Question: Answer this question in a sheet that you name Swap. A firm has a five-year obligation ($50 million notional principal) on which it must pay

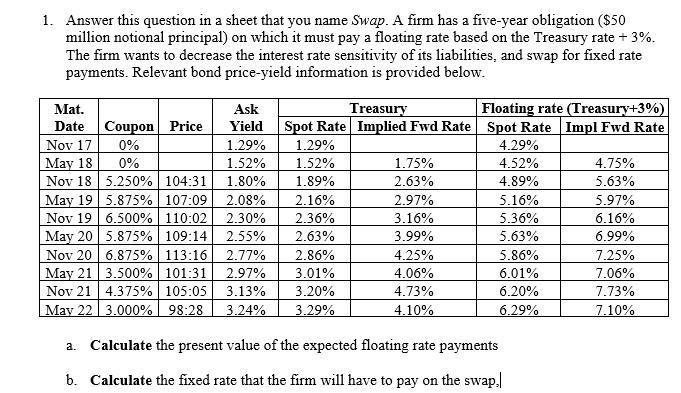

Answer this question in a sheet that you name Swap. A firm has a five-year obligation ($50 million notional principal) on which it must pay a floating rate based on the Treasury rate +3%. The firm wants to decrease the interest rate sensitivity of its liabilities, and swap for fixed rate payments. Relevant bond price-yield information is provided below. a. Calculate the present value of the expected floating rate payments b. Calculate the fixed rate that the firm will have to pay on the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts