Question: Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in buildings and machinery for its

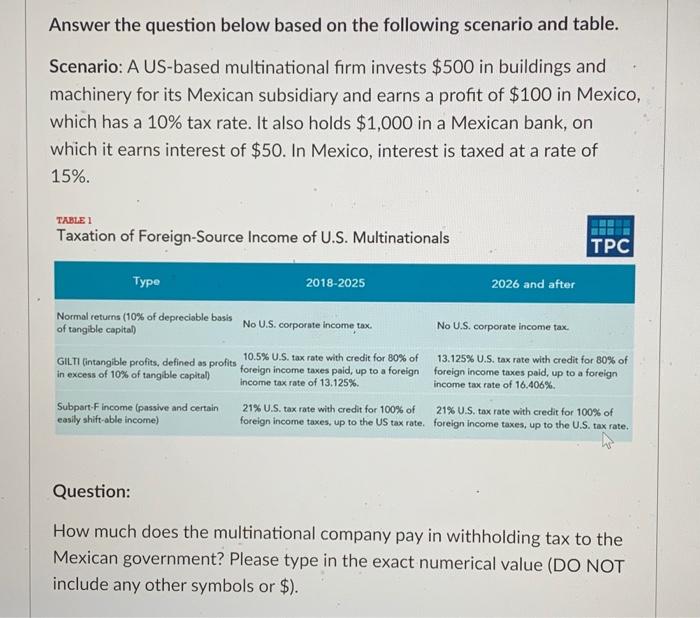

Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in buildings and machinery for its Mexican subsidiary and earns a profit of $100 in Mexico, which has a 10% tax rate. It also holds $1,000 in a Mexican bank, on which it earns interest of $50. In Mexico, interest is taxed at a rate of 15%. TABLE 1 Taxation of Foreign-Source Income of U.S. Multinationals Normal returns (10% of depreciable basis of tangible capital) GILTI (intangible profits, defined as profits in excess of 10% of tangible capital) Subpart-F income (passive and certain easily shift-able income) 2018-2025 No U.S. corporate income tax. 10.5% U.S. tax rate with credit for 80% of foreign income taxes paid, up to a foreign income tax rate of 13.125 %. 21% U.S. tax rate with credit for 100% of foreign income taxes, up to the US tax rate. 2026 and after No U.S. corporate income tax. TPC 13.125% U.S. tax rate with credit for 80% of foreign income taxes paid, up to a foreign income tax rate of 16.406%. 21% U.S. tax rate with credit for 100% of foreign income taxes, up to the U.S. tax rate. Question: How much does the multinational company pay in withholding tax to the Mexican government? Please type in the exact numerical value (DO NOT include any other symbols or $).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts