Question: Answer these 3 question, quickly. The following table shows the annual expected returns for two stocks, Stock A and Stock B. What are Stock A's

Answer these 3 question, quickly.

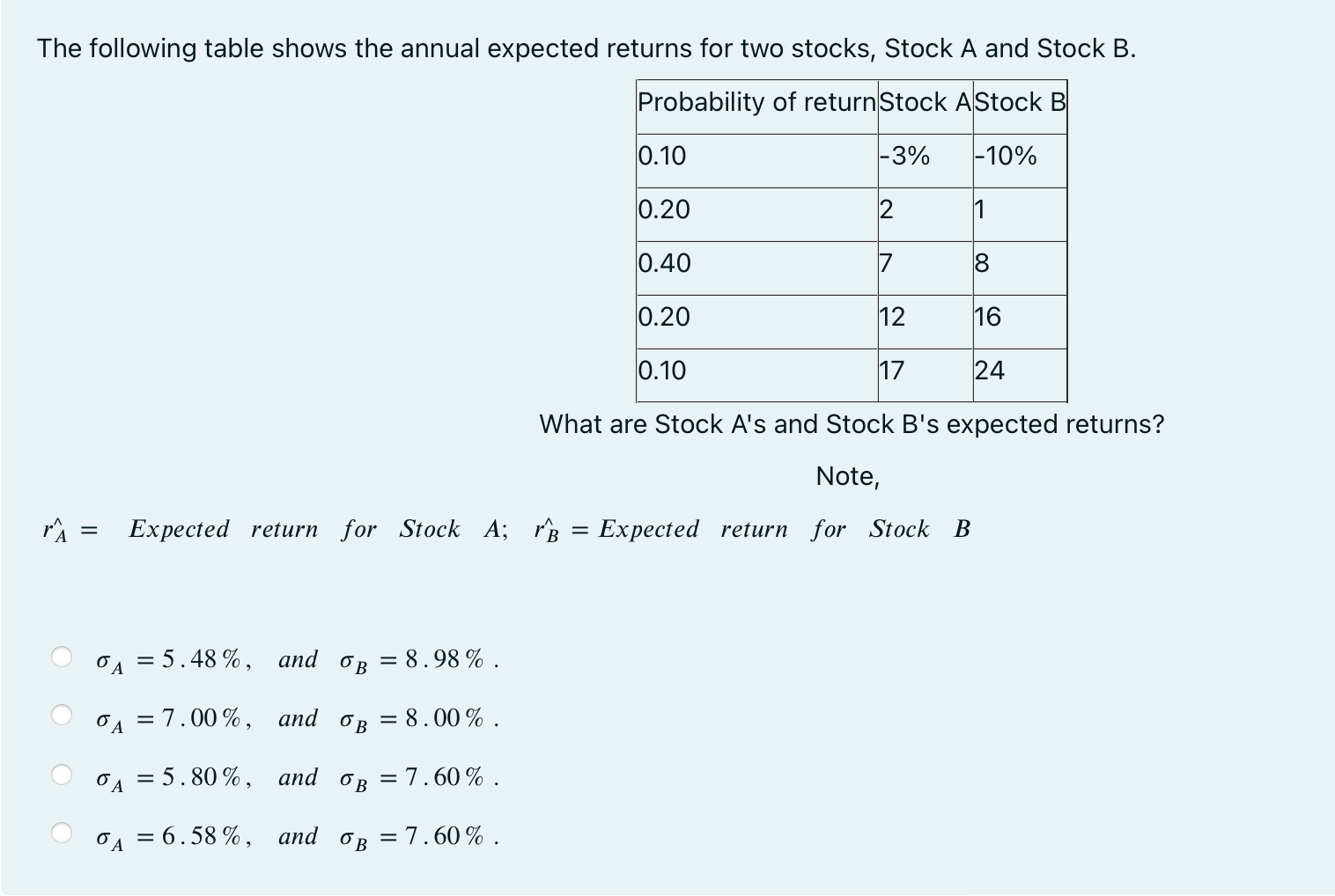

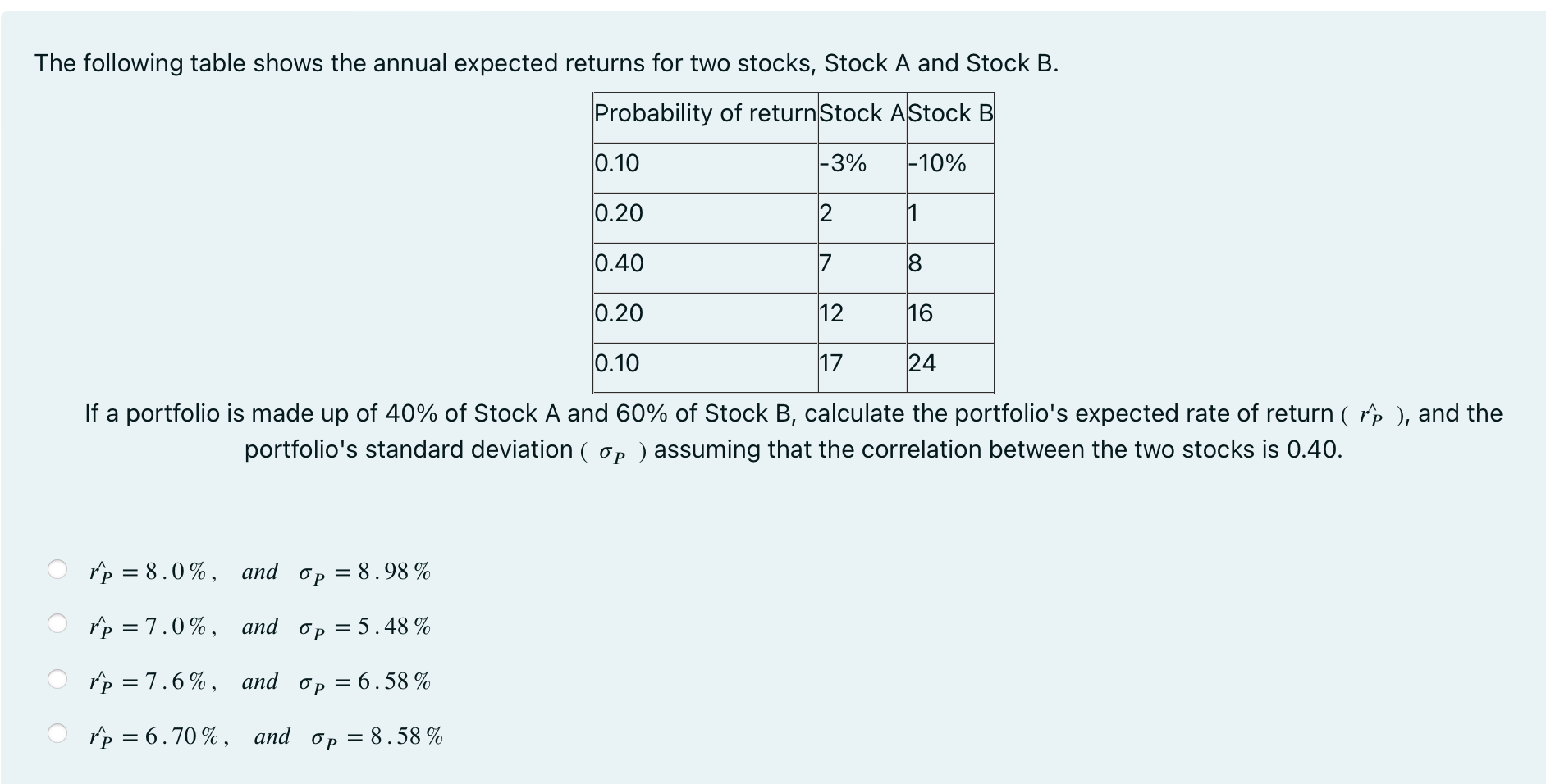

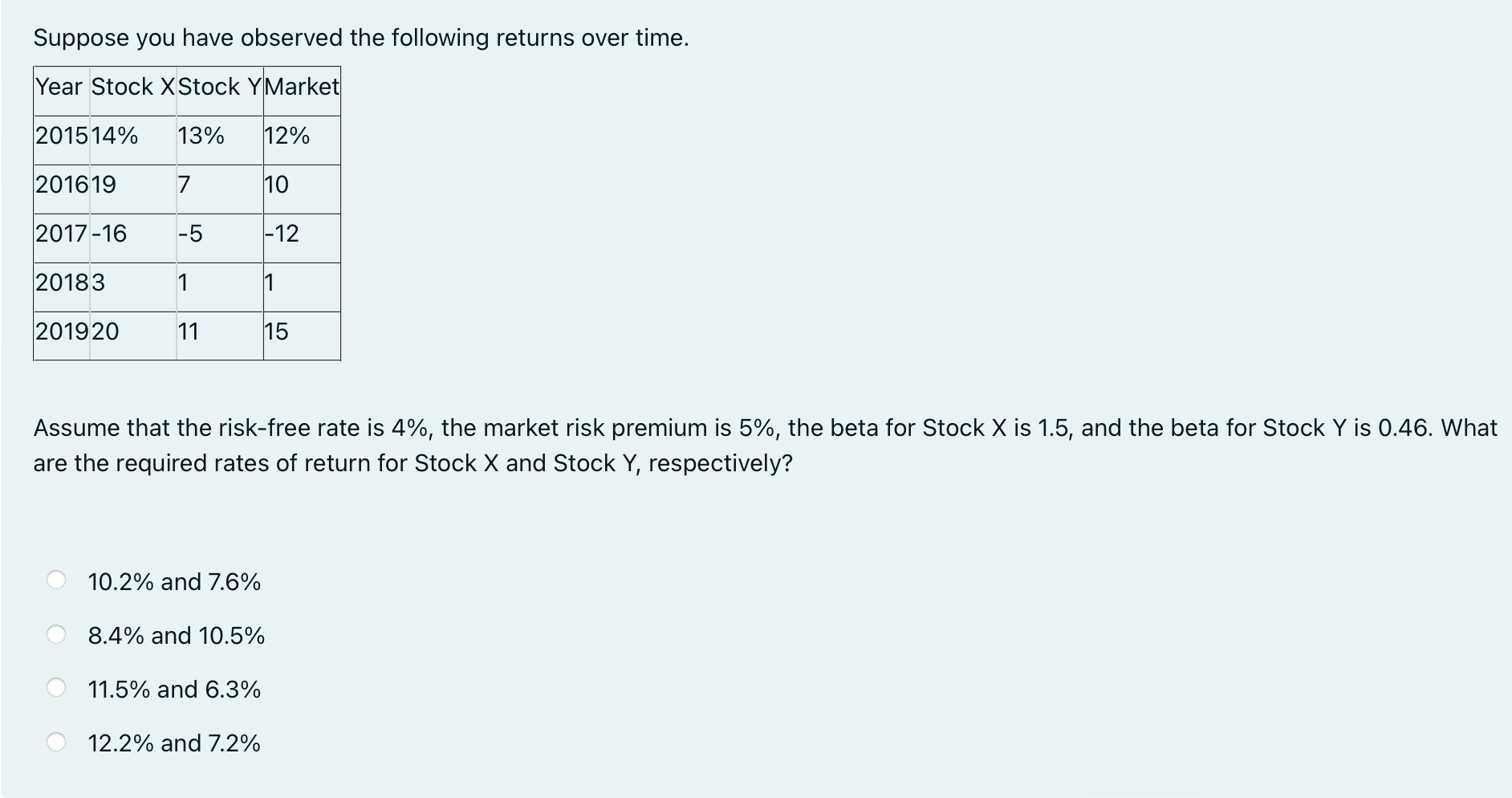

The following table shows the annual expected returns for two stocks, Stock A and Stock B. What are Stock A's and Stock B's expected returns? Note, rA Expected return for Stock A;B^= Expected return for Stock B A=5.48%, and B=8.98%. A=7.00%, and B=8.00%. A=5.80%, and B=7.60%. A=6.58%, and B=7.60%. The following table shows the annual expected returns for two stocks, Stock A and Stock B. If a portfolio is made up of 40% of Stock A and 60% of Stock B, calculate the portfolio's expected rate of return (rP^), and the portfolio's standard deviation ( P ) assuming that the correlation between the two stocks is 0.40 . rP^=8.0%,andP=8.98%rP^=7.0%,andP=5.48%rP^=7.6%,andP=6.58%rP^=6.70%,andP=8.58% Suppose you have observed the following returns over time. Assume that the risk-free rate is 4%, the market risk premium is 5%, the beta for Stock X is 1.5 , and the beta for Stock Y is 0.46 . What are the required rates of return for Stock X and Stock Y, respectively? 10.2% and 7.6% 8.4% and 10.5% 11.5% and 6.3% 12.2% and 7.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts