Question: answer all prompts correctly for a like. Use this information about Department G to answer the question that follows. Department G had 2,040 units 25%

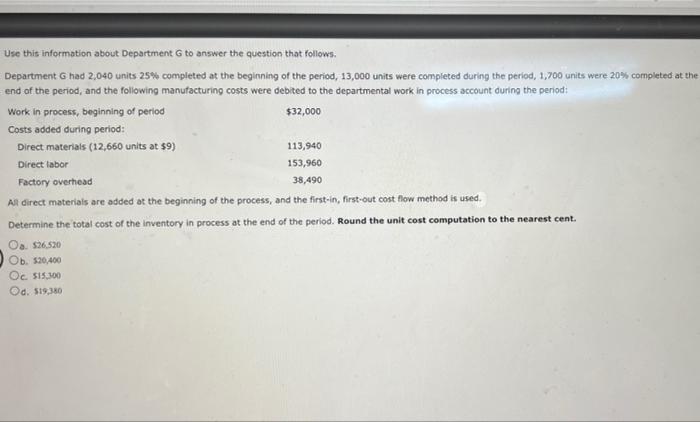

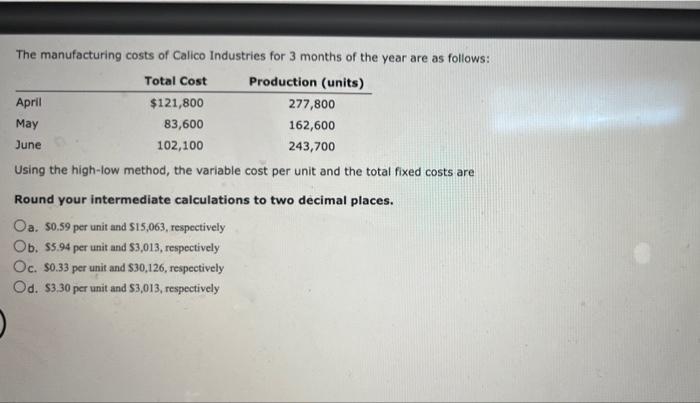

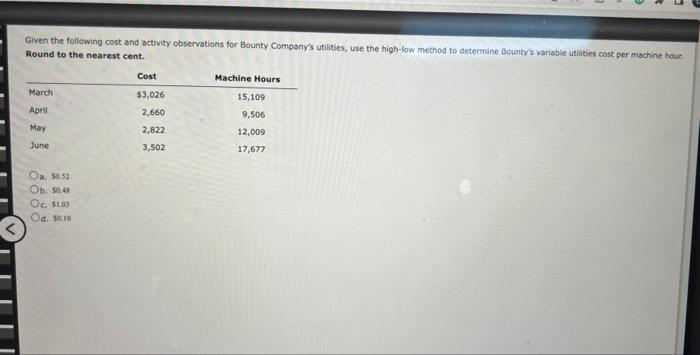

Use this information about Department G to answer the question that follows. Department G had 2,040 units 25% completed at the beginning of the period, 13,000 units were completed during the period, 1,700 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period: Work in process, beginning of period $32,000 Costs added during period: Direct materials (12,660 units at $9) 113,940 Direct labor 153,960 Factory overhead 38,490 All direct materials are added at the beginning of the process, and the first-in, first-out cost flow method is used. Determine the total cost of the inventory in process at the end of the period. Round the unit cost computation to the nearest cent. Oa. $26.520 Ob. $20,400 Oc. $15,300 Od. $19,380 The manufacturing costs of Calico Industries for 3 months of the year are as follows: Total Cost Production (units) April $121,800 277,800 May 83,600 162,600 June 102,100 243,700 Using the high-low method, the variable cost per unit and the total fixed costs are Round your intermediate calculations to two decimal places. Oa. $0.59 per unit and $15,063, respectively Ob. $5.94 per unit and $3,013, respectively Oc. $0.33 per unit and $30,126, respectively Od. $3.30 per unit and $3,013, respectively Given the following cost and activity observations for Bounty Company's utilities, use the high-low method to determine Bounty's variable utilities cost per machine hour. Round to the nearest cent. Cost Machine Hours March $3,026 15,109 April 2,660 9,506 May 2,822 12,009 June 3,502 17,677 Oa, 50.52 Ob. 50.48 Oc. $1.03 Od. 30.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts