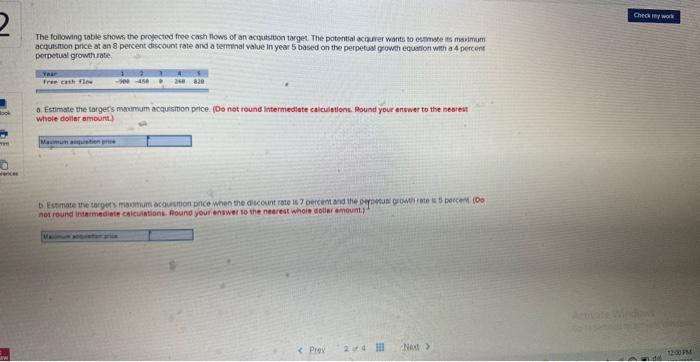

Question: Answer this correctly and I will upvote A and B. If wrong i will dislike ;) Yr 1 is -900 Yr 2 is -450 Yr

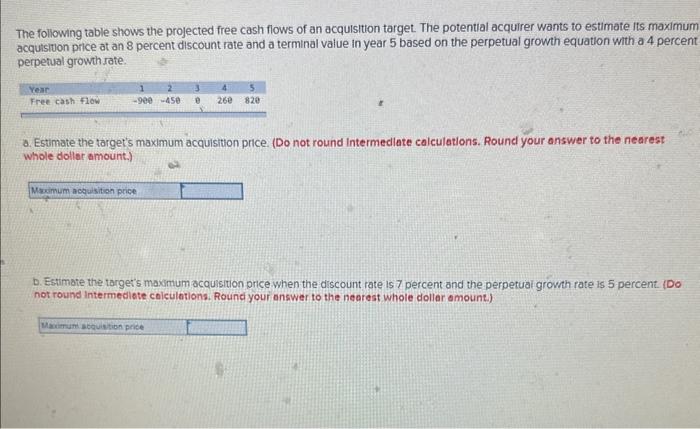

The following table shows the prolected free cash fows of an acgutsibon target. The potential aceserer wants so esemste its maimim actutsuon phice at an 8 percent discount rate and a termenal value in year 5 based on the perpetial growth equation with a 4 pertent perpetisal growthrate. a. Estimate the targess macimam acqusmion price. (Do not round intermedlate calculations. Aound your answer to the nesrest Whale doilist amount. hot round insimediate caiciaintions. Pound your enswer to the nearest whoie colier amount.) The following table shows the projected free cash flows of an acquisition target. The potential acquirer wants to estimate its maximur acquisition price at an 8 percent discount rate and a terminal value in year 5 based on the perpetual growth equation with a 4 percen perpetual growth rate. a. Estimate the target's maximum acquisition price. (Do not round Intermedlate calculations. Round your answer to the nearest whole doller amount.) b. Estimate the targer's maxmum acquisition price when the discount rate is 7 percent and the perpetuai growth rate is 5 percent. (Do not round Intermedlate colculotions. Round your answer to the nearest whole dollar omount)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts