Question: Answer question 6 only. Please show all work and formula used and please dont use excel to solve. 1. What are the two sources of

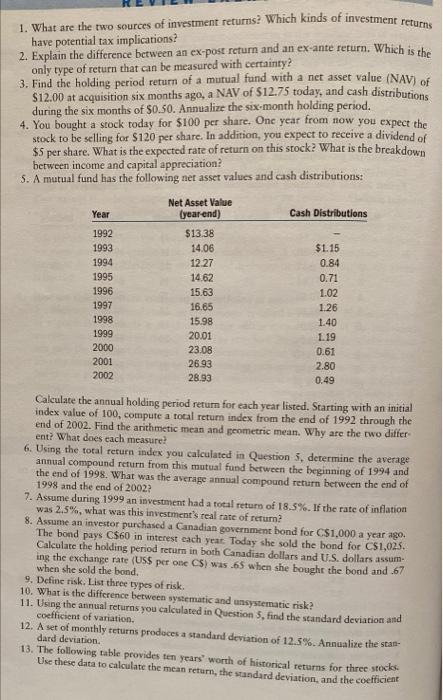

1. What are the two sources of investment returns? Which kinds of investment returns have potential tax implications? 2. Explain the difference between an ex-post return and an ex ante return. Which is the only type of return that can be measured with certainty? 3. Find the holding period return of a mutual fund with a net asset value (NAV) of $12.00 at acquisition six months ago, a NAV of $12.75 today, and cash distributions during the six months of $0.50. Annualize the six-month holding period. 4. You bought a stock today for $100 per share. One year from now you expect the stock to be selling for $120 per share. In addition, you expect to receive a dividend of $5 per share. What is the expected rate of return on this stock? What is the breakdown between income and capital appreciation S. A mutual fund has the following net asset values and cash distributions: Year Cash Distributions 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Net Asset Value [year end) $13.38 14.06 12.27 14.62 15.63 16.65 15.98 20.01 23.08 26.93 28.93 $1.15 0.84 0.71 1.02 1.26 1.40 1.19 0.61 2.80 0.49 Calculate the annual holding period return for each year listed. Starting with an initial index value of 100, compute a total return index from the end of 1992 through the end of 2002. Find the arithmetic mean and geometric mean. Why are the two differ ent? What does each measure? 6. Using the total return index you calculated in Question 5, determine the average annual compound return from this mutual fund between the beginning of 1994 and the end of 1998. What was the average annual compound return between the end of 1998 and the end of 2002? 7. Assume during 1999 an investment had a total return of 18.5%. If the rate of inflation was 2.5%, what was this investment's real rate of return 8. Assume an investor purchased a Canadian government bond for C$1.000 a year ago The bond pays C$60 in interest each year. Today she sold the bond for CS1,025. Calculate the holding period return in both Canadian dollars and U.S. dollars assum- ing the exchange rate (USS per one CS) was 65 when she bought the bond and .67 when she sold the bond, 9. Define tisk. List three types of risk. 10. What is the difference between systematic and unsystematic risk? 11. Using the annual returns you calculated in Question 5, find the standard deviation and coefficient of variation. 12. A set of monthly returns produces a standard deviation of 12.5%. Annualize the stat dard deviation 13. The following table provides ten years' worth of historical returns for three stocks. Use these data to calculate the mean return, the standard deviation, and the coefficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts