Question: Please include your work! Thank you! Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in

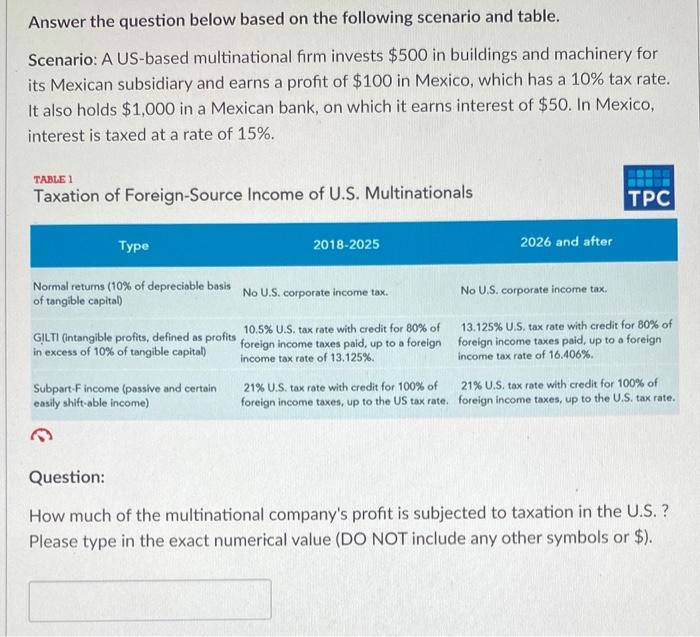

Answer the question below based on the following scenario and table. Scenario: A US-based multinational firm invests $500 in buildings and machinery for its Mexican subsidiary and earns a profit of $100 in Mexico, which has a 10% tax rate. It also holds $1,000 in a Mexican bank, on which it earns interest of $50. In Mexico, interest is taxed at a rate of 15%. TABLE 1 Taxation of Foreign-Source Income of U.S. Multinationals TPC Type 2018-2025 2026 and after Normal returns (10% of depreciable basis No U.S. corporate income tax. of tangible capital) No U.S. corporate income tax GILTI (intangible profits, defined as profits foreign income taxes paid, up to a foreign foreign income taxes paid up to a foreign 10.5% U.S. tax rate with credit for 80% of 13.125% U.S. tax rate with credit for 80% of in excess of 10% of tangible capital) income tax rate of 13.125% Income tax rate of 16.406%. Subpart.Fincome (passive and certain 21% U.S. tax rate with credit for 100% of 21% U.S. tax rate with credit for 100% of easily shift-able income) foreign income taxes, up to the US tax rate foreign income taxes, up to the U.S. tax rate. Question: How much of the multinational company's profit is subjected to taxation in the U.S. ? Please type in the exact numerical value (DO NOT include any other symbols or $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts