Question: Answer me fast Golden Gate Co. is evaluating the replacement of its existing manufacturing equipment with a new equipment. The old equipment is 5 year

Answer me fast

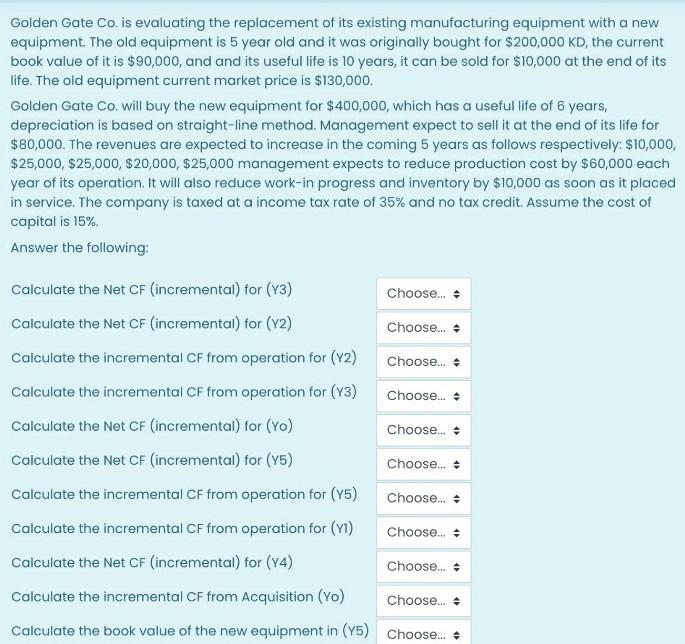

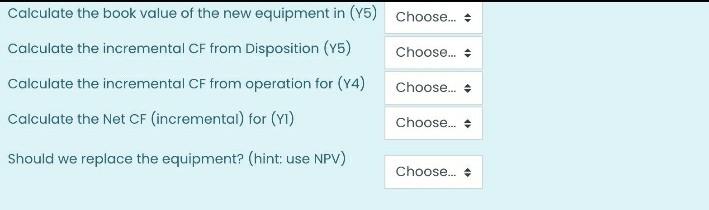

Golden Gate Co. is evaluating the replacement of its existing manufacturing equipment with a new equipment. The old equipment is 5 year old and it was originally bought for $200,000 KD, the current book value of it is $90,000, and and its useful life is 10 years, it can be sold for $10,000 at the end of its life. The old equipment current market price is $130,000. Golden Gate Co. will buy the new equipment for $400,000, which has a useful life of 6 years, depreciation is based on straight-line method. Management expect to sell it at the end of its life for $80,000. The revenues are expected to increase in the coming 5 years as follows respectively: $10,000, $25,000, $25,000, $20,000, $25,000 management expects to reduce production cost by $60,000 each year of its operation. It will also reduce work-in progress and inventory by $10,000 as soon as it placed in service. The company is taxed at a income tax rate of 35% and no tax credit. Assume the cost of capital is 15% Answer the following: Choose... - Choose... Choose. Choose... Choose. Calculate the Net CF (incremental) for (Y3) Calculate the Net CF (incremental) for (v2) Calculate the incremental CF from operation for (Y2) Calculate the incremental CF from operation for (Y3) Calculate the Net CF (incremental) for (yo) Calculate the Net CF (incremental) for (75) Calculate the incremental CF from operation for (Y5) Calculate the incremental CF from operation for (Y1) Calculate the Net CF (incremental) for (Y4) Calculate the incremental CF from Acquisition (Yo) Calculate the book value of the new equipment in (Y5) Choose.. . Choose... - Choose... Choose... Choose... Choose... Calculate the book value of the new equipment in (Y5) Choose... + Choose... Calculate the incremental CF from Disposition (Y5) Calculate the incremental CF from operation for (Y4) Calculate the Net CF (incremental) for (YI) Choose.. Choose... Should we replace the equipment? (hint: use NPV) Choose... Golden Gate Co. is evaluating the replacement of its existing manufacturing equipment with a new equipment. The old equipment is 5 year old and it was originally bought for $200,000 KD, the current book value of it is $90,000, and and its useful life is 10 years, it can be sold for $10,000 at the end of its life. The old equipment current market price is $130,000. Golden Gate Co. will buy the new equipment for $400,000, which has a useful life of 6 years, depreciation is based on straight-line method. Management expect to sell it at the end of its life for $80,000. The revenues are expected to increase in the coming 5 years as follows respectively: $10,000, $25,000, $25,000, $20,000, $25,000 management expects to reduce production cost by $60,000 each year of its operation. It will also reduce work-in progress and inventory by $10,000 as soon as it placed in service. The company is taxed at a income tax rate of 35% and no tax credit. Assume the cost of capital is 15% Answer the following: Choose... - Choose... Choose. Choose... Choose. Calculate the Net CF (incremental) for (Y3) Calculate the Net CF (incremental) for (v2) Calculate the incremental CF from operation for (Y2) Calculate the incremental CF from operation for (Y3) Calculate the Net CF (incremental) for (yo) Calculate the Net CF (incremental) for (75) Calculate the incremental CF from operation for (Y5) Calculate the incremental CF from operation for (Y1) Calculate the Net CF (incremental) for (Y4) Calculate the incremental CF from Acquisition (Yo) Calculate the book value of the new equipment in (Y5) Choose.. . Choose... - Choose... Choose... Choose... Choose... Calculate the book value of the new equipment in (Y5) Choose... + Choose... Calculate the incremental CF from Disposition (Y5) Calculate the incremental CF from operation for (Y4) Calculate the Net CF (incremental) for (YI) Choose.. Choose... Should we replace the equipment? (hint: use NPV) Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts