Question: First name Question 1 (4 marks) Go to the St. Louis Federal Reserve FRED database, and find data on the total assets of all U.S.

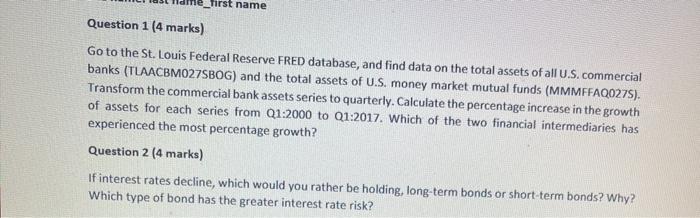

First name Question 1 (4 marks) Go to the St. Louis Federal Reserve FRED database, and find data on the total assets of all U.S. commercial banks (TLAACBM027SBOG) and the total assets of U.S. money market mutual funds (MMMFFAQO275). Transform the commercial bank assets series to quarterly. Calculate the percentage increase in the growth of assets for each series from 01:2000 to 01:2017. Which of the two financial intermediaries has experienced the most percentage growth? Question 2 (4 marks) If interest rates decline, which would you rather be holding, long-term bonds or short-term bonds? Why? Which type of bond has the greater interest rate risk? First name Question 1 (4 marks) Go to the St. Louis Federal Reserve FRED database, and find data on the total assets of all U.S. commercial banks (TLAACBM027SBOG) and the total assets of U.S. money market mutual funds (MMMFFAQO275). Transform the commercial bank assets series to quarterly. Calculate the percentage increase in the growth of assets for each series from 01:2000 to 01:2017. Which of the two financial intermediaries has experienced the most percentage growth? Question 2 (4 marks) If interest rates decline, which would you rather be holding, long-term bonds or short-term bonds? Why? Which type of bond has the greater interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts