Question: ANSWER THE FOLLOWING QUESTION WITH A CLEAR SOLUTION AND FORMAT. Problem 10.113TH MONTH PAY AND OTHER BENEFITS Jonathan, a purely employed taxpayer, received the following

ANSWER THE FOLLOWING QUESTION WITH A CLEAR SOLUTION AND FORMAT.

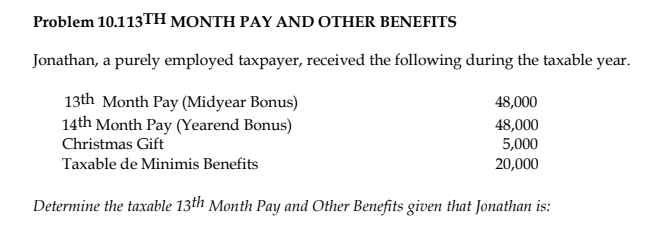

Problem 10.113TH MONTH PAY AND OTHER BENEFITS Jonathan, a purely employed taxpayer, received the following during the taxable year. 13th Month Pay (Midyear Bonus) 14th Month Pay (Yearend Bonus) Christmas Gift Taxable de Minimis Benefits Determine the taxable 13th Month Pay and Other Benefits given that Jonathan is: 48,000 48,000 5,000 20,000

Step by Step Solution

There are 3 Steps involved in it

Problem 10113 Jonathan is a rankandfile employee Taxable 13th Month Pay is P48000 fully taxab... View full answer

Get step-by-step solutions from verified subject matter experts