Question: answer the last three questions based on this passage managers have complete discretion about all operating and capital allocation decisions within their businesses. They are

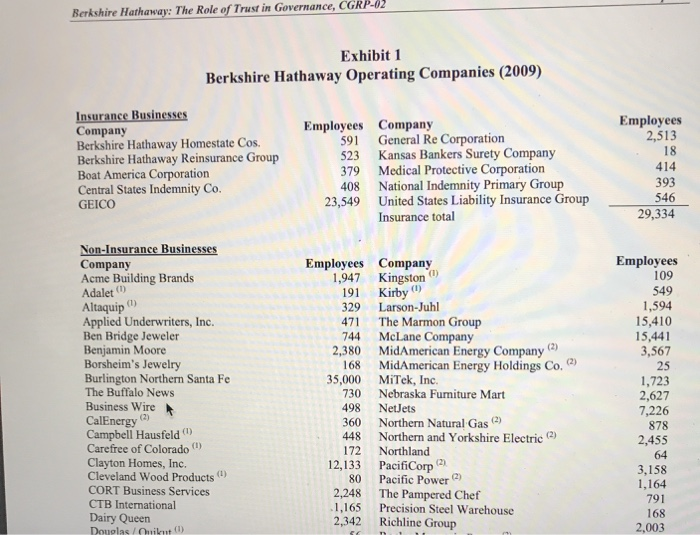

answer the last three questions based on this passage

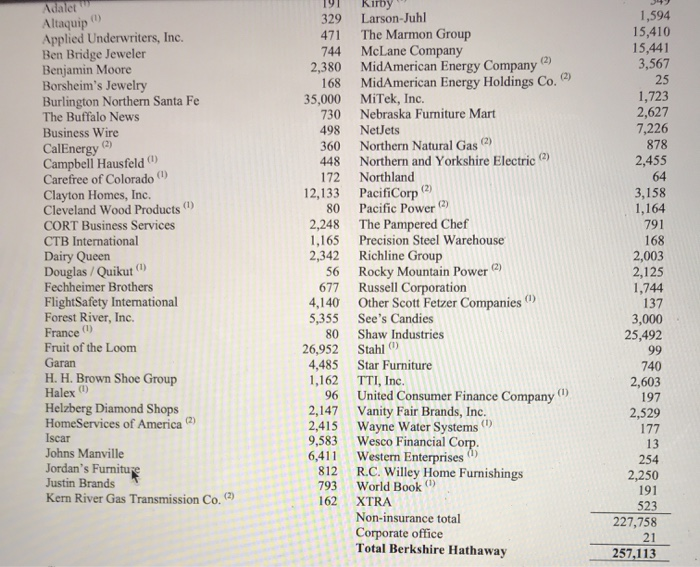

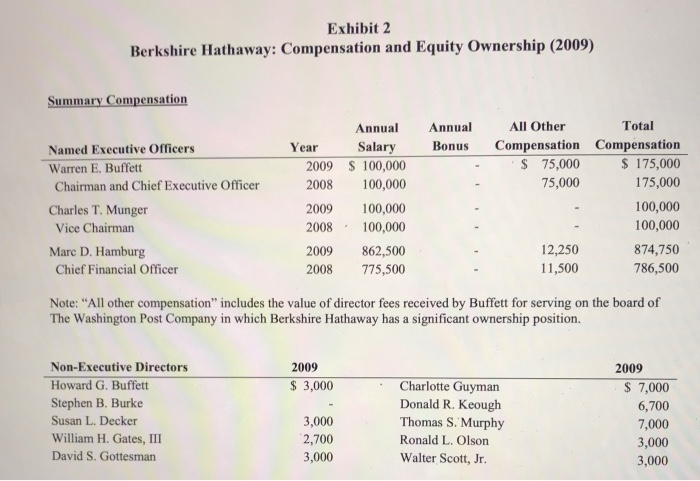

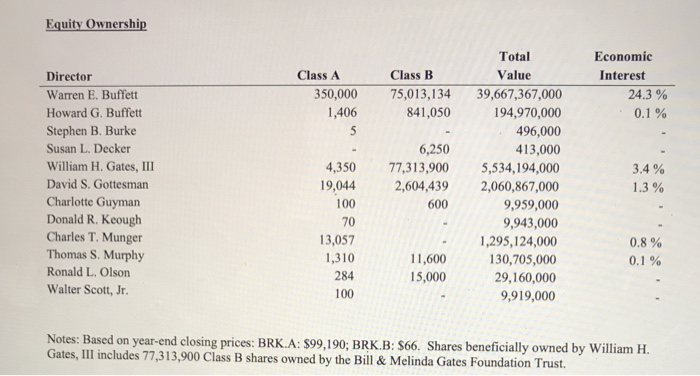

managers have complete discretion about all operating and capital allocation decisions within their businesses. They are not required to meet with Buffett, submit budgets for approval, or develop long-term operating plans. Instead, they make all decisions themselves, without supervision or corporate control. Munger describes the Berkshire Hathaway system as "delegation just short of abdication."2 The success of this model is predicated on two conditions: purchasing businesses that are unlikely to need significant attention and working with managers who are unlikely to need oversight. The businesses that Berkshire purchases are characterized by stable economics, high levels of free cash flow, and low requirements for incremental capital. They have distinct and durable competitive advantages either in terms of production, distribution, or economic franchise. They are also built on a culture of honesty and integrity. As Munger explains, "We try to buy companies so permeated by a good ethos that they don't need a lot of direction and checking from headquarters." They are led by capable and honest management, often the same individuals who founded and still run the company. In most cases, Buffett insists that the seller retain a minority interest, so that they remain de facto owners working in partnership with Berkshire Hathaway. Upon close of an acquisition, managers are given simple instructions. They should treat the business as though they are its sole owner. They should give no consideration to the accounting implications of their decisions but focus entirely on enhancing competitive position and maximizing free cash flow. They should do nothing to tarnish the reputation of their company or Berkshire. Buffett believes that this hands-off approach is critical for a successful long-term working relationship, "Our job is not so much to select great managers, because they have this proven record that they come with. Our job is to retain them.... We are dependent on them. ... We can't run their businesses. So our job is to make sure that they have the same enthusiasm, excitement, and passion for their job after the stock certificate changes hands as they had before. We can't run their businesses. So our job is to make sure that they have the same enthusiasm, excitement, and passion for their job after the stock certificate changes hands as they had before. Managers are paid modest salaries but stand to receive very significant cash bonuses if performance goals are achieved. Buffett tailors the compensation plan to each business, based on its economics and competitive positioning. Managers are compensated for elements of the business that are directly under their control (such as growth and profitability of insurance contracts). Particular emphasis is placed on the ability to return free cash flow to headquarters. The company does not grant equity-based awards because their value cannot be as closely correlated to performance as can cash bonuses. Still, cash bonuses can reach extreme levels tens of millions for superior performance. By contrast, Buffett and Munger receive modest compensation. Their salaries are set at $100,000. They receive no bonuses, options, or restricted grants. Instead, their economic incentive is driven by direct holdings of company stock which they purchased with their own money in the 1960s. As of year-end 2009, the value of those holdings were $40 billion and $1.3 billion, respectively. Similarly, board members receive negligible fees for their services and are encouraged to purchase substantial sums of company stock with their own money. Equity ownership is intended to align their interests with those of shareholders (see Exhibit 2). CORPORATE CONTROLS AND OVERSIGHT The internal controls and oversight mechanisms at Berkshire Hathaway are nominal in comparison to those employed by other corporations. No due diligence is performed before an acquisition is completed. In general, Buffett asks that the seller of a business to suggest a price. If he thinks it is reasonable, he will accept and the deal is closed. Further, purchase decisions are not reviewed in advance by the board. Munger explains, "Can you imagine Warren Buffett saying to somebody, 'Well, I'm sorry, I have to go back and check with my directors'? I mean, of course he has to go back to check with his directors, but he knows what they're going to say, and everybody knows that what he says is going to govern." Buffett is also primarily responsible for enterprise risk management Risk oversight is not delegated to a committee or risk management function. According to Buffett, "I regard myself as the chief risk officer at Berkshire." The company's primary tool to mitigate enterprise risk is the delegation of responsibility to managers with proven skill and integrity. Munger explains, "A lot of people think if you just had more process and more compliance, you could create a better result in the world. Well, Berkshire has had practically no process. We had hardly any internal audit until they forced it on us. We just try to operate in a seamless web of deserved trust and be careful whom we trust."9 WHY THIS MATTERS 1. The Berkshire Hathaway model is predicated on responsibility and trust. How do the company's acquisition criteria, operating principles, and incentives work together to reinforce those values? 2. The theory of corporate governance is based on an assumption that self-interested managers will take actions that benefit themselves at the cost of shareholders (the "agency problem") and yet Berkshire Hathaway is built on the opposite assumption. How should companies take agency risk into account when designing their governance systems? 3. The operating principles of Berkshire Hathaway are in stark contrast to the "best practices" recommended by governance experts. What does this say about the reliability of those best practices? Berkshire Hathaway: The Role of Trust in Governance, CGRP-02 Exhibit 1 Berkshire Hathaway Operating Companies (2009) Employees 2,513 18 Insurance Businesses Company Berkshire Hathaway Homestate Cos. Berkshire Hathaway Reinsurance Group Boat America Corporation Central States Indemnity Co. GEICO Employees Company 591 General Re Corporation 523 Kansas Bankers Surety Company 379 Medical Protective Corporation 408 National Indemnity Primary Group 23,549 United States Liability Insurance Group Insurance total 414 393 546 29,334 Non-Insurance Businesses Company Acme Building Brands Adalet (1) Altaquip) Employees 109 549 1,594 15,410 15,441 3,567 25 Applied Underwriters, Inc. Ben Bridge Jeweler Benjamin Moore Borsheim's Jewelry Burlington Northern Santa Fe The Buffalo News Business Wire CalEnergy (2) Campbell Hausfeld) Carefree of Colorado) Clayton Homes, Inc. Cleveland Wood Products CORT Business Services CTB International Dairy Queen Douglas/Ouikut () Employees Company 1,947 Kingston 191 Kirby 329 Larson-Juhl 471 The Marmon Group 744 McLane Company 2,380 MidAmerican Energy Company 168 MidAmerican Energy Holdings Co.) 35,000 Mitek, Inc. 730 Nebraska Furniture Mart 498 NetJets 360 Northern Natural Gas (2) 448 Northern and Yorkshire Electric (2) 172 Northland 12,133 PacifiCorp (2) 80 Pacific Power 2,248 The Pampered Chef .1,165 Precision Steel Warehouse 2,342 Richline Group 1,723 2,627 7,226 878 2,455 64 3,158 1,164 791 168 2,003 Adalet 1,594 15,410 15,441 3,567 25 1,723 2,627 7,226 878 498 2,455 Altaquip) Applied Underwriters, Inc. Ben Bridge Jeweler Benjamin Moore Borsheim's Jewelry Burlington Northern Santa Fe The Buffalo News Business Wire CalEnergy) Campbell Hausfeld) Carefree of Colorado Clayton Homes, Inc. Cleveland Wood Products (1) CORT Business Services CTB International Dairy Queen Douglas/Quikut (1) Fechheimer Brothers FlightSafety International Forest River, Inc. France) Fruit of the Loom Garan H. H. Brown Shoe Group Halex Helzberg Diamond Shops Home Services of America Iscar Johns Manville Jordan's Furniture Justin Brands Kern River Gas Transmission 191 Kirby 329 Larson-Juhl 471 The Marmon Group 744 McLane Company 2,380 MidAmerican Energy Company 168 MidAmerican Energy Holdings Co.) 35,000 MiTek, Inc. 730 Nebraska Furniture Mart NetJets 360 Northern Natural Gas (2) 448 Northern and Yorkshire Electric) 172 Northland 12,133 PacifiCorp (2) 80 Pacific Power) 2,248 The Pampered Chef 1,165 Precision Steel Warehouse 2,342 Richline Group 56 Rocky Mountain Power 2) 677 Russell Corporation 4,140 Other Scott Fetzer Companies 5,355 See's Candies 80 Shaw Industries 26,952 Stahl 4,485 Star Furniture 1,162 TTI, Inc. 96 United Consumer Finance Company 2,147 Vanity Fair Brands, Inc. 2,415 Wayne Water Systems (1) 9,583 Wesco Financial Corp. 6,411 Western Enterprises) 812 R.C. Willey Home Furnishings 793 World Book 162 XTRA Non-insurance total Corporate office Total Berkshire Hathaway 64 3,158 1,164 791 168 2,003 2,125 1,744 137 3,000 25,492 99 740 2,603 197 2,529 177 NN 13 254 2,250 191 523 227,758 257,113 Exhibit 2 Berkshire Hathaway: Compensation and Equity Ownership (2009) Summary Compensation Annual Bonus All Other Compensation $ 75,000 75,000 Named Executive Officers Warren E. Buffett Chairman and Chief Executive Officer Charles T. Munger Vice Chairman Marc D. Hamburg Chief Financial Officer - Total Compensation $ 175,000 175,000 100,000 100,000 Annual Year Salary 2009 $ 100,000 2008 100,000 2009 100,000 2008 : 100,000 2009 862,500 2008 775,500 12,250 11,500 874,750 786,500 Note: "All other compensation" includes the value of director fees received by Buffett for serving on the board of The Washington Post Company in which Berkshire Hathaway has a significant ownership position. 2009 $ 3,000 Non-Executive Directors Howard G. Buffett Stephen B. Burke Susan L. Decker William H. Gates, III David S. Gottesman 3,000 2,700 3,000 Charlotte Guyman Donald R. Keough Thomas S. Murphy Ronald L. Olson Walter Scott, Jr. 2009 $ 7,000 6,700 7,000 3,000 3,000 Equity Ownership Class A 350,000 1,406 Class B 75,013,134 841,050 Economic Interest 24.3 % 0.1% Director Warren E. Buffett Howard G. Buffett Stephen B. Burke Susan L. Decker William H. Gates, III David S. Gottesman Charlotte Guyman Donald R. Keough Charles T. Munger Thomas S. Murphy Ronald L. Olson Walter Scott, Jr. 4,350 19,044 100 6,250 77,313,900 2,604,439 600 Total Value 39,667,367,000 194,970,000 496,000 413,000 5,534,194,000 2,060,867,000 9,959,000 9,943,000 1,295,124,000 130,705,000 29,160,000 9,919,000 3.4% 1.3% 0.8 % 13,057 1,310 284 100 11,600 15,000 Notes: Based on year-end closing prices: BRK.A: $99,190; BRK.B: $66. Shares beneficially owned by William H. Gates, III includes 77,313,900 Class B shares owned by the Bill & Melinda Gates Foundation Trust

answer the last three questions based on this passage

answer the last three questions based on this passage