Question: please answer quickly please answer as soon as possible i post this third time i need this urgently please answer all questions PART 1. PORTFOLIO

please answer quickly

please answer quickly

please answer as soon as possible

i post this third time i need this urgently

please answer all questions

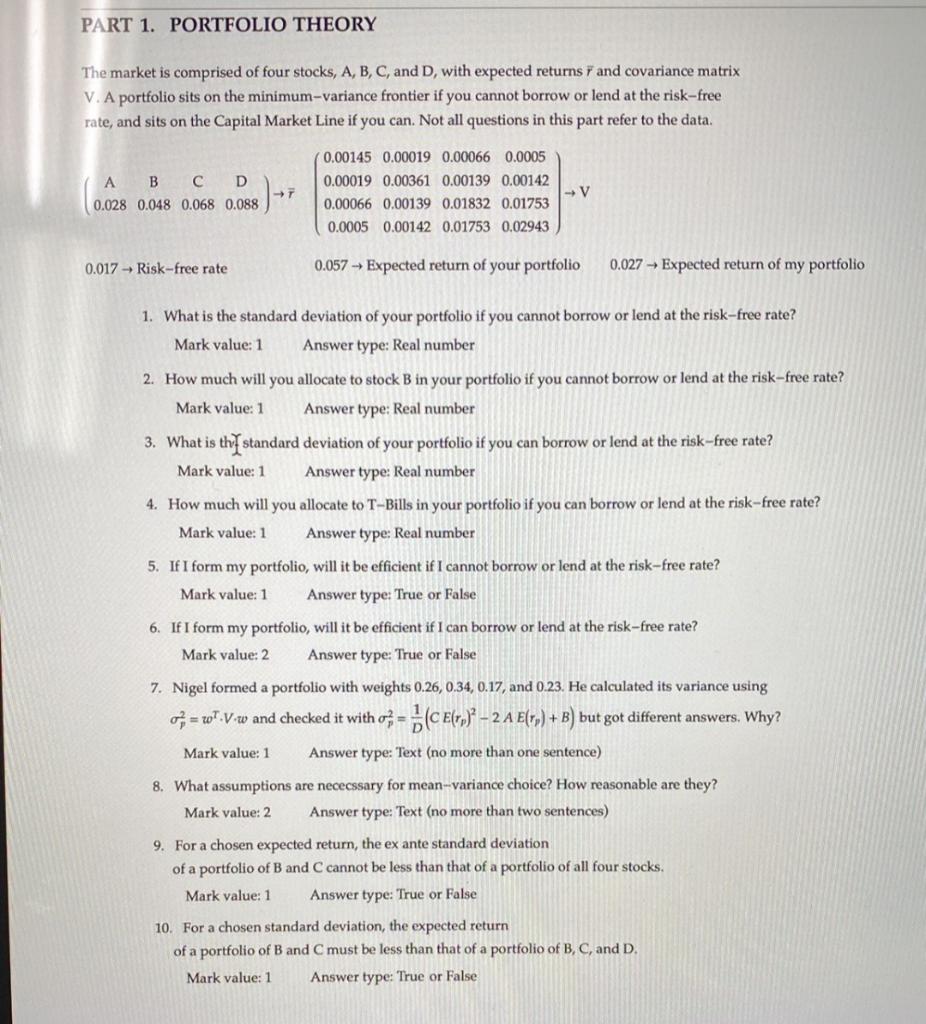

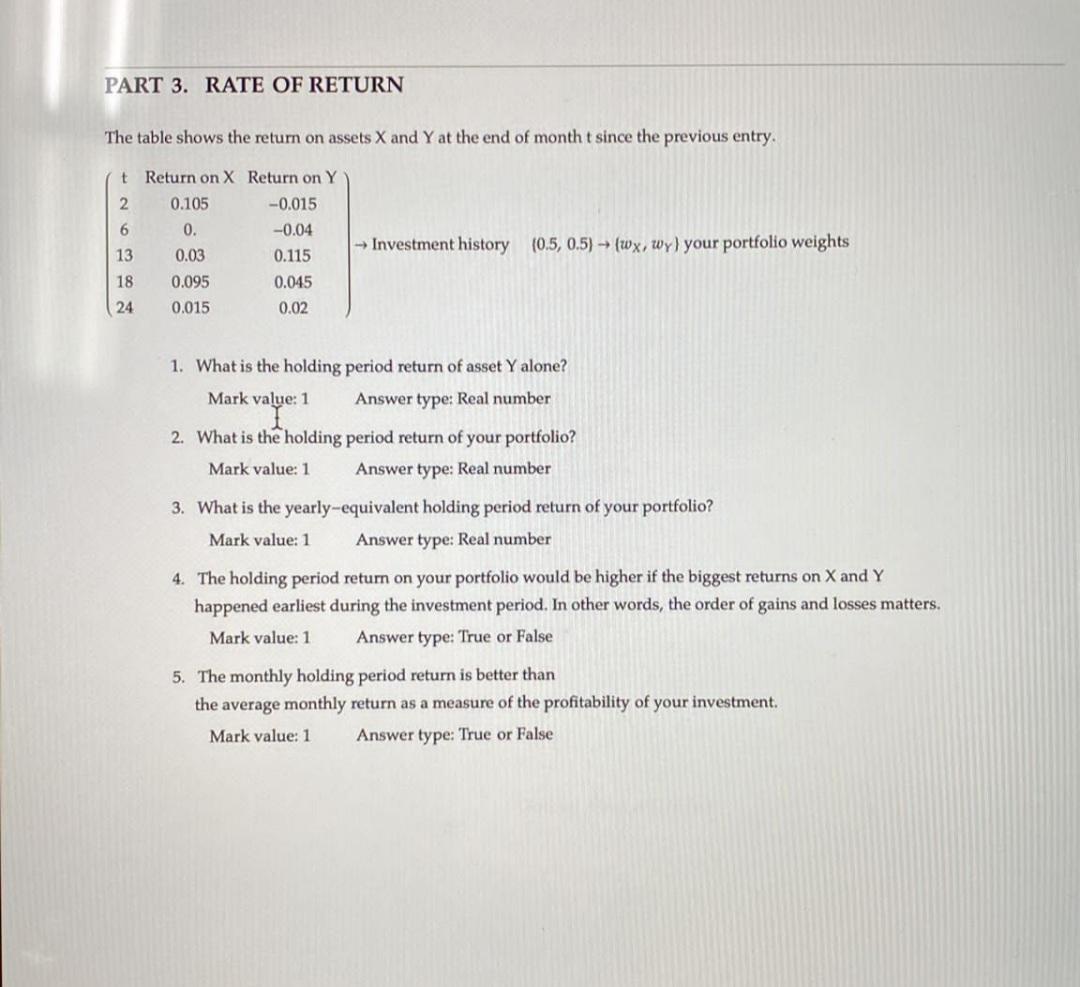

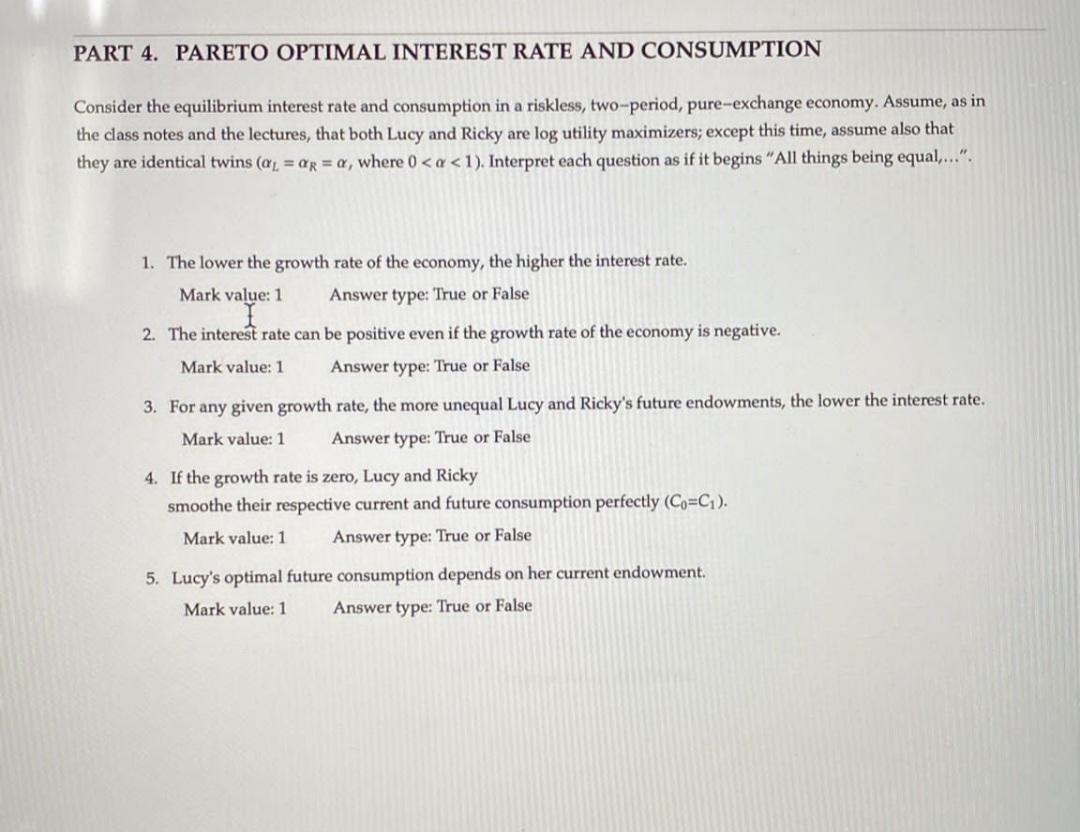

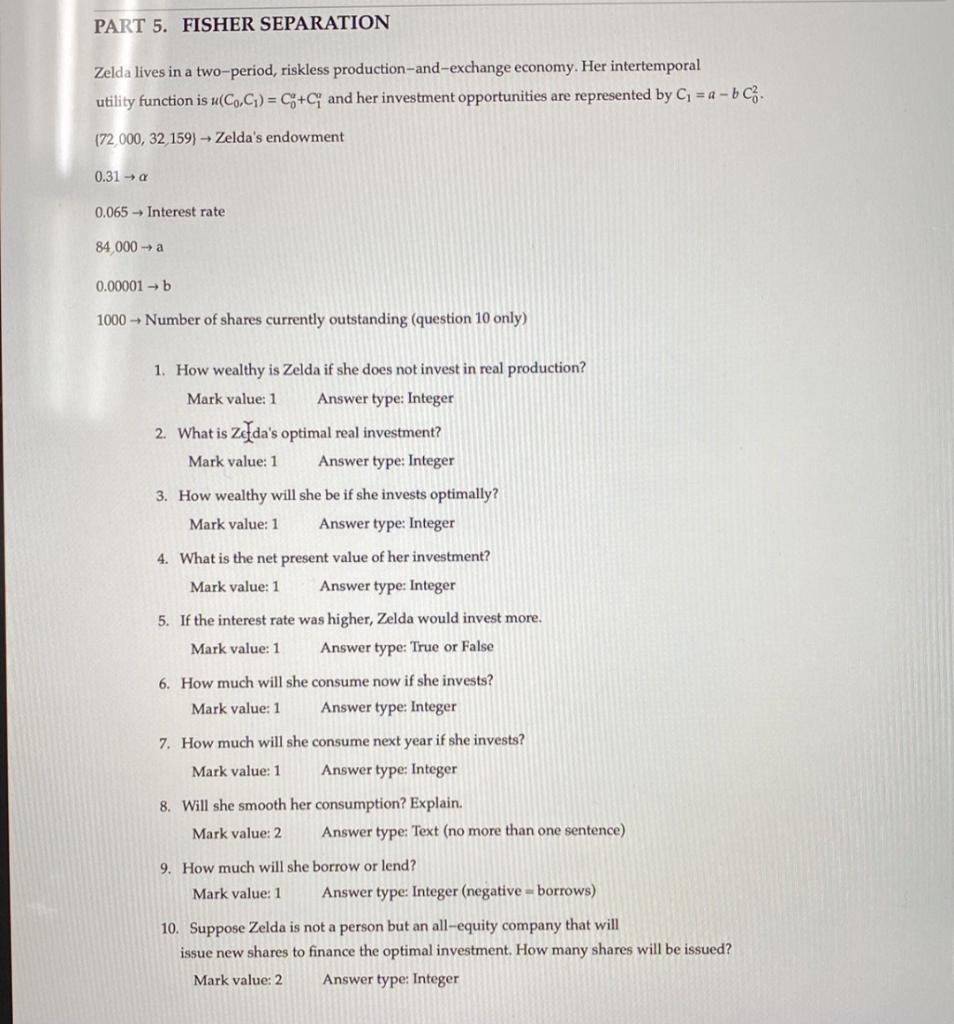

PART 1. PORTFOLIO THEORY The market is comprised of four stocks, A, B, C, and D, with expected returns 8 and covariance matrix V. A portfolio sits on the minimum-variance frontier if you cannot borrow or lend at the risk-free rate, and sits on the Capital Market Line if you can. Not all questions in this part refer to the data A B C D 0.028 0.048 0.068 0.088 0.00145 0.00019 0.00066 0.0005 0.00019 0.00361 0.00139 0.00142 0.00066 0.00139 0.01832 0.01753 0.0005 0.00142 0.01753 0.02943 V 0.017 Risk-free rate 0.057 Expected return of your portfolio 0.027 Expected return of my portfolio 1. What is the standard deviation of your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 2. How much will you allocate to stock B in your portfolio if you cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 3. What is the standard deviation of your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 4. How much will you allocate to T-Bills in your portfolio if you can borrow or lend at the risk-free rate? Mark value: 1 Answer type: Real number 5. If I form my portfolio, will it be efficient if I cannot borrow or lend at the risk-free rate? Mark value: 1 Answer type: True or False 6. If I form my portfolio, will it be efficient if I can borrow or lend at the risk-free rate? Mark value: 2 Answer type: True or False 7. Nigel formed a portfolio with weights 0.26, 0.34, 0.17, and 0.23. He calculated its variance using - 2 A ET,) + B) but got different answers. Why? 09 = ro".v.w and checked it with o; - (CE(r)* Mark value: 1 Answer type: Text (no more than one sentence) 8. What assumptions are necessary for mean-variance choice? How reasonable are they? Mark value: 2 Answer type: 'Text (no more than two sentences) 9. For a chosen expected return, the ex ante standard deviation of a portfolio of B and C cannot be less than that of a portfolio of all four stocks. Mark value: 1 Answer type: True or False 10. For a chosen standard deviation, the expected return of a portfolio of B and C must be less than that of a portfolio of B, C, and D. Mark value: 1 Answer type: True or False PART 3. RATE OF RETURN The table shows the return on assets X and Y at the end of month t since the previous entry. t Return on X Return on Y 2. 0.105 -0.015 6 0. -0.04 13 0.03 0.115 18 0.095 0.045 24 0.015 0.02 - Investment history (0.5, 0.5) (wx, wy) your portfolio weights 1. What is the holding period return of asset Y alone? Mark value: 1 Answer type: Real number 2. What is the holding period return of your portfolio? Mark value: 1 Answer type: Real number 3. What is the yearly-equivalent holding period return of your portfolio? Mark value: 1 Answer type: Real number 4. The holding period return on your portfolio would be higher if the biggest returns on X and Y happened earliest during the investment period. In other words, the order of gains and losses matters. Mark value: 1 Answer type: True or False 5. The monthly holding period return is better than the average monthly return as a measure of the profitability of your investment Mark value: 1 Answer type: True or False PART 4. PARETO OPTIMAL INTEREST RATE AND CONSUMPTION Consider the equilibrium interest rate and consumption in a riskless, two-period, pure-exchange economy. Assume, as in the class notes and the lectures, that both Lucy and Ricky are log utility maximizers; except this time, assume also that they are identical twins (QL = ax = a, where 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts