Question: answer all questions correctly for a like. Question 3 (0.2 points) Calculate the market to book ratio of a firm with a current share price

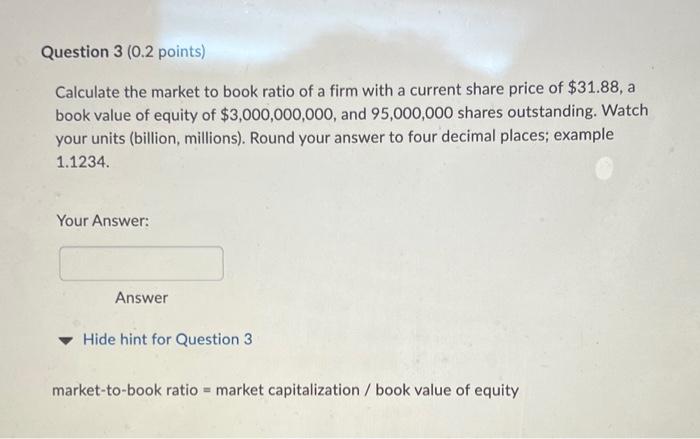

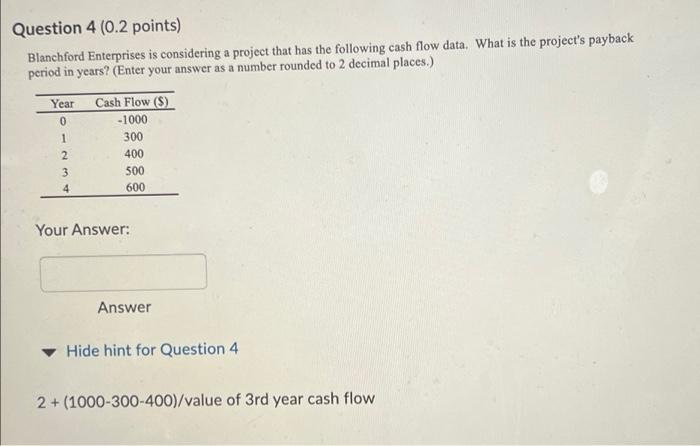

Question 3 (0.2 points) Calculate the market to book ratio of a firm with a current share price of $31.88, a book value of equity of $3,000,000,000, and 95,000,000 shares outstanding. Watch your units (billion, millions). Round your answer to four decimal places; example 1.1234 Your Answer: Answer Hide hint for Question 3 market-to-book ratio = market capitalization / book value of equity Question 4 (0.2 points) Blanchford Enterprises is considering a project that has the following cash flow data. What is the project's payback period in years? (Enter your answer as a number rounded to 2 decimal places.) Year 0 1 2 3 4 Cash Flow ($) -1000 300 400 500 600 Your Answer: Answer Hide hint for Question 4 2+(1000-300-400)/value of 3rd year cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts