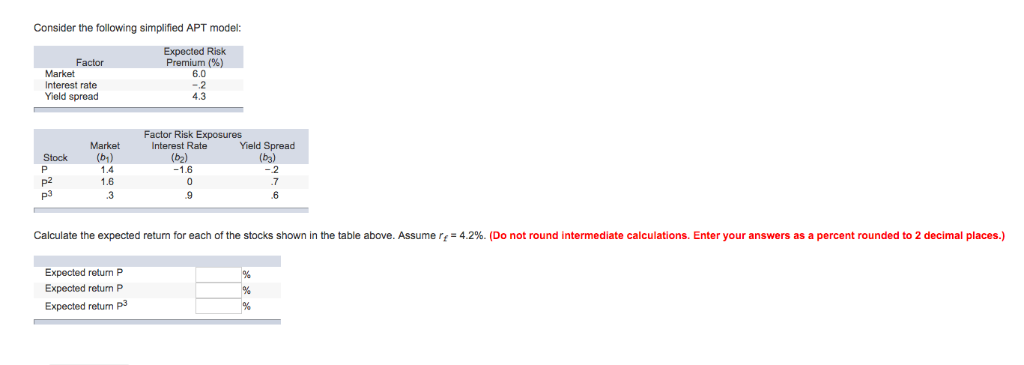

Question: Consider the following simplified APT model: Expected Risk Factor Premium (%) 6.0 Market Interest rate Yield spread 4.3 Factor Risk Exposures Interest Rate (b2) Yield

Consider the following simplified APT model: Expected Risk Factor Premium (%) 6.0 Market Interest rate Yield spread 4.3 Factor Risk Exposures Interest Rate (b2) Yield Spread Stock (b) 1.4 1.6 .3 (b3) p2 p3 .7 .6 .9 Calculate the expected retum for each of the stocks shown in the table above. Assume rf-4.2%. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected retun P Expected return P Expected retum p3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts