Question: Answer all please Discountco signed a 12-year note payable on January 1, 2016, of $1,140,000. The note requires annual principal payments each December 31 of

Answer all please

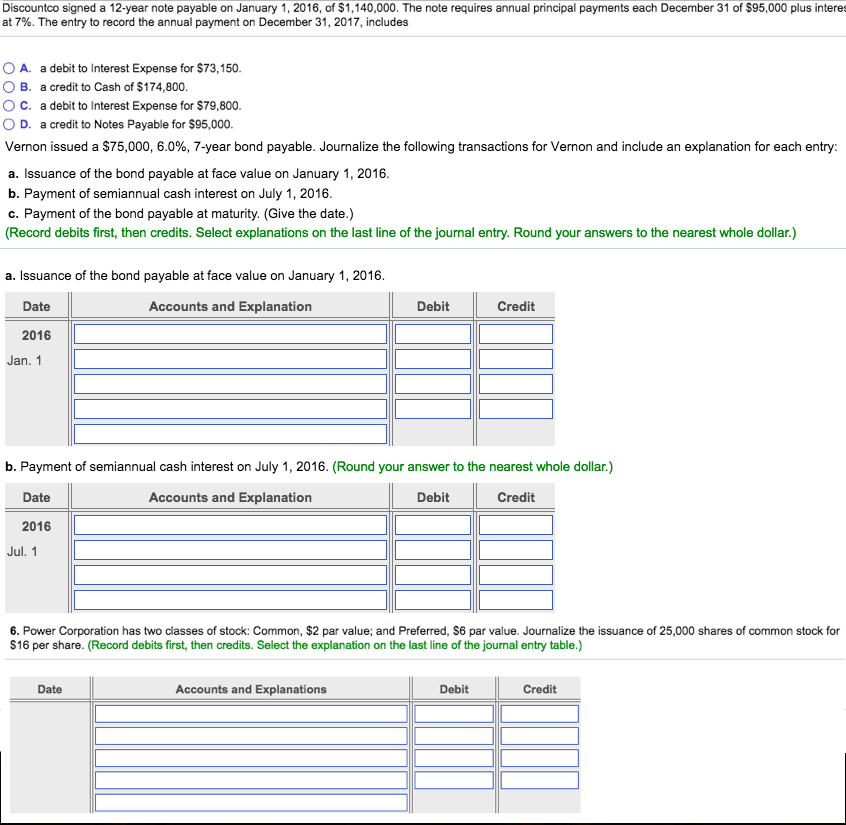

Discountco signed a 12-year note payable on January 1, 2016, of $1,140,000. The note requires annual principal payments each December 31 of $95,000 plus interes at 7%. The entry to record the annual payment on December 31, 2017, includes OA. O B. a debit to Interest Expense for $73,150 a credit to Cash of $174,800 C. a debit to Interest Expense for $79,800 O D. a credit to Notes Payable for $95,000 Vernon issued a $75,000, 6.0%, 7-year bond payable. Journalize the following transactions for Vernon and include an explanation for each entry: a. Issuance of the bond payable at face value on January 1, 2016 b. Payment of semiannual cash interest on July 1, 2016 c. Payment of the bond payable at maturity. (Give the date.) (Record debits first, then credits. Select explanations on the last line of the journal entry. Round your answers to the nearest whole dollar.) a. Issuance of the bond payable at face value on January 1, 2016 Date Accounts and Explanation Debit Credit 2016 Jan. 1 b. Payment of semiannual cash interest on July 1, 2016. (Round your answer to the nearest whole dollar.) Date Accounts and Explanation Debit Credit 2016 Jul. 1 6. Power Corporation has two classes of stock: Common, $2 par value; and Preferred, S6 par value. Journalize the issuance of 25,000 shares of common stock for $16 per share. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanations Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts