Question: Answer should be given after going through the case study Answers should be detailed on Case study 9 QUESTIONS 1) Analyse the impact of J.C.

Answer should be given after going through the case study Answers should be detailed on

Case study

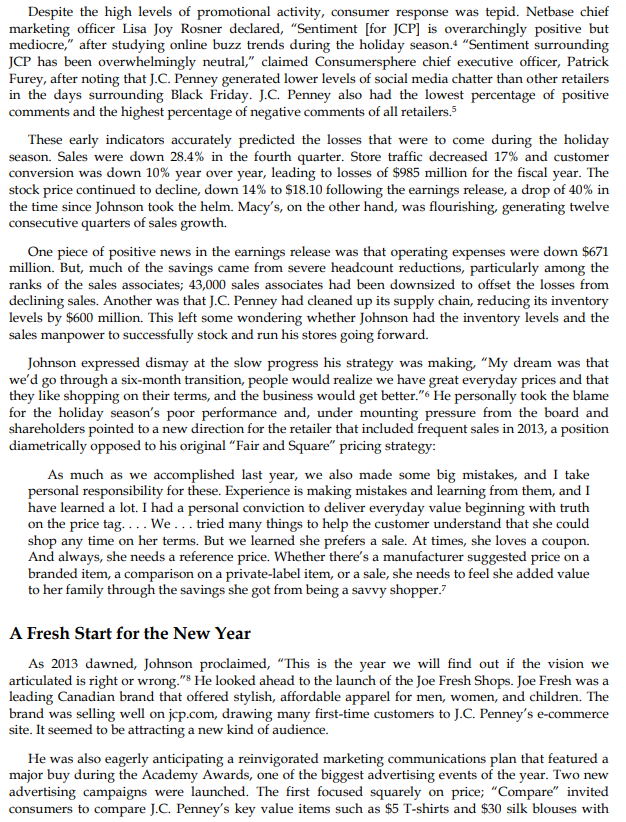

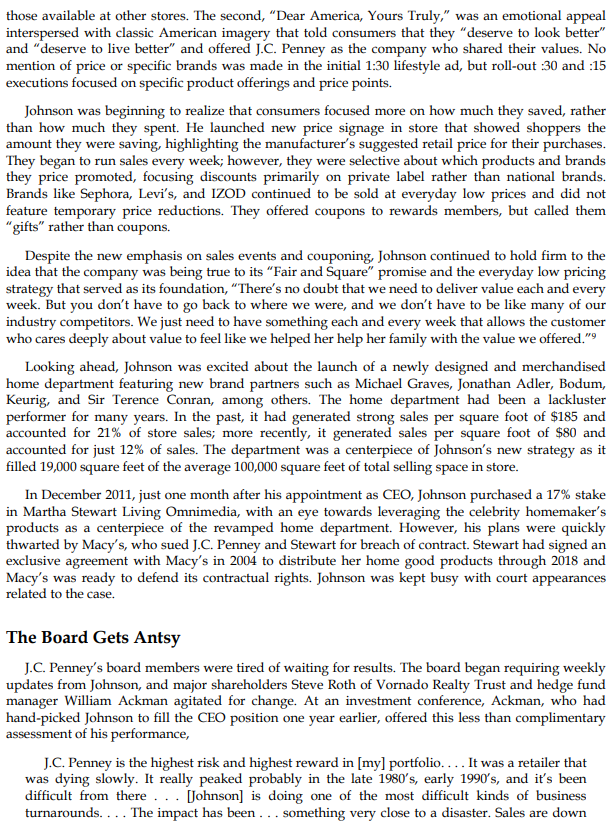

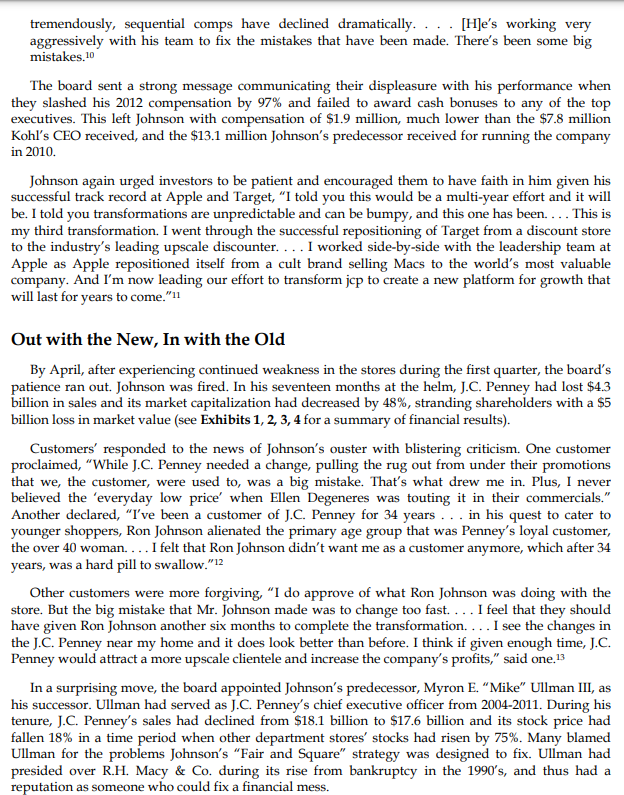

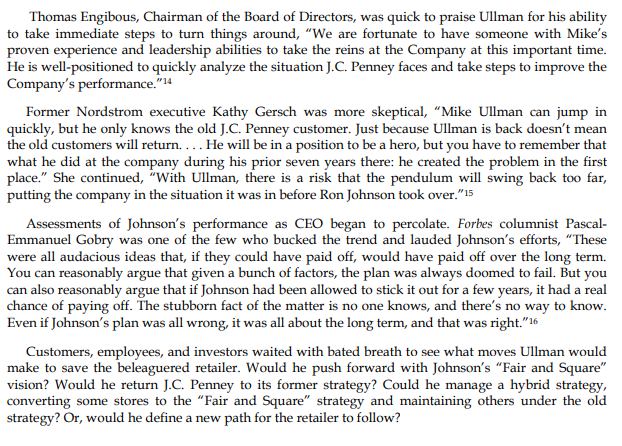

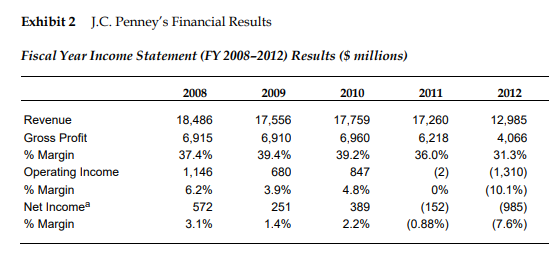

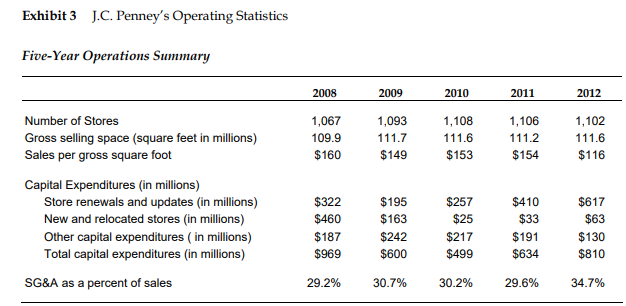

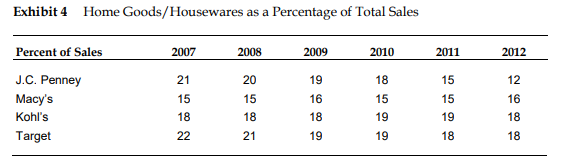

9 QUESTIONS 1) Analyse the impact of J.C. Penny's radical makeover strategy under Ron Johnson, new CEO ,from strategic implications of Branding view point. 2) Examine the challenges faced and opportunities explored by JC Penny in integrated marketing mix activities to build its brand equity JC Penny's Fair & Square Strategy O O o Business analysis Strategic implications of branding viewpoint Challenges faced and opportunities explored O J.C. Penney's Fair and Square Strategy (B): Out with the New, In with the Old Ron Johnson, chief executive officer of department store J.C. Penney, swiftly felt the blowback from his August 2012 second quarter earnings release as J.C. Penney's stock price dropped an additional 8%, compounding its freefall that had started six months earlier. By mid-August, the stock was down 37% for the year and analysts were calling for further declines as J.C. Penney entered the critical back-to-school and holiday selling seasons. An internal consumer survey sent to J.C. Penney's customers that month suggested that the radical changes Johnson had made were not winning favor with consumers. Two-thirds of randomly selected survey respondents were negative and their comments criticized Johnson's changes to J.C. Penney's pricing strategy, merchandise assortment, and brand. Johnson had been at the helm of J.C. Penney for ten months, and his tenure was marked by an ambitious plan to turn around the fortunes of the declining retailer. Johnson's "Fair and Square" strategy aimed to radically reposition the business model and brand, and featured changes to retail store design, merchandising, product portfolio, pricing strategy, marketing communications, and sales compensation. At the heart of the turnaround was a switch from J.C. Penney's existing high-low pricing strategy to a new everyday low pricing strategy. In the earnings call, Johnson urged investors to be patient, as he continued to stand firmly behind the "Fair and Square" strategy, "We have now completed the first six months of our transformation and while business continues to be softer than anticipated, we are confident the transformation of J.C. Penney is on track. The transition from a highly promotional business model to one based on everyday value will take time and we will stay the course." Going Back to School Moving into the all-important back-to-school selling season, Johnson's focus shifted to the ongoing store redesigns. Nearly 700 stores were under renovation by August 2012 and the first new branded Shops, including Levi's, Liz Clairborne and IZOD, were being installed. He was particularly excited about a new Shop dubbed jepTM that featured a new private label brand from J.C. Penney dedicated to high quality fashion basics that would replace some of the retailer's aging private label brands such as St. John's Bay. However, Johnson couldn't renovate stores quickly enough; only 11% of J.C. Penney's selling space chainwide had been remodeled to accommodate the store-within-a- store concept. Cost estimates to outfit the remaining floor space were in the range of $1 billion and were scheduled to take three years. Despite the newly invigorated store designs, the bad news continued with the release of third quarter results. Same-store sales fell by 26%, contributing to a $123 million loss on the quarter. Gross profit dollars were 36% lower than the previous year. Customer traffic dwindled, down 12% in the quarter, and the number of shoppers who made purchases decreased by 10%. While the free haircuts offered in August produced traffic gains, traffic and sales in September and October were estimated to be down 33%. Low margin clearance goods accounted for 35% of sales in August (versus 15% the prior year), indicating that many of the 1.6 million customers who received a free haircut were bargain shoppers. The only bright spot in the earnings release was that sales for the eight new Shops were up by 33% and their sales per square foot rose from $180 to $239. The new Shops, plus the existing Sephora and MNG Shops, generated 23% of sales in the third quarter. Johnson tried to put an optimistic spin on the poor earnings report, "[Our plan is) gaining traction with customers every day and is surpassing our own expectations in terms of sales productivity, which continues to give us confidence in our long-term business model." BIG Insight reported that J.C. Penney had lost 1.3 million of its core shoppers to Macy's, Target, Kohl's, and Walmart in the past year. While the other competitors gained customer share among female apparel shoppers, J.C. Penney's customer share decreased by 13%. These customers accounted for an estimated $745 million in annual revenue (each customer is estimated to spend $500 per year). 'Tis the Season to be Jolly' (or Not) Many retailers' fortunes are made or lost in the fourth quarter of the year. Beginning with Black Friday (the Friday after the Thanksgiving holiday) and continuing through to Christmas and New Year's, the holiday shopping season accounts for 19% of annual retail sales. It was critical to Johnson that J.C. Penney have a strong holiday selling season. Johnson stepped up promotional programs in the fourth quarter, offering free family photo portraits in stores in November and December. $10 coupons, termed "gifts were distributed to customers via emails to drive in store sales. These coupons were accompanied by a personal letter from Johnson that outlined his vision and highlighted some of the big changes happening - the Shops openings, the new jepTM private label brand launch, and the everyday low pricing strategy. The letter invited customers to visit the "new and improved jep" and positioned the coupon as a thank you gift from J.C. Penney for their loyalty. The retailer then mailed a 48-page Black Friday catalog featuring hot specials from 6:00 a.m. to 11:00p.m. on women's, men's and children's apparel and accessories. In store, sales associates distributed 80 million gift buttons for the chance to win 20 million prizes including vacations, a trip to attend the taping of the Ellen DeGeneres show, free merchandise, and gift certificates. "Black Friday is America's greatest shopping tradition and we're celebrating the occasion with our only sale of the year," said Johnson, "All day long, customers will find some of our lowest prices ever and the chance to win amazing gifts, including once in a lifetime trips to great American destinations. It's our way of kicking off the holiday season and saying, 'Merry Christmas, America!'"3 Advertising during the holiday season featured Ellen DeGeneres touting the button promotion. Despite the high levels of promotional activity, consumer response was tepid. Netbase chief marketing officer Lisa Joy Rosner declared, "Sentiment [for JCP) is overarchingly positive but mediocre," after studying online buzz trends during the holiday season. "Sentiment surrounding JCP has been overwhelmingly neutral," claimed Consumersphere chief executive officer, Patrick Furey, after noting that J.C. Penney generated lower levels of social media chatter than other retailers in the days surrounding Black Friday. J.C. Penney also had the lowest percentage of positive comments and the highest percentage of negative comments of all retailers. These early indicators accurately predicted the losses that were to come during the holiday season. Sales were down 28.4% in the fourth quarter. Store traffic decreased 17% and customer conversion was down 10% year over year, leading to losses of $985 million for the fiscal year. The stock price continued to decline, down 14% to $18.10 following the earnings release, a drop of 40% in the time since Johnson took the helm. Macy's, on the other hand, was flourishing, generating twelve consecutive quarters of sales growth. One piece of positive news in the earnings release was that operating expenses were down $671 million. But, much of the savings came from severe headcount reductions, particularly among the ranks of the sales associates; 43,000 sales associates had been downsized to offset the losses from declining sales. Another was that J.C. Penney had cleaned up its supply chain, reducing its inventory levels by $600 million. This left some wondering whether Johnson had the inventory levels and the sales manpower to successfully stock and run his stores going forward. Johnson expressed dismay at the slow progress his strategy was making, "My dream was that we'd go through a six-month transition, people would realize we have great everyday prices and that they like shopping on their terms, and the business would get better." He personally took the blame for the holiday season's poor performance and, under mounting pressure from the board and shareholders pointed to a new direction for the retailer that included frequent sales in 2013, a position diametrically opposed to his original Fair and Square pricing strategy: As much as we accomplished last year, we also made some big mistakes, and I take personal responsibility for these. Experience is making mistakes and learning from them, and I have learned a lot. I had a personal conviction to deliver everyday value beginning with truth on the price tag.... We... tried many things to help the customer understand that she could shop any time on her terms. But we learned she prefers a sale. At times, she loves a coupon. And always, she needs a reference price. Whether there's a manufacturer suggested price on a branded item, a comparison on a private-label item, or a sale, she needs to feel she added value to her family through the savings she got from being a savvy shopper. A Fresh Start for the New Year As 2013 dawned, Johnson proclaimed, This is the year we will find out if the vision we articulated is right or wrong." He looked ahead to the launch of the Joe Fresh Shops. Joe Fresh was a leading Canadian brand that offered stylish, affordable apparel for men, women, and children. The brand was selling well on jcp.com, drawing many first-time customers to J.C. Penney's e-commerce site. It seemed to be attracting a new kind of audience. He was also eagerly anticipating a reinvigorated marketing communications plan that featured a major buy during the Academy Awards, one of the biggest advertising events of the year. Two new advertising campaigns were launched. The first focused squarely on price; "Compare" invited consumers to compare J.C. Penney's key value items such as $5 T-shirts and $30 silk blouses with those available at other stores. The second, "Dear America, Yours Truly," was an emotional appeal interspersed with classic American imagery that told consumers that they "deserve to look better" and "deserve to live better" and offered J.C. Penney as the company who shared their values. No mention of price or specific brands was made in the initial 1:30 lifestyle ad, but roll-out :30 and :15 executions focused on specific product offerings and price points. Johnson was beginning to realize that consumers focused more on how much they saved, rather than how much they spent. He launched new price signage in store that showed shoppers the amount they were saving, highlighting the manufacturer's suggested retail price for their purchases. They began to run sales every week; however, they were selective about which products and brands they price promoted, focusing discounts primarily on private label rather than national brands. Brands like Sephora, Levi's, and IZOD continued to be sold at everyday low prices and did not feature temporary price reductions. They offered coupons to rewards members, but called them "gifts" rather than coupons. Despite the new emphasis on sales events and couponing, Johnson continued to hold firm to the idea that the company was being true to its "Fair and Square" promise and the everyday low pricing strategy that served as its foundation, "There's no doubt that we need to deliver value each and every week. But you don't have to go back to where we were, and we don't have to be like many of our industry competitors. We just need to have something each and every week that allows the customer who cares deeply about value to feel like we helped her help her family with the value we offered."9 Looking ahead, Johnson was excited about the launch of a newly designed and merchandised home department featuring new brand partners such as Michael Graves, Jonathan Adler, Bodum, Keurig, and Sir Terence Conran, among others. The home department had been a lackluster performer for many years. In the past, it had generated strong sales per square foot of $185 and accounted for 21% of store sales; more recently, it generated sales per square foot of $80 and accounted for just 12% of sales. The department was a centerpiece of Johnson's new strategy as it filled 19,000 square feet of the average 100,000 square feet of total selling space in store. In December 2011, just one month after his appointment as CEO, Johnson purchased a 17% stake in Martha Stewart Living Omnimedia, with an eye towards leveraging the celebrity homemaker's products as a centerpiece of the revamped home department. However, his plans were quickly thwarted by Macy's, who sued J.C. Penney and Stewart for breach of contract. Stewart had signed an exclusive agreement with Macy's in 2004 to distribute her home good products through 2018 and Macy's was ready to defend its contractual rights. Johnson was kept busy with court appearances related to the case. The Board Gets Antsy J.C. Penney's board members were tired of waiting for results. The board began requiring weekly updates from Johnson, and major shareholders Steve Roth of Vornado Realty Trust and hedge fund manager William Ackman agitated for change. At an investment conference, Ackman, who had hand-picked Johnson to fill the CEO position one year earlier, offered this less than complimentary assessment of his performance, J.C. Penney is the highest risk and highest reward in [my] portfolio.... It was a retailer that was dying slowly. It really peaked probably in the late 1980's, early 1990's, and it's been difficult from there ... [Johnson) is doing one of the most difficult kinds of business turnarounds. ... The impact has been ... something very close to a disaster. Sales are down tremendously, sequential comps have declined dramatically. [H]e's working very aggressively with his team to fix the mistakes that have been made. There's been some big mistakes.10 The board sent a strong message communicating their displeasure with his performance when they slashed his 2012 compensation by 97% and failed to award cash bonuses to any of the top executives. This left Johnson with compensation of $1.9 million, much lower than the $7.8 million Kohl's CEO received, and the $13.1 million Johnson's predecessor received for running the company in 2010. Johnson again urged investors to be patient and encouraged them to have faith in him given his successful track record at Apple and Target, "I told you this would be a multi-year effort and it will be. I told you transformations are unpredictable and can be bumpy, and this one has been. ... This is my third transformation. I went through the successful repositioning of Target from a discount store to the industry's leading upscale discounter. ... I worked side-by-side with the leadership team at Apple as Apple repositioned itself from a cult brand selling Macs to the world's most valuable company. And I'm now leading our effort to transform jep to create a new platform for growth that will last for years to come." Out with the New, In with the Old By April, after experiencing continued weakness in the stores during the first quarter, the board's patience ran out. Johnson was fired. In his seventeen months at the helm, J.C. Penney had lost $4.3 billion in sales and its market capitalization had decreased by 48%, stranding shareholders with a $5 billion loss in market value (see Exhibits 1, 2, 3, 4 for a summary of financial results). Customers' responded to the news of Johnson's ouster with blistering criticism. One customer proclaimed, "While J.C. Penney needed a change, pulling the rug out from under their promotions that we, the customer, were used to, was a big mistake. That's what drew me in. Plus, I never believed the 'everyday low price' when Ellen Degeneres was touting it in their commercials." Another declared, "I've been a customer of J.C. Penney for 34 years ... in his quest to cater to younger shoppers, Ron Johnson alienated the primary age group that was Penney's loyal customer, the over 40 woman.... I felt that Ron Johnson didn't want me as a customer anymore, which after 34 years, was a hard pill to swallow."12 Other customers were more forgiving, I do approve of what Ron Johnson was doing with the store. But the big mistake that Mr. Johnson made was to change too fast. ... I feel that they should have given Ron Johnson another six months to complete the transformation.... I see the changes in the J.C. Penney near my home and it does look better than before. I think if given enough time, J.C. Penney would attract a more upscale clientele and increase the company's profits," said one. 13 In a surprising move, the board appointed Johnson's predecessor, Myron E. Mike Ullman III, as his successor. Ullman had served as J.C. Penney's chief executive officer from 2004-2011. During his tenure, J.C. Penney's sales had declined from $18.1 billion to $17.6 billion and its stock price had fallen 18% in a time period when other department stores stocks had risen by 75%. Many blamed Ullman for the problems Johnson's "Fair and Square" strategy was designed to fix. Ullman had presided over R.H. Macy & Co. during its rise from bankruptcy in the 1990's, and thus had a reputation as someone who could fix a financial mess. Thomas Engibous, Chairman of the Board of Directors, was quick to praise Ullman for his ability to take immediate steps to turn things around, "We are fortunate to have someone with Mike's proven experience and leadership abilities to take the reins at the Company at this important time. He is well-positioned to quickly analyze the situation J.C. Penney faces and take steps to improve the Company's performance."14 Former Nordstrom executive Kathy Gersch was more skeptical, "Mike Ullman can jump in quickly, but he only knows the old J.C. Penney customer. Just because Ullman is back doesn't mean the old customers will return.... He will be in a position to be a hero, but you have to remember that what he did at the company during his prior seven years there: he created the problem in the first place." She continued, "With Ullman, there is a risk that the pendulum will swing back too far, putting the company in the situation it was in before Ron Johnson took over."15 Assessments of Johnson's performance as CEO began to percolate. Forbes columnist Pascal- Emmanuel Gobry was one of the few who bucked the trend and lauded Johnson's efforts, "These were all audacious ideas that, if they could have paid off, would have paid off over the long term. You can reasonably argue that given a bunch of factors, the plan was always doomed to fail. But you can also reasonably argue that if Johnson had been allowed to stick it out for a few years, it had a real chance of paying off. The stubborn fact of the matter is no one knows, and there's no way to know. Even if Johnson's plan was all wrong, it was all about the long term, and that was right."16 Customers, employees, and investors waited with bated breath to see what moves Ullman would make to save the beleaguered retailer. Would he push forward with Johnson's "Fair and Square" vision? Would he return J.C. Penney to its former strategy? Could he manage a hybrid strategy, converting some stores to the "Fair and Square" strategy and maintaining others under the old strategy? Or, would he define a new path for the retailer to follow? Exhibit 1 J.C. Penney's Stock Price under Ron Johnson (November 1, 2011-April 8, 2013) 1) Compare Mov. Avgs 11/01/2011 1D 3D 11 04/08/2013 Last Price Line 6M YTD 1Y SY Max Daily No Lower Chart Security/Study Event USD SE2 Exhibit 2 J.C. Penney's Financial Results Fiscal Year Income Statement (FY 2008-2012) Results ($ millions) 2008 2009 2010 2011 2012 Revenue Gross Profit % Margin Operating Income % Margin Net Income % Margin 18,486 6,915 37.4% 1,146 6.2% 572 3.1% 17,556 6,910 39.4% 680 3.9% 251 1.4% 17,759 6,960 39.2% 847 4.8% 389 2.2% 17,260 6,218 36.0% (2) 0% (152) (0.88%) 12,985 4,066 31.3% (1,310) (10.1%) (985) (7.6%) Exhibit 3 J.C. Penney's Operating Statistics Five-Year Operations Summary 2008 2009 2010 2011 2012 1,067 109.9 $160 1,093 111.7 $149 1,108 111.6 $153 1,106 111.2 $154 1,102 111.6 $116 Number of Stores Gross selling space (square feet in millions) Sales per gross square foot Capital Expenditures (in millions) Store renewals and updates (in millions) New and relocated stores (in millions) Other capital expenditures (in millions) Total capital expenditures (in millions) SG&A as a percent of sales $322 $460 $187 $969 $195 $163 $242 $600 $257 $25 $217 $499 $410 $33 $191 $634 $617 $63 $130 $810 29.2% 30.7% 30.2% 29.6% 34.7% Exhibit 4 Home Goods/Housewares as a Percentage of Total Sales 2007 2008 2009 2010 2011 2012 21 20 19 18 15 12 Percent of Sales J.C. Penney Macy's Kohl's Target 15 15 18 16 18 15 19 15 19 18 22 16 18 18 21 19 19 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts