Question: Answer the following questions relating to diversification. a. What implication does diversification have for investors? b. If an investor decides to hold a 1-stock portfolio

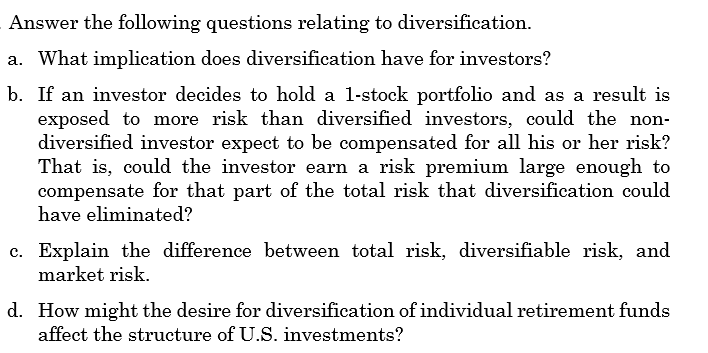

Answer the following questions relating to diversification. a. What implication does diversification have for investors? b. If an investor decides to hold a 1-stock portfolio and as a result is exposed to more risk than diversified investors, could the non- diversified investor expect to be compensated for all his or her risk? That is, could the investor earn a risk premium large enough to compensate for that part of the total risk that diversification could have eliminated? c. Explain the difference between total risk, diversifiable risk, and market risk. d. How might the desire for diversification of individual retirement funds affect the structure of U.S. investments? Answer the following questions relating to diversification. a. What implication does diversification have for investors? b. If an investor decides to hold a 1-stock portfolio and as a result is exposed to more risk than diversified investors, could the non- diversified investor expect to be compensated for all his or her risk? That is, could the investor earn a risk premium large enough to compensate for that part of the total risk that diversification could have eliminated? c. Explain the difference between total risk, diversifiable risk, and market risk. d. How might the desire for diversification of individual retirement funds affect the structure of U.S. investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts