Question: Answer the question using US GAAP. Do not copy the answers previously posted. They are all wrong. Please try to post answers as quickly as

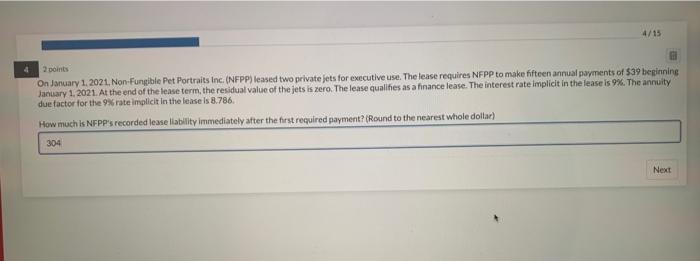

2 points On January 1.2021, Non-Fungible Pet Portraits inc. (NFPp) leased two private jets for executive use. The lease requires NFP to make fifteen annual payments of $39 herianing january 1.2021. At the end of the lease term, the residual value of the jets is zero. The lease qualifies as a finance lease. The interest rate implicit in the lease is 9%. The annuity due factor for the 9% rate implicit in the lease is 8.786. How much is NFPP's recorded lease liability immediately after the first reeqired payment? (Round to the nearest whole dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts