Question: Answer the question using US GAAP. Do not copy the answers previously posted. They are all wrong. Please try to post answer asap Heayy Co.

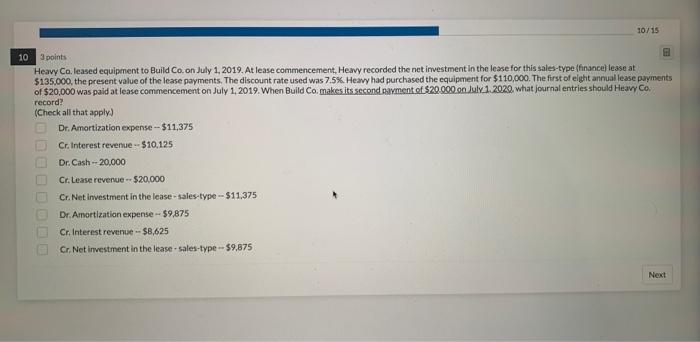

Heayy Co. leased equipment to Build Co. on July 1, 2019. At lease commencement, Heany recorded the net imvestment in the lease for this sales-type (finaoce) lease at $135.000, the present value of the lease payments. The discount rate used was 7.5%. Heawy had purchased the equipment for $110,000. The frart of elght annual lease payments of $20,000 was paid at lease commencement on July 1, 2019. When Build Co. makes its second parment of $20000 on July 1.2020 what journal entries should HeaWy Co. record? (Check all that apply) Dr. Amortization expense $11,375 Cr. Interest revenue $10,125 Dr. Cash 20,000 Cr.tease reverue $20,000 Cr. Net investment in the lease-sales-type $11,375 Dr. Amortization expense $9,875 Cr. Interest revenue $8,625 Cr, Net investment in the lease - sales-type $9,875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts