Question: Answer the question using US GAAP. Do not copy the answers previously posted. They are all wrong. Please try to post answer asap On Jan

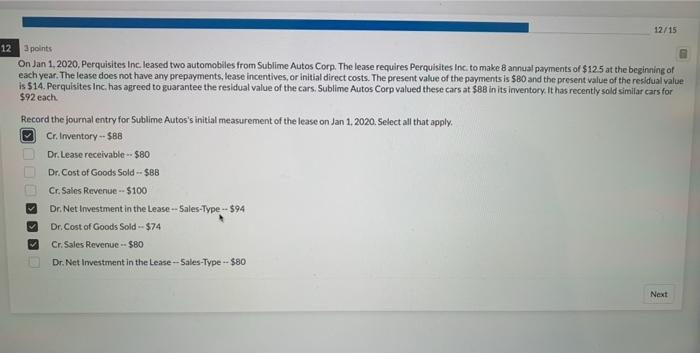

On Jan 1,2020, Perquisites Inc leased two automobiles from Sublime Autos Corp. The lease requires Perquisites Inc, to make 8 annual payments of $12.5 at the beginning of each year. The lease does not have any prepayments, lease incentives, or initial direct costs. The present value of the payments is $80 and the present value of the residual value is $14. Perquisites Inc, has agreed to guarantee the residual value of the cars. Sublime Autos Corp valued these cars at $8B in its inventory it has recently sold similar cars for $92 each Record the journal entry for Sublime Autos's initial measurement of the lease on Jan 1. 2020.5elect all that apply. Cr. Inventory $8B Dr. Lease receivable =$80 Dr. Cost of Goods Sold $BB Cr. Sales Revenue $100 Dri Net Investment in the Lease - 5 ales-Type 594 Dr. Cost of Goods Sold $74 Cr. Sales Revenue $80 Dr. Net Investment in the Lease - 5 ales-Type - $80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts