Question: Answer for a) is provided below. Please help to answer b) only. Thank you Spreadsheet 5.1 Scenario analysis of holding-period return of the mutual fund

Answer for a) is provided below. Please help to answer b) only. Thank you

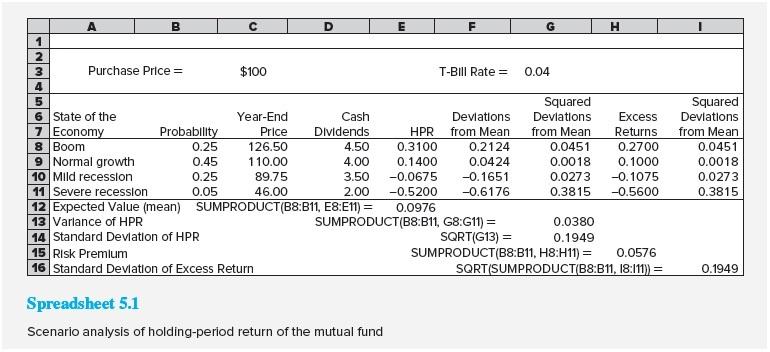

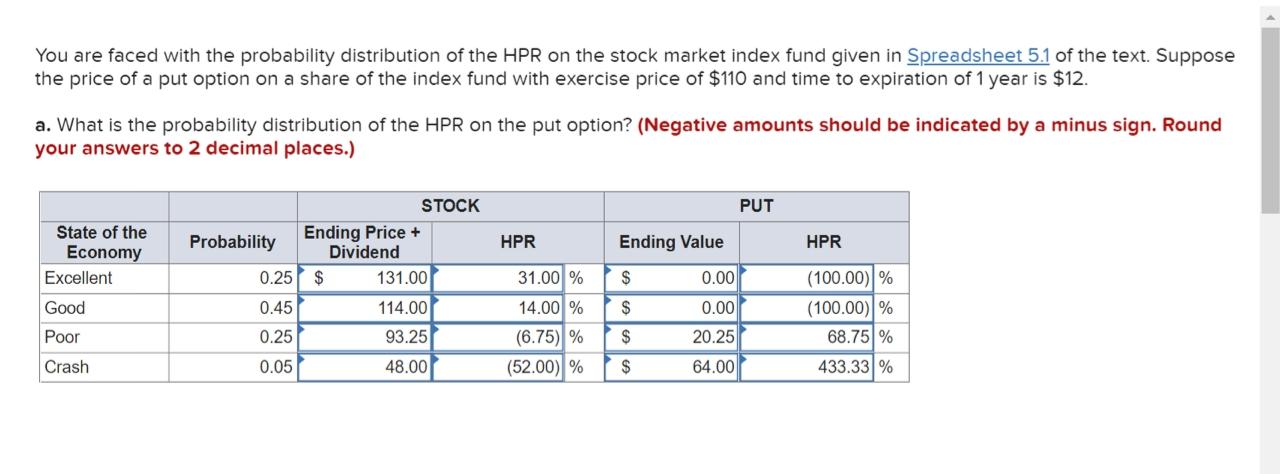

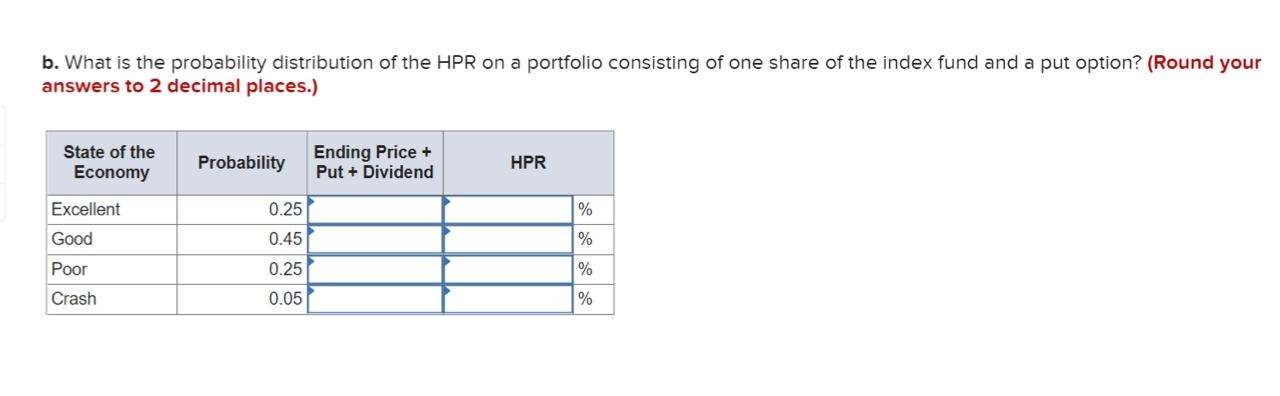

Spreadsheet 5.1 Scenario analysis of holding-period return of the mutual fund You are faced with the probability distribution of the HPR on the stock market index fund given in of the text. Suppose the price of a put option on a share of the index fund with exercise price of $110 and time to expiration of 1 year is $12. a. What is the probability distribution of the HPR on the put option? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) b. What is the probability distribution of the HPR on a portfolio consisting of one share of the index fund and a put option? (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts