Question: answer quickly please answer as soon as possible PART 1. PORTFOLIO THEORY The market is comprised of four stocks, A, B, C, and D, with

answer quickly please answer as soon as possible

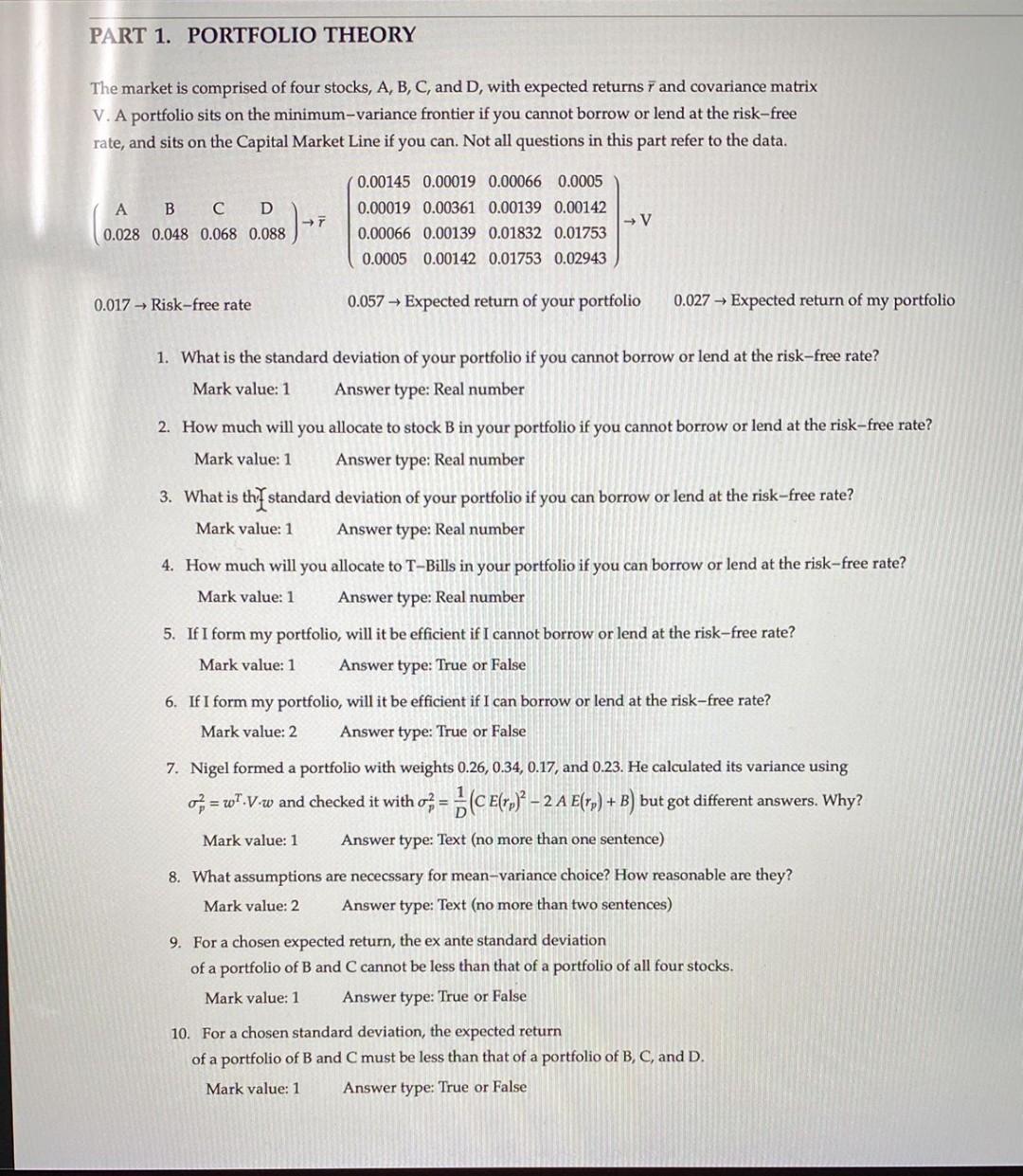

PART 1. PORTFOLIO THEORY The market is comprised of four stocks, A, B, C, and D, with expected returns and covariance matrix V. A portfolio sits on the minimum-variance frontier if you cannot borrow or lend at the risk-free rate, and sits on the Capital Market Line if you can. Not all questions in this part refer to the data. A B C D 0.028 0.048 0.068 0.088 $)- 0.00145 0.00019 0.00066 0.0005 0.00019 0.00361 0.00139 0.00142 0.00066 0.00139 0.01832 0.01753 0.0005 0.00142 0.01753 0.02943 V 0.017 Risk-free rate 0.057 - Expected return of your portfolio 0.027 - Expected return of my portfolio 1. What is the standard deviation of your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 2. How much will you allocate to stock B in your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 3. What is th/ standard deviation of your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 4. How much will you allocate to T-Bills in your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 5. If I form my portfolio, will it be efficient if I cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: True or False 6. If I form my portfolio, will it be efficient if I can borrow or lend at the risk-free rate? Mark value: 2 Answer type: True or False 7. Nigel formed a portfolio with weights 0.26,0.34, 0.17, and 0.23. He calculated its variance using 03= w".V-w and checked it with o; - 5 (CE(vw) 2 A E(79) + B) but got different answers. Why? Answer type: Text (no more than one sentence) Mark value: 1 8. What assumptions are nececssary for mean-variance choice? How reasonable are they? Mark value: 2 Answer type: Text (no more than two sentences) 9. For a chosen expected return, the ex ante standard deviation of a portfolio of B and C cannot be less than that of a portfolio of all four stocks. Mark value: 1 Answer type: True or False 10. For a chosen standard deviation, the expected return of a portfolio of B and C must be less than that of a portfolio of B, C, and D. Mark value: 1 Answer type: True or False PART 1. PORTFOLIO THEORY The market is comprised of four stocks, A, B, C, and D, with expected returns and covariance matrix V. A portfolio sits on the minimum-variance frontier if you cannot borrow or lend at the risk-free rate, and sits on the Capital Market Line if you can. Not all questions in this part refer to the data. A B C D 0.028 0.048 0.068 0.088 $)- 0.00145 0.00019 0.00066 0.0005 0.00019 0.00361 0.00139 0.00142 0.00066 0.00139 0.01832 0.01753 0.0005 0.00142 0.01753 0.02943 V 0.017 Risk-free rate 0.057 - Expected return of your portfolio 0.027 - Expected return of my portfolio 1. What is the standard deviation of your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 2. How much will you allocate to stock B in your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 3. What is th/ standard deviation of your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 4. How much will you allocate to T-Bills in your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 5. If I form my portfolio, will it be efficient if I cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: True or False 6. If I form my portfolio, will it be efficient if I can borrow or lend at the risk-free rate? Mark value: 2 Answer type: True or False 7. Nigel formed a portfolio with weights 0.26,0.34, 0.17, and 0.23. He calculated its variance using 03= w".V-w and checked it with o; - 5 (CE(vw) 2 A E(79) + B) but got different answers. Why? Answer type: Text (no more than one sentence) Mark value: 1 8. What assumptions are nececssary for mean-variance choice? How reasonable are they? Mark value: 2 Answer type: Text (no more than two sentences) 9. For a chosen expected return, the ex ante standard deviation of a portfolio of B and C cannot be less than that of a portfolio of all four stocks. Mark value: 1 Answer type: True or False 10. For a chosen standard deviation, the expected return of a portfolio of B and C must be less than that of a portfolio of B, C, and D. Mark value: 1 Answer type: True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts