Question: Answer the following. Exercise 1-1: Indicate whether the following items shall be shown as intangible assets on statement of financial position. a. Cost of developing

Answer the following.

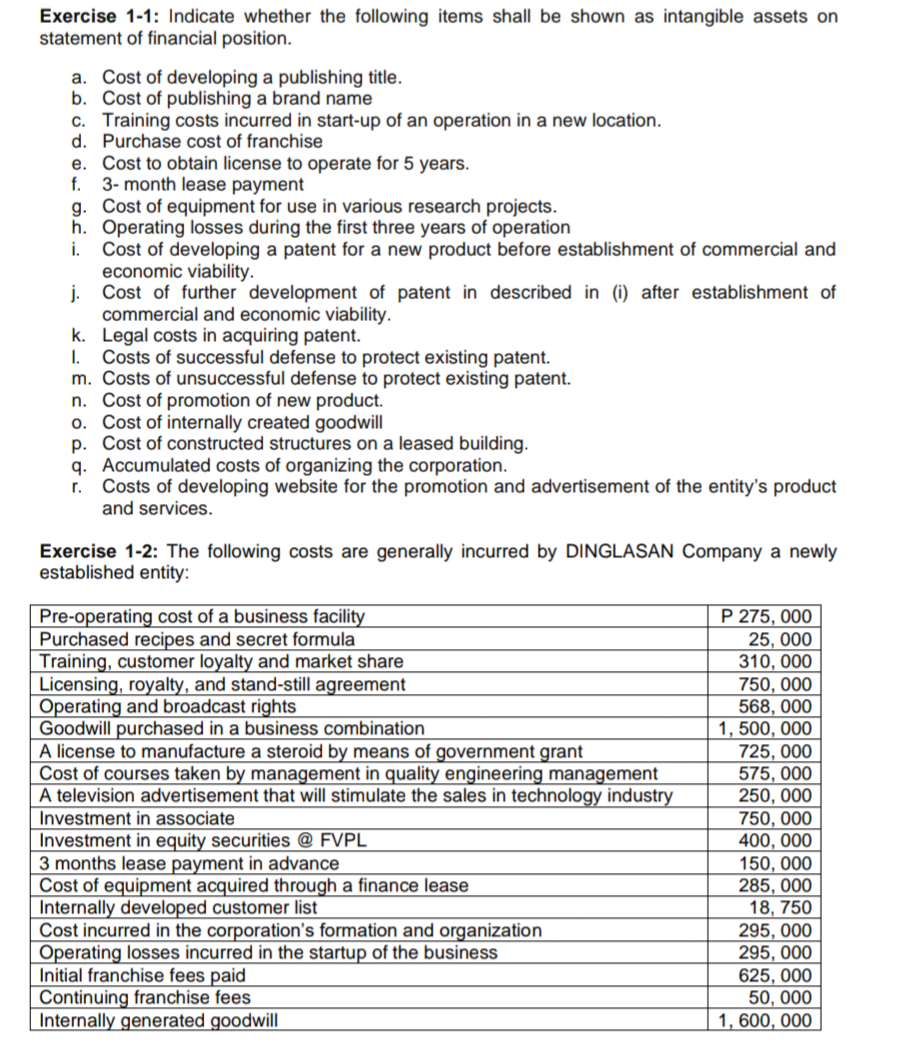

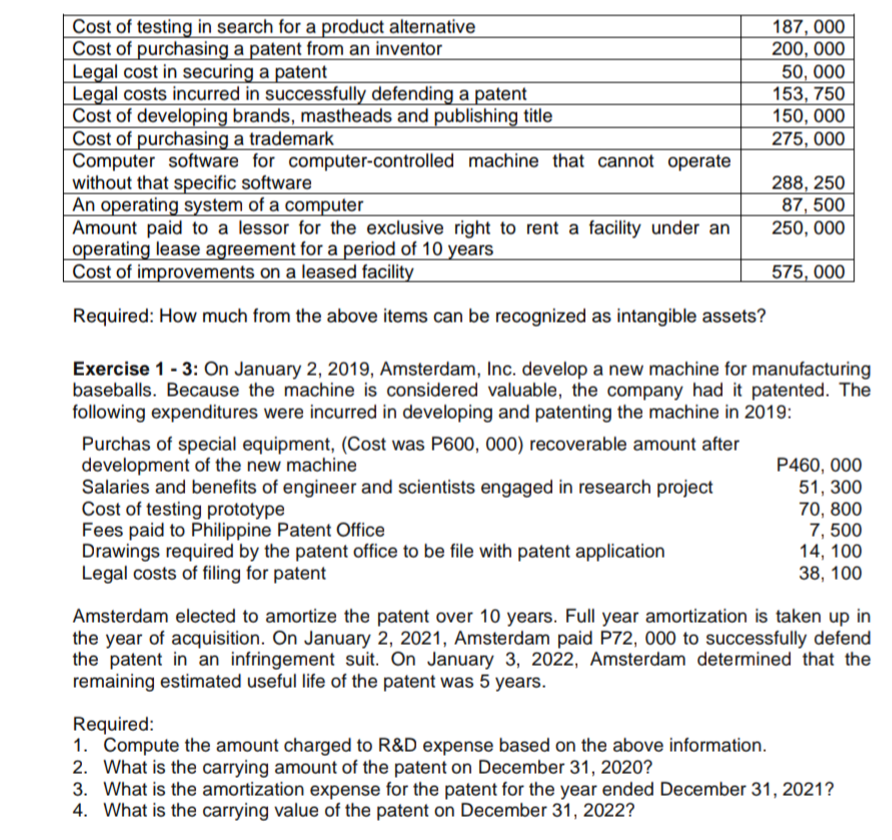

Exercise 1-1: Indicate whether the following items shall be shown as intangible assets on statement of financial position. a. Cost of developing a publishing title. b. Cost of publishing a brand name C. Training costs incurred in start-up of an operation in a new location. d. Purchase cost of franchise e. Cost to obtain license to operate for 5 years. . 3- month lease payment g. Cost of equipment for use in various research projects. h. Operating losses during the first three years of operation i. Cost of developing a patent for a new product before establishment of commercial and economic viability. j. Cost of further development of patent in described in (i) after establishment of commercial and economic viability. k. Legal costs in acquiring patent. I. Costs of successful defense to protect existing patent. m. Costs of unsuccessful defense to protect existing patent. n. Cost of promotion of new product. o. Cost of internally created goodwill p. Cost of constructed structures on a leased building. q. Accumulated costs of organizing the corporation. r. Costs of developing website for the promotion and advertisement of the entity's product and services. Exercise 1-2: The following costs are generally incurred by DINGLASAN Company a newly established entity: Pre-operating cost of a business facility P 275, 000 Purchased recipes and secret formula 25, 000 Training, customer loyalty and market share 310, 000 Licensing, royalty, and stand-still agreement 750, 000 Operating and broadcast rights 568, 000 Goodwill purchased in a business combination 1, 500, 000 A license to manufacture a steroid by means of government grant 725, 000 Cost of courses taken by management in quality engineering management 575, 000 A television advertisement that will stimulate the sales in technology industry 250, 000 Investment in associate 750, 000 Investment in equity securities @ FVPL 400, 000 3 months lease payment in advance 150, 000 Cost of equipment acquired through a finance lease 285, 000 Internally developed customer list 18, 750 Cost incurred in the corporation's formation and organization 295, 000 Operating losses incurred in the startup of the business 295, 000 Initial franchise fees paid 625, 000 Continuing franchise fees 50, 000 Internally generated goodwill 1, 600, 000Cost of testing in search for a product alternative 187, 000 Cost of purchasing a patent from an inventor 200, 000 Legal cost in securing a patent 50, 000 Legal costs incurred in successfully defending a patent 153, 750 Cost of developing brands, mastheads and publishing title 150, 000 Cost of purchasing a trademark 275, 000 Computer software for computer-controlled machine that cannot operate without that specific software 288, 250 An operating system of a computer 87, 500 Amount paid to a lessor for the exclusive right to rent a facility under an 250, 000 operating lease agreement for a period of 10 years Cost of improvements on a leased facility 575, 000 Required: How much from the above items can be recognized as intangible assets? Exercise 1 - 3: On January 2, 2019, Amsterdam, Inc. develop a new machine for manufacturing baseballs. Because the machine is considered valuable, the company had it patented. The following expenditures were incurred in developing and patenting the machine in 2019: Purchas of special equipment, (Cost was P600, 000) recoverable amount after development of the new machine P460, 000 Salaries and benefits of engineer and scientists engaged in research project 51, 300 Cost of testing prototype 70, 800 Fees paid to Philippine Patent Office 7, 500 Drawings required by the patent office to be file with patent application 14, 100 Legal costs of filing for patent 38, 100 Amsterdam elected to amortize the patent over 10 years. Full year amortization is taken up in the year of acquisition. On January 2, 2021, Amsterdam paid P72, 000 to successfully defend the patent in an infringement suit. On January 3, 2022, Amsterdam determined that the remaining estimated useful life of the patent was 5 years. Required: 1. Compute the amount charged to R&D expense based on the above information. 2. What is the carrying amount of the patent on December 31, 2020? 3. What is the amortization expense for the patent for the year ended December 31, 2021? 4. What is the carrying value of the patent on December 31, 2022