Question: please include work Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in buildings and machinery

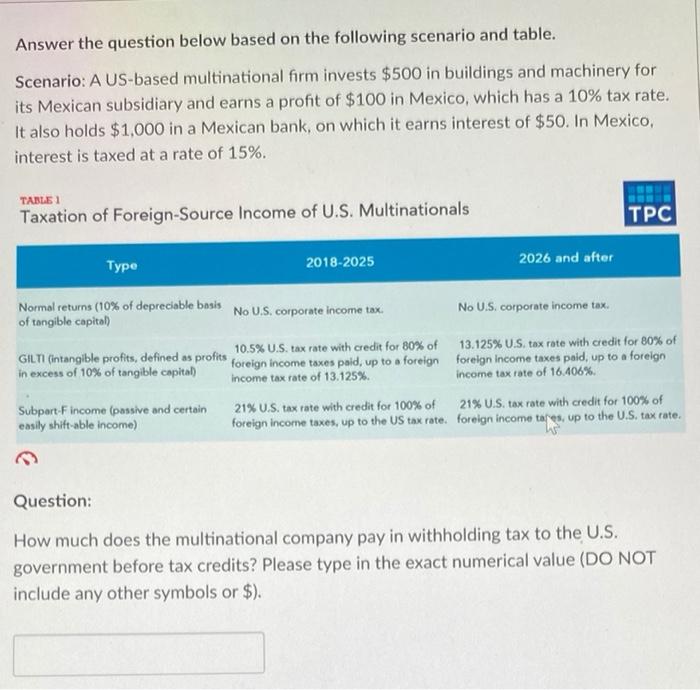

Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in buildings and machinery for its Mexican subsidiary and earns a profit of $100 in Mexico, which has a 10% tax rate. It also holds $1,000 in a Mexican bank, on which it earns interest of $50. In Mexico, interest is taxed at a rate of 15%. TABLET Taxation of Foreign-Source Income of U.S. Multinationals TPC Type 2018-2025 2026 and after Normal returns (10% of depreciable basis No U.S. corporate income tax of tangible capital) No U.S. corporate income tax. GILTI (intangible profits, defined as profits 10.5% U.S. tax rate with credit for 80% of 13.125% U.S. tax rate with credit for 80% of in excess of 10% of tangible capital) foreign income taxes paid, up to a foreign foreign income taxes paid, up to a foreign income tax rate of 13.125%. income tax rate of 16.406%. Subpart-F income (passive and certain 21% U.S. tax rate with credit for 100% of 21% U.S. tax rate with credit for 100% of easily shift-able income) foreign income taxes, up to the US tax rate foreign income tares, up to the U.S. tax rate. Question: How much does the multinational company pay in withholding tax to the U.S. government before tax credits? Please type in the exact numerical value (DO NOT include any other symbols or $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts