Question: answer question one and parts a and b with it. please gove expkanation for each step as you solve the question Question 1. You are

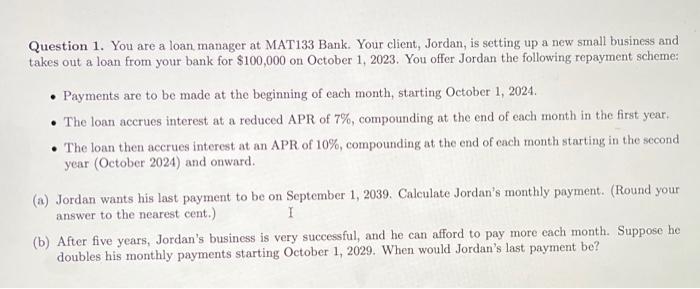

Question 1. You are a loan manager at MAT133 Bank. Your client, Jordan, is setting up a new small business and takes out a loan from your bank for $100,000 on October 1, 2023. You offer Jordan the following repayment scheme: - Payments are to be made at the beginning of each month, starting October 1, 2024. - The loan accrues interest at a reduced APR of 7\%, compounding at the end of each month in the first year. - The loan then accrues interest at an APR of 10%, compounding at the end of each month starting in the second year (October 2024) and onward. (a) Jordan wants his last payment to be on September 1, 2039. Calculate Jordan's monthly payment. (Round your answer to the nearest cent.) (b) After five years, Jordan's business is very successful, and he can afford to pay more each month. Suppose he doubles his monthly payments starting October 1, 2029. When would Jordan's last payment be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts