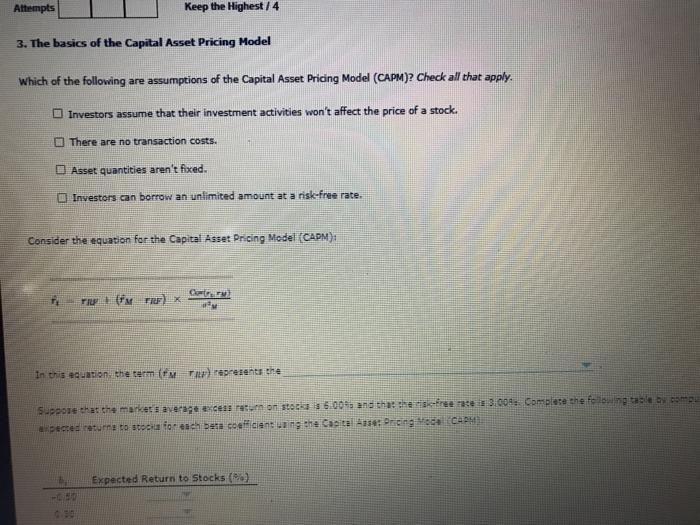

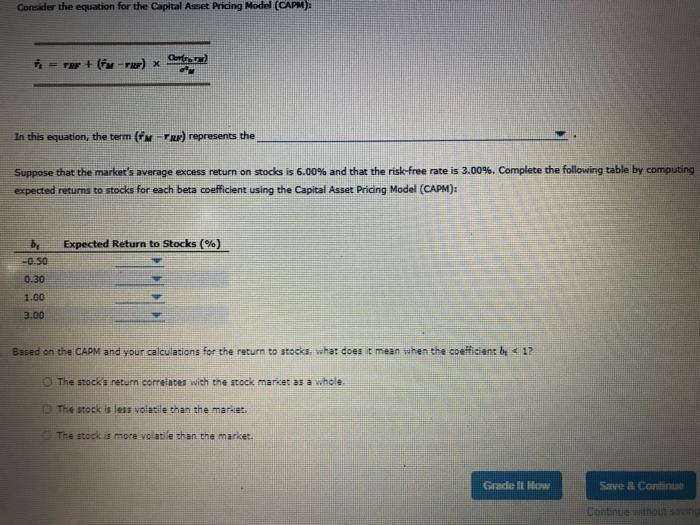

Attempts Keep the Highest/4 3. The basics of the Capital Asset Pricing Model Which of the following are assumptions of the Capital Asset Pricing Model (CAPM)? Check all that apply. Investors assume that their investment activities won't affect the price of a stock. There are no transaction costs. D Asset quantities aren't fixed. Investors can borrow an unlimited amount at a risk-free rate. Consider the equation for the Capital Asset Pricing Medel (CAPM), CZ In this equation the term (tv) represents the Suppose that the markets average excels return on stoc 6.000 and that the freeze 3.008. Complete the following use by como expected returns to stoc foresch Data coefficient using the Castal 114 Pricing Mo CAPM Expected Return to Stocks (2) Consider the equation for the Capital Asset Pricing Model (CAPM): Carte) = mar + (n -TRE) X In this equation, the term (In Tre) represents the Suppose that the market's average excess return on stocks is 6.00% and that the risk-free rate is 3.00%. Complete the following table by computing expected returns to stocks for each beta coefficient using the Capital Asset Pricing Model (CAPM): Expected Return to Stocks (%) by -0.50 0.30 1.00 3.00 Based on the CAPM and your calculations for the return to stocks, what does it mean when the coefficant by 12 The stocks return correlates with the stock marset as a whole The stock is less volatile than the market The stock is more valable than the market. Graciel Save a Conti Continue without ang

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts