Question: answer both parts. will thumbs up for correct answer Problem 17-9 (Algo) Determine pension expense; PBO; plan assets; net pension asset or liability; journal entries

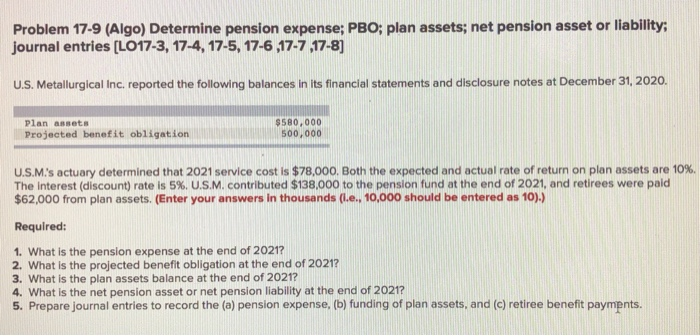

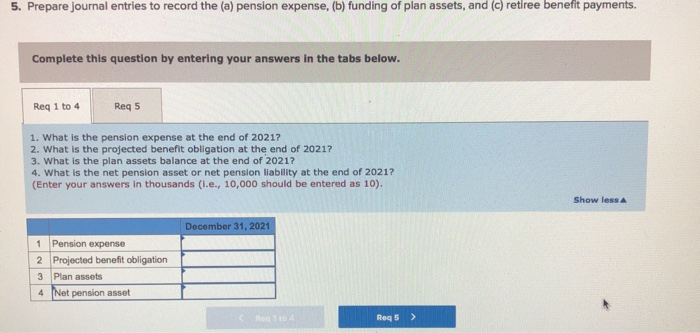

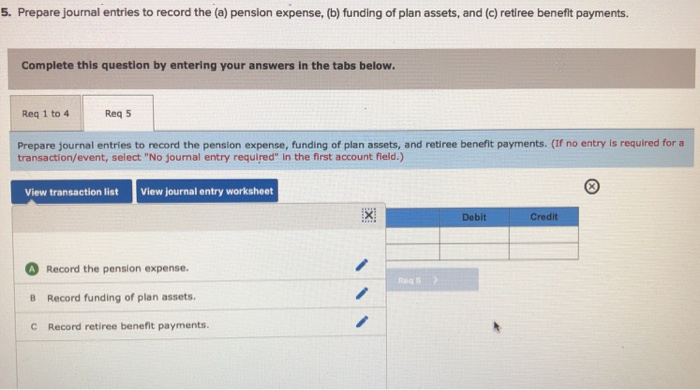

Problem 17-9 (Algo) Determine pension expense; PBO; plan assets; net pension asset or liability; journal entries [LO17-3, 17-4, 17-5, 17-6,17-7,17-8) U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure notes at December 31, 2020. Plan assets Projected benefit obligation $580,000 500,000 U.S.M's actuary determined that 2021 service cost is $78,000. Both the expected and actual rate of return on plan assets are 10%. The Interest (discount) rate is 5%. U.S.M. contributed $138,000 to the pension fund at the end of 2021, and retirees were paid $62,000 from plan assets. (Enter your answers in thousands (.e., 10,000 should be entered as 10).) Required: 1. What is the pension expense at the end of 2021? 2. What is the projected benefit obligation at the end of 2021? 3. What is the plan assets balance at the end of 2021? 4. What is the net pension asset or net pension liability at the end of 2021? 5. Prepare journal entries to record the (a) pension expense, (b) funding of plan assets, and (c) retiree benefit payments. 5. Prepare journal entries to record the (a) pension expense, (b) funding of plan assets, and (c) retiree benefit payments. Complete this question by entering your answers in the tabs below. Reg 1 to 4 Reg 5 1. What is the pension expense at the end of 20217 2. What is the projected benefit obligation at the end of 2021? 3. What is the plan assets balance at the end of 2021? 4. What is the net pension asset or net pension liability at the end of 2021? (Enter your answers in thousands (I.e., 10,000 should be entered as 10). Show less December 31, 2021 1 Pension expense 2 Projected benefit obligation 3 Plan assets 4 Net pension asset Req6 > 5. Prepare journal entries to record the (a) pension expense, (b) funding of plan assets, and (c) retiree benefit payments. Complete this question by entering your answers in the tabs below. Req 1 to 4 Reg 5 Prepare journal entries to record the pension expense, funding of plan assets, and retiree benefit payments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet X Debit Credit Record the pension expense. B Record funding of plan assets. C Record retiree benefit payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts