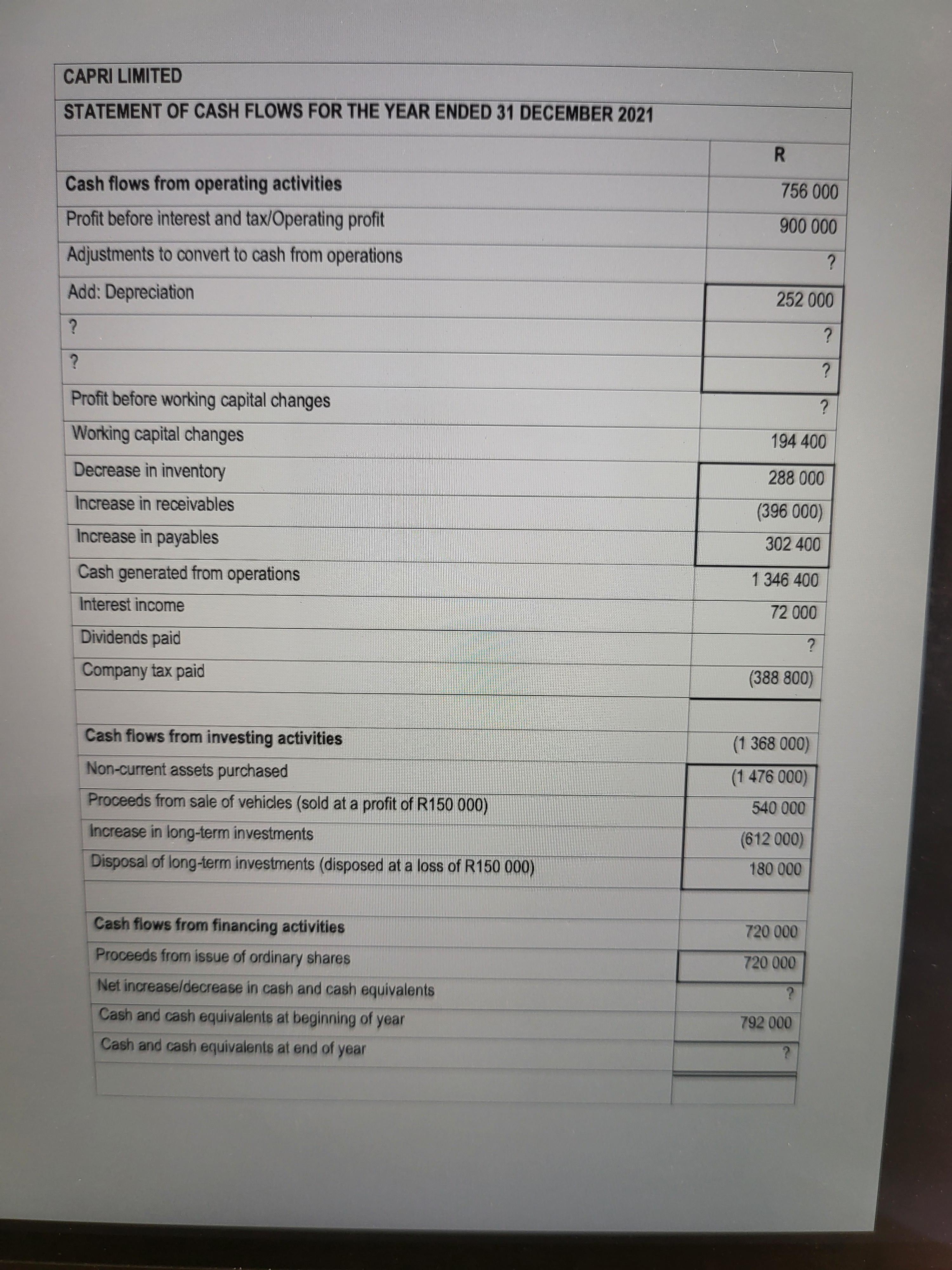

Question: Answer that are based on the Statement of Cash Flows for the year ended 3 1 December 2 0 2 1 1 . 1 Calculate

CAPRI LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 Cash flows from operating activities Profit before interest and tax/Operating profit Adjustments to convert to cash from operations Add: Depreciation ? ? Profit before working capital changes Working capital changes Decrease in inventory Increase in receivables Increase in payables Cash generated from operations Interest income Dividends paid Company tax paid Cash flows from investing activities Non-current assets purchased Proceeds from sale of vehicles (sold at a profit of R150 000) Increase in long-term investments Disposal of long-term investments (disposed at a loss of R150 000) Cash flows from financing activities Proceeds from issue of ordinary shares Net increase/decrease in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year R 756 000 900 000 ? 252 000 ? ? ? 194 400 288 000 (396 000) 302 400 1 346 400 72 000 ? (388 800) (1 368 000) (1 476 000) 540 000 (612 000) 180 000 720 000 720 000 ? 792 000 ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts